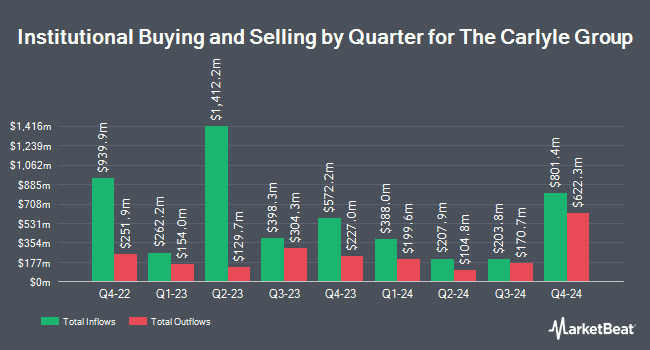

City of London Investment Management Co. Ltd. reduced its holdings in shares of Carlyle Group Inc. (NASDAQ:CG - Free Report) by 13.1% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 108,837 shares of the financial services provider's stock after selling 16,407 shares during the quarter. City of London Investment Management Co. Ltd.'s holdings in Carlyle Group were worth $4,744,000 as of its most recent filing with the SEC.

Several other institutional investors and hedge funds have also made changes to their positions in the business. Bank Pictet & Cie Europe AG acquired a new stake in shares of Carlyle Group in the 4th quarter valued at about $215,000. Orion Portfolio Solutions LLC acquired a new stake in shares of Carlyle Group in the 4th quarter valued at about $425,000. Schroder Investment Management Group boosted its position in shares of Carlyle Group by 5.7% in the 4th quarter. Schroder Investment Management Group now owns 23,127 shares of the financial services provider's stock valued at $1,168,000 after purchasing an additional 1,257 shares during the period. O Shaughnessy Asset Management LLC boosted its position in shares of Carlyle Group by 45.9% in the 4th quarter. O Shaughnessy Asset Management LLC now owns 7,980 shares of the financial services provider's stock valued at $403,000 after purchasing an additional 2,511 shares during the period. Finally, Wellington Management Group LLP lifted its position in Carlyle Group by 4.1% during the 4th quarter. Wellington Management Group LLP now owns 8,664 shares of the financial services provider's stock worth $437,000 after acquiring an additional 344 shares during the period. 55.88% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on the company. Citigroup raised Carlyle Group from a "neutral" rating to a "buy" rating and increased their price objective for the stock from $44.00 to $65.00 in a research report on Thursday, July 10th. TD Cowen raised Carlyle Group from a "hold" rating to a "buy" rating and set a $56.00 price objective for the company in a research report on Wednesday, May 14th. Cowen raised Carlyle Group from a "hold" rating to a "buy" rating in a research report on Wednesday, May 14th. Evercore ISI increased their price objective on Carlyle Group from $45.00 to $58.00 and gave the stock an "in-line" rating in a research report on Thursday, July 10th. Finally, Wells Fargo & Company increased their target price on Carlyle Group from $49.00 to $61.00 and gave the stock an "equal weight" rating in a research note on Friday, July 11th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating and eight have given a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $58.40.

Check Out Our Latest Stock Analysis on Carlyle Group

Carlyle Group Price Performance

NASDAQ CG traded up $0.66 during mid-day trading on Friday, hitting $62.23. The stock had a trading volume of 2,653,991 shares, compared to its average volume of 2,606,057. Carlyle Group Inc. has a 52-week low of $33.02 and a 52-week high of $64.09. The company has a market cap of $22.47 billion, a price-to-earnings ratio of 18.20, a P/E/G ratio of 1.19 and a beta of 1.90. The company has a 50 day simple moving average of $54.26 and a 200 day simple moving average of $48.13. The company has a quick ratio of 2.36, a current ratio of 2.24 and a debt-to-equity ratio of 1.52.

Carlyle Group (NASDAQ:CG - Get Free Report) last released its quarterly earnings data on Friday, May 9th. The financial services provider reported $1.14 earnings per share for the quarter, beating the consensus estimate of $0.97 by $0.17. The firm had revenue of $973.10 million during the quarter, compared to the consensus estimate of $972.27 million. Carlyle Group had a return on equity of 23.60% and a net margin of 20.22%. Carlyle Group's quarterly revenue was up 2.0% on a year-over-year basis. During the same period last year, the business posted $1.01 EPS. Equities analysts forecast that Carlyle Group Inc. will post 4.48 EPS for the current fiscal year.

Carlyle Group Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Thursday, August 28th. Shareholders of record on Monday, August 18th will be issued a dividend of $0.35 per share. This represents a $1.40 dividend on an annualized basis and a yield of 2.2%. The ex-dividend date is Monday, August 18th. Carlyle Group's dividend payout ratio is 40.94%.

Carlyle Group Profile

(

Free Report)

The Carlyle Group Inc is an investment firm specializing in direct and fund of fund investments. Within direct investments, it specializes in management-led/ Leveraged buyouts, privatizations, divestitures, strategic minority equity investments, structured credit, global distressed and corporate opportunities, small and middle market, equity private placements, consolidations and buildups, senior debt, mezzanine and leveraged finance, and venture and growth capital financings, seed/startup, early venture, emerging growth, turnaround, mid venture, late venture, PIPES.

Recommended Stories

Before you consider Carlyle Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carlyle Group wasn't on the list.

While Carlyle Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.