Canada Pension Plan Investment Board lifted its holdings in Arista Networks, Inc. (NYSE:ANET - Free Report) by 24.8% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,833,041 shares of the technology company's stock after acquiring an additional 363,909 shares during the period. Canada Pension Plan Investment Board owned 0.15% of Arista Networks worth $142,024,000 at the end of the most recent reporting period.

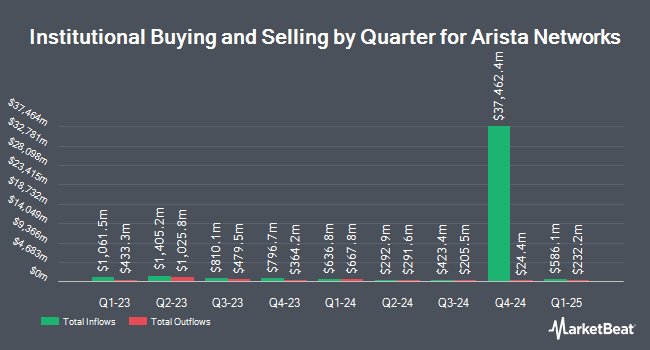

A number of other hedge funds have also recently made changes to their positions in the business. HighMark Wealth Management LLC boosted its stake in Arista Networks by 179.7% during the first quarter. HighMark Wealth Management LLC now owns 358 shares of the technology company's stock valued at $28,000 after buying an additional 230 shares during the last quarter. Quarry LP boosted its stake in Arista Networks by 381.5% during the fourth quarter. Quarry LP now owns 260 shares of the technology company's stock valued at $29,000 after buying an additional 206 shares during the last quarter. Dunhill Financial LLC boosted its stake in Arista Networks by 415.7% during the fourth quarter. Dunhill Financial LLC now owns 263 shares of the technology company's stock valued at $29,000 after buying an additional 212 shares during the last quarter. Cloud Capital Management LLC bought a new position in Arista Networks during the first quarter valued at approximately $30,000. Finally, McIlrath & Eck LLC bought a new position in Arista Networks during the fourth quarter valued at approximately $35,000. Institutional investors own 82.47% of the company's stock.

Arista Networks Trading Down 0.3%

Shares of ANET stock traded down $0.41 on Tuesday, reaching $136.14. 4,890,540 shares of the company's stock were exchanged, compared to its average volume of 10,360,247. Arista Networks, Inc. has a 52 week low of $59.43 and a 52 week high of $141.99. The stock has a market capitalization of $171.11 billion, a PE ratio of 53.56, a P/E/G ratio of 3.21 and a beta of 1.49. The company's fifty day simple moving average is $119.20 and its 200 day simple moving average is $97.57.

Arista Networks (NYSE:ANET - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The technology company reported $0.73 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.65 by $0.08. Arista Networks had a return on equity of 31.05% and a net margin of 40.90%.The firm had revenue of $2.20 billion during the quarter, compared to analyst estimates of $2.11 billion. During the same period last year, the company earned $0.53 EPS. Arista Networks's quarterly revenue was up 30.4% compared to the same quarter last year. Arista Networks has set its Q3 2025 guidance at EPS. As a group, sell-side analysts predict that Arista Networks, Inc. will post 2.2 earnings per share for the current fiscal year.

Arista Networks announced that its Board of Directors has authorized a share buyback plan on Tuesday, May 6th that permits the company to buyback $1.50 billion in shares. This buyback authorization permits the technology company to purchase up to 1.3% of its shares through open market purchases. Shares buyback plans are often an indication that the company's leadership believes its stock is undervalued.

Analysts Set New Price Targets

ANET has been the subject of a number of research reports. UBS Group increased their price target on Arista Networks from $115.00 to $155.00 and gave the company a "buy" rating in a research note on Wednesday, August 6th. JPMorgan Chase & Co. increased their price target on Arista Networks from $130.00 to $150.00 and gave the company an "overweight" rating in a research note on Wednesday, August 6th. The Goldman Sachs Group increased their price target on Arista Networks from $115.00 to $155.00 and gave the company a "buy" rating in a research note on Wednesday, August 6th. Piper Sandler increased their price target on Arista Networks from $89.00 to $143.00 and gave the company a "neutral" rating in a research note on Wednesday, August 6th. Finally, KGI Securities cut Arista Networks to a "neutral" rating in a report on Wednesday, May 7th. Fourteen analysts have rated the stock with a Buy rating and five have issued a Hold rating to the company's stock. Based on data from MarketBeat, Arista Networks has an average rating of "Moderate Buy" and an average price target of $138.07.

View Our Latest Report on ANET

Insider Buying and Selling

In other Arista Networks news, SVP Kenneth Duda sold 30,000 shares of Arista Networks stock in a transaction on Monday, August 18th. The stock was sold at an average price of $136.51, for a total transaction of $4,095,300.00. Following the completion of the sale, the senior vice president directly owned 12,976 shares of the company's stock, valued at $1,771,353.76. The trade was a 69.81% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Jayshree Ullal sold 24,040 shares of Arista Networks stock in a transaction on Monday, August 25th. The shares were sold at an average price of $132.77, for a total value of $3,191,790.80. Following the sale, the chief executive officer directly owned 9,917 shares of the company's stock, valued at approximately $1,316,680.09. This trade represents a 70.80% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 5,839,614 shares of company stock valued at $724,163,153. Insiders own 3.54% of the company's stock.

About Arista Networks

(

Free Report)

Arista Networks, Inc engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Its cloud networking solutions consist of Extensible Operating System (EOS), a publish-subscribe state-sharing networking operating system offered in combination with a set of network applications.

Read More

Before you consider Arista Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arista Networks wasn't on the list.

While Arista Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.