Cardinal Point Capital Management ULC acquired a new position in Telus Digital (NYSE:TIXT - Free Report) in the 2nd quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 106,385 shares of the company's stock, valued at approximately $386,000.

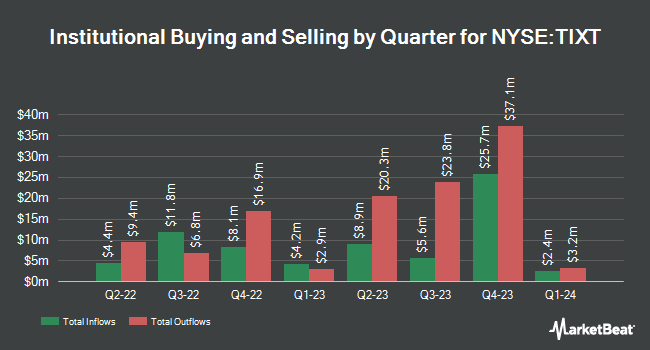

Several other institutional investors have also recently bought and sold shares of the stock. Acadian Asset Management LLC raised its position in Telus Digital by 1,347.7% in the 1st quarter. Acadian Asset Management LLC now owns 728,179 shares of the company's stock worth $1,942,000 after purchasing an additional 677,879 shares during the last quarter. Circumference Group LLC raised its position in Telus Digital by 8.0% in the 1st quarter. Circumference Group LLC now owns 675,000 shares of the company's stock worth $1,816,000 after purchasing an additional 50,000 shares during the last quarter. Goldman Sachs Group Inc. raised its position in shares of Telus Digital by 73.5% during the 1st quarter. Goldman Sachs Group Inc. now owns 541,635 shares of the company's stock valued at $1,457,000 after acquiring an additional 229,369 shares during the last quarter. TD Asset Management Inc raised its position in shares of Telus Digital by 4.0% during the 1st quarter. TD Asset Management Inc now owns 260,719 shares of the company's stock valued at $699,000 after acquiring an additional 9,992 shares during the last quarter. Finally, Bank of Nova Scotia raised its position in shares of Telus Digital by 4.1% during the 1st quarter. Bank of Nova Scotia now owns 257,784 shares of the company's stock valued at $692,000 after acquiring an additional 10,053 shares during the last quarter. Institutional investors own 59.55% of the company's stock.

Telus Digital Price Performance

Shares of NYSE TIXT opened at $4.36 on Friday. The firm has a market cap of $1.21 billion, a PE ratio of -3.13 and a beta of 0.94. The company has a current ratio of 0.84, a quick ratio of 0.84 and a debt-to-equity ratio of 0.85. Telus Digital has a 1-year low of $2.13 and a 1-year high of $4.60. The company has a fifty day moving average price of $4.34 and a 200 day moving average price of $3.60.

Telus Digital (NYSE:TIXT - Get Free Report) last announced its earnings results on Friday, August 1st. The company reported $0.06 earnings per share for the quarter, topping analysts' consensus estimates of $0.05 by $0.01. The firm had revenue of $711.33 million during the quarter, compared to analyst estimates of $660.87 million. Telus Digital had a negative net margin of 14.09% and a positive return on equity of 1.99%. Telus Digital has set its FY 2025 guidance at 0.320-0.320 EPS. Research analysts predict that Telus Digital will post 0.32 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several brokerages have commented on TIXT. CIBC cut shares of Telus Digital from a "neutral" rating to a "tender" rating and upped their target price for the company from $3.40 to $4.50 in a research report on Wednesday, September 3rd. National Bankshares cut shares of Telus Digital from a "sector perform" rating to a "tender" rating and upped their target price for the company from $4.00 to $4.50 in a research report on Wednesday, September 3rd. National Bank Financial lowered shares of Telus Digital from an "outperform" rating to a "sector perform" rating and set a $4.00 price target for the company. in a report on Monday, July 21st. Weiss Ratings reissued a "sell (d)" rating on shares of Telus Digital in a report on Friday. Finally, Stifel Canada lowered shares of Telus Digital from a "strong-buy" rating to a "hold" rating in a report on Tuesday, September 2nd. Eight analysts have rated the stock with a Hold rating and one has assigned a Sell rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Reduce" and an average price target of $3.93.

Check Out Our Latest Report on Telus Digital

Telus Digital Company Profile

(

Free Report)

TELUS Digital Inc design, builds, and delivers digital solutions for customer experience (CX) in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally. The company provides digital experience solutions, such as AI and bots, omnichannel CX, enterprise mobility solutions, cloud contact center, big data analytics, platform transformation, and UX/UI design; and customer experience solutions, including work anywhere/work from home, contact center outsourcing, technical support, sales growth and customer retention, healthcare/patient experience, and debt collection.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Telus Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Telus Digital wasn't on the list.

While Telus Digital currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.