Carrera Capital Advisors grew its holdings in Verizon Communications Inc. (NYSE:VZ - Free Report) by 1,683.6% in the second quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 126,636 shares of the cell phone carrier's stock after buying an additional 119,536 shares during the period. Verizon Communications makes up 1.1% of Carrera Capital Advisors' portfolio, making the stock its 17th largest holding. Carrera Capital Advisors' holdings in Verizon Communications were worth $5,480,000 as of its most recent SEC filing.

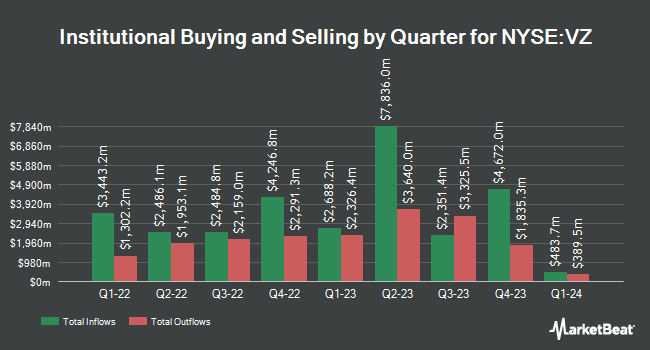

A number of other institutional investors and hedge funds have also made changes to their positions in VZ. Sage Mountain Advisors LLC lifted its holdings in shares of Verizon Communications by 42.0% in the 2nd quarter. Sage Mountain Advisors LLC now owns 26,018 shares of the cell phone carrier's stock worth $1,126,000 after acquiring an additional 7,691 shares during the last quarter. AlphaQuest LLC lifted its holdings in shares of Verizon Communications by 39.5% in the 2nd quarter. AlphaQuest LLC now owns 44,107 shares of the cell phone carrier's stock worth $1,909,000 after acquiring an additional 12,493 shares during the last quarter. Sumitomo Mitsui Trust Group Inc. lifted its holdings in shares of Verizon Communications by 16.0% in the 2nd quarter. Sumitomo Mitsui Trust Group Inc. now owns 11,962,291 shares of the cell phone carrier's stock worth $517,608,000 after acquiring an additional 1,651,459 shares during the last quarter. Jackson Hole Capital Partners LLC lifted its holdings in Verizon Communications by 6.7% during the 2nd quarter. Jackson Hole Capital Partners LLC now owns 79,875 shares of the cell phone carrier's stock valued at $3,456,000 after buying an additional 5,045 shares in the last quarter. Finally, Catalyst Capital Advisors LLC lifted its holdings in Verizon Communications by 10.0% during the 2nd quarter. Catalyst Capital Advisors LLC now owns 15,442 shares of the cell phone carrier's stock valued at $668,000 after buying an additional 1,403 shares in the last quarter. 62.06% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on VZ shares. JPMorgan Chase & Co. lifted their price objective on shares of Verizon Communications from $47.00 to $49.00 and gave the company a "neutral" rating in a report on Tuesday, July 22nd. Royal Bank Of Canada boosted their price target on shares of Verizon Communications from $45.00 to $46.00 and gave the company a "sector perform" rating in a report on Tuesday, July 22nd. Scotiabank boosted their price target on shares of Verizon Communications from $50.00 to $50.50 and gave the company a "sector perform" rating in a report on Monday, October 6th. Wall Street Zen lowered shares of Verizon Communications from a "buy" rating to a "hold" rating in a report on Friday, September 26th. Finally, Arete Research upgraded shares of Verizon Communications to a "strong-buy" rating in a report on Tuesday, July 8th. Three equities research analysts have rated the stock with a Strong Buy rating, five have given a Buy rating and thirteen have given a Hold rating to the company's stock. According to MarketBeat, Verizon Communications currently has an average rating of "Moderate Buy" and an average price target of $47.41.

View Our Latest Analysis on VZ

Verizon Communications Price Performance

Verizon Communications stock opened at $38.83 on Friday. Verizon Communications Inc. has a 52-week low of $37.58 and a 52-week high of $47.35. The firm has a market capitalization of $163.70 billion, a price-to-earnings ratio of 9.05, a PEG ratio of 2.89 and a beta of 0.37. The company has a fifty day simple moving average of $42.84 and a 200-day simple moving average of $42.96. The company has a quick ratio of 0.60, a current ratio of 0.64 and a debt-to-equity ratio of 1.19.

Verizon Communications Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, November 3rd. Stockholders of record on Friday, October 10th will be given a dividend of $0.69 per share. This is a boost from Verizon Communications's previous quarterly dividend of $0.68. This represents a $2.76 annualized dividend and a dividend yield of 7.1%. The ex-dividend date of this dividend is Friday, October 10th. Verizon Communications's dividend payout ratio is currently 64.34%.

About Verizon Communications

(

Free Report)

Verizon Communications Inc, through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. It operates in two segments, Verizon Consumer Group (Consumer) and Verizon Business Group (Business).

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Verizon Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verizon Communications wasn't on the list.

While Verizon Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.