Candriam S.C.A. trimmed its stake in shares of Martin Marietta Materials, Inc. (NYSE:MLM - Free Report) by 12.3% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 4,056 shares of the construction company's stock after selling 571 shares during the quarter. Candriam S.C.A.'s holdings in Martin Marietta Materials were worth $1,939,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

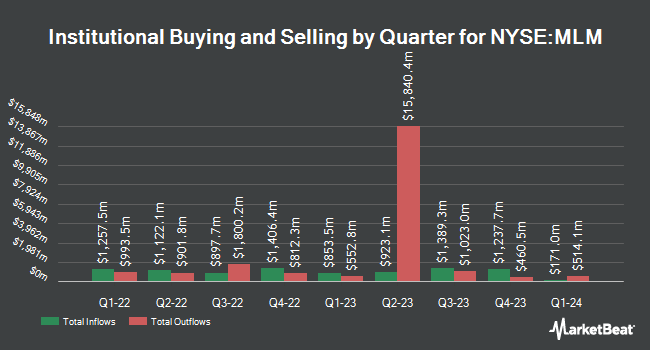

Other institutional investors and hedge funds have also bought and sold shares of the company. Wayfinding Financial LLC bought a new position in Martin Marietta Materials during the 1st quarter worth approximately $29,000. Chilton Capital Management LLC bought a new position in Martin Marietta Materials during the 1st quarter worth approximately $30,000. Zions Bancorporation National Association UT bought a new position in Martin Marietta Materials during the 1st quarter worth approximately $30,000. IMA Advisory Services Inc. bought a new position in Martin Marietta Materials during the 1st quarter worth approximately $40,000. Finally, Valley National Advisers Inc. grew its position in Martin Marietta Materials by 193.9% during the 1st quarter. Valley National Advisers Inc. now owns 97 shares of the construction company's stock worth $45,000 after acquiring an additional 64 shares during the last quarter. 95.04% of the stock is currently owned by institutional investors.

Insider Transactions at Martin Marietta Materials

In other Martin Marietta Materials news, Director Laree E. Perez sold 1,038 shares of Martin Marietta Materials stock in a transaction on Friday, August 8th. The stock was sold at an average price of $613.32, for a total transaction of $636,626.16. Following the completion of the transaction, the director owned 15,417 shares in the company, valued at approximately $9,455,554.44. The trade was a 6.31% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 0.68% of the company's stock.

Martin Marietta Materials Stock Down 0.0%

Shares of MLM traded down $0.01 on Wednesday, reaching $617.03. The stock had a trading volume of 413,367 shares, compared to its average volume of 478,894. The firm has a market capitalization of $37.21 billion, a price-to-earnings ratio of 34.22, a price-to-earnings-growth ratio of 5.51 and a beta of 0.89. The company has a debt-to-equity ratio of 0.56, a quick ratio of 1.21 and a current ratio of 2.35. The company has a 50-day simple moving average of $575.95 and a 200-day simple moving average of $533.89. Martin Marietta Materials, Inc. has a 12-month low of $441.95 and a 12-month high of $633.23.

Martin Marietta Materials (NYSE:MLM - Get Free Report) last released its earnings results on Thursday, August 7th. The construction company reported $5.43 EPS for the quarter, missing analysts' consensus estimates of $5.44 by ($0.01). The firm had revenue of $1.81 billion during the quarter, compared to analysts' expectations of $1.88 billion. Martin Marietta Materials had a net margin of 16.47% and a return on equity of 11.88%. The company's revenue for the quarter was up 2.7% compared to the same quarter last year. During the same quarter in the previous year, the business earned $4.76 EPS. Martin Marietta Materials has set its FY 2025 guidance at EPS. Sell-side analysts predict that Martin Marietta Materials, Inc. will post 19.53 EPS for the current year.

Martin Marietta Materials Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Tuesday, September 2nd will be paid a dividend of $0.83 per share. The ex-dividend date is Tuesday, September 2nd. This is a positive change from Martin Marietta Materials's previous quarterly dividend of $0.79. This represents a $3.32 dividend on an annualized basis and a yield of 0.5%. Martin Marietta Materials's dividend payout ratio (DPR) is presently 17.53%.

Wall Street Analysts Forecast Growth

MLM has been the topic of several recent research reports. Wall Street Zen upgraded Martin Marietta Materials from a "sell" rating to a "hold" rating in a research report on Saturday, August 9th. Raymond James Financial lifted their price objective on Martin Marietta Materials from $600.00 to $645.00 and gave the stock an "outperform" rating in a research report on Friday, August 8th. Stephens reiterated an "overweight" rating and issued a $700.00 price objective on shares of Martin Marietta Materials in a research report on Monday, August 4th. Bank of America lifted their price objective on Martin Marietta Materials from $577.00 to $643.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 5th. Finally, DA Davidson lifted their price objective on Martin Marietta Materials from $625.00 to $700.00 and gave the stock a "buy" rating in a research report on Monday, August 11th. Two equities research analysts have rated the stock with a Strong Buy rating, thirteen have given a Buy rating and four have issued a Hold rating to the company. According to data from MarketBeat, Martin Marietta Materials has an average rating of "Moderate Buy" and an average price target of $622.63.

Get Our Latest Report on MLM

Martin Marietta Materials Profile

(

Free Report)

Martin Marietta Materials, Inc, a natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally. It offers crushed stone, sand, and gravel products; ready mixed concrete and asphalt; paving products and services; and Portland and specialty cement for use in the infrastructure projects, and nonresidential and residential construction markets, as well as in the railroad, agricultural, utility, and environmental industries.

Read More

Before you consider Martin Marietta Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Martin Marietta Materials wasn't on the list.

While Martin Marietta Materials currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.