Cache Advisors LLC acquired a new position in Bank of America Co. (NYSE:BAC - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 8,036 shares of the financial services provider's stock, valued at approximately $353,000.

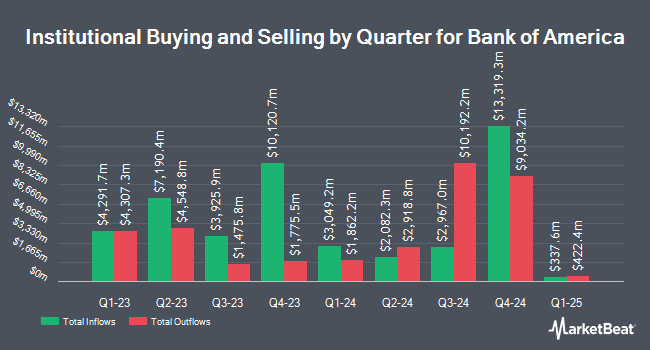

Several other large investors have also modified their holdings of the business. Zurcher Kantonalbank Zurich Cantonalbank boosted its holdings in Bank of America by 4.6% during the 4th quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 3,940,121 shares of the financial services provider's stock valued at $173,168,000 after acquiring an additional 173,021 shares during the period. OFI Invest Asset Management bought a new stake in shares of Bank of America during the fourth quarter worth $60,679,000. Arizona State Retirement System boosted its stake in shares of Bank of America by 0.5% during the fourth quarter. Arizona State Retirement System now owns 2,028,439 shares of the financial services provider's stock valued at $89,150,000 after purchasing an additional 10,377 shares during the period. Keybank National Association OH grew its holdings in shares of Bank of America by 1.1% in the fourth quarter. Keybank National Association OH now owns 3,458,616 shares of the financial services provider's stock worth $152,006,000 after purchasing an additional 38,258 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. increased its stake in Bank of America by 0.7% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 42,929,896 shares of the financial services provider's stock worth $1,886,769,000 after buying an additional 297,858 shares during the period. Hedge funds and other institutional investors own 70.71% of the company's stock.

Analyst Ratings Changes

BAC has been the subject of several research analyst reports. Oppenheimer reaffirmed an "outperform" rating on shares of Bank of America in a research note on Thursday, May 22nd. Royal Bank of Canada decreased their target price on Bank of America from $50.00 to $45.00 and set an "outperform" rating for the company in a research report on Wednesday, April 16th. Barclays dropped their price target on Bank of America from $58.00 to $54.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 16th. Evercore ISI decreased their price objective on Bank of America from $51.00 to $48.00 and set an "outperform" rating for the company in a report on Tuesday, April 1st. Finally, Robert W. Baird upgraded shares of Bank of America from a "neutral" rating to an "outperform" rating and increased their target price for the stock from $45.00 to $50.00 in a report on Friday, March 7th. Two research analysts have rated the stock with a sell rating, five have issued a hold rating, seventeen have issued a buy rating and four have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $47.50.

Check Out Our Latest Research Report on BAC

Bank of America Stock Performance

Shares of Bank of America stock traded down $0.21 during midday trading on Wednesday, hitting $44.01. The company had a trading volume of 13,227,674 shares, compared to its average volume of 43,899,191. The stock has a market cap of $331.46 billion, a price-to-earnings ratio of 13.67, a PEG ratio of 1.21 and a beta of 1.27. Bank of America Co. has a 12-month low of $33.06 and a 12-month high of $48.08. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 1.04. The company has a fifty day simple moving average of $40.39 and a 200 day simple moving average of $43.58.

Bank of America (NYSE:BAC - Get Free Report) last posted its quarterly earnings results on Tuesday, April 15th. The financial services provider reported $0.90 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.80 by $0.10. The business had revenue of $27.37 billion during the quarter, compared to analysts' expectations of $26.83 billion. Bank of America had a net margin of 14.10% and a return on equity of 10.29%. As a group, analysts predict that Bank of America Co. will post 3.7 earnings per share for the current fiscal year.

Bank of America Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, June 27th. Stockholders of record on Friday, June 6th will be issued a $0.26 dividend. This represents a $1.04 dividend on an annualized basis and a dividend yield of 2.36%. The ex-dividend date of this dividend is Friday, June 6th. Bank of America's dividend payout ratio is presently 30.95%.

About Bank of America

(

Free Report)

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates in four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

Read More

Before you consider Bank of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of America wasn't on the list.

While Bank of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.