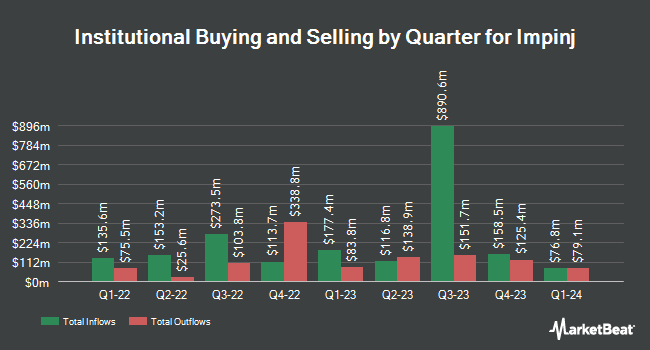

Capital Fund Management S.A. lifted its stake in Impinj, Inc. (NASDAQ:PI - Free Report) by 593.7% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 86,010 shares of the company's stock after purchasing an additional 73,612 shares during the period. Capital Fund Management S.A. owned about 0.30% of Impinj worth $7,801,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Guggenheim Capital LLC increased its holdings in Impinj by 7.6% in the 4th quarter. Guggenheim Capital LLC now owns 6,087 shares of the company's stock worth $884,000 after buying an additional 429 shares during the period. Marshall Wace LLP purchased a new position in Impinj in the 4th quarter valued at about $1,682,000. Canada Pension Plan Investment Board purchased a new position in Impinj in the 4th quarter valued at about $29,000. MetLife Investment Management LLC lifted its stake in Impinj by 7.3% in the 4th quarter. MetLife Investment Management LLC now owns 13,878 shares of the company's stock valued at $2,016,000 after buying an additional 946 shares in the last quarter. Finally, Teachers Retirement System of The State of Kentucky raised its holdings in Impinj by 94.6% in the 4th quarter. Teachers Retirement System of The State of Kentucky now owns 7,600 shares of the company's stock valued at $1,104,000 after acquiring an additional 3,694 shares during the last quarter.

Impinj Stock Performance

Shares of PI stock traded up $9.02 on Wednesday, hitting $187.88. The company's stock had a trading volume of 305,454 shares, compared to its average volume of 623,945. The stock's 50 day moving average is $133.25 and its 200-day moving average is $109.23. Impinj, Inc. has a fifty-two week low of $60.85 and a fifty-two week high of $239.88. The company has a debt-to-equity ratio of 1.51, a quick ratio of 8.44 and a current ratio of 11.64. The company has a market capitalization of $5.47 billion, a PE ratio of 18,801.80 and a beta of 1.74.

Impinj (NASDAQ:PI - Get Free Report) last announced its earnings results on Wednesday, July 30th. The company reported $0.80 earnings per share for the quarter, topping analysts' consensus estimates of $0.72 by $0.08. The business had revenue of $97.89 million during the quarter, compared to the consensus estimate of $93.78 million. Impinj had a net margin of 0.18% and a return on equity of 8.14%. Impinj's quarterly revenue was down 4.5% on a year-over-year basis. During the same quarter last year, the firm earned $0.83 earnings per share. Impinj has set its Q3 2025 guidance at 0.470-0.510 EPS. Equities research analysts expect that Impinj, Inc. will post -0.47 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on PI shares. Piper Sandler raised their price target on shares of Impinj from $140.00 to $180.00 and gave the stock an "overweight" rating in a report on Thursday, July 31st. Needham & Company LLC lifted their target price on shares of Impinj from $115.00 to $165.00 and gave the company a "buy" rating in a report on Thursday, July 31st. Cantor Fitzgerald raised their price target on shares of Impinj from $133.00 to $158.00 and gave the company an "overweight" rating in a research report on Thursday, July 31st. Finally, Susquehanna raised their price target on shares of Impinj from $130.00 to $140.00 and gave the company a "positive" rating in a research report on Tuesday, July 22nd. Six analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $163.29.

Check Out Our Latest Report on PI

Impinj Profile

(

Free Report)

Impinj, Inc operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform wirelessly connects items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item.

See Also

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.