Cbre Investment Management Listed Real Assets LLC increased its holdings in Agree Realty Corporation (NYSE:ADC - Free Report) by 98.7% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 821,090 shares of the real estate investment trust's stock after acquiring an additional 407,820 shares during the period. Cbre Investment Management Listed Real Assets LLC owned about 0.75% of Agree Realty worth $63,380,000 at the end of the most recent reporting period.

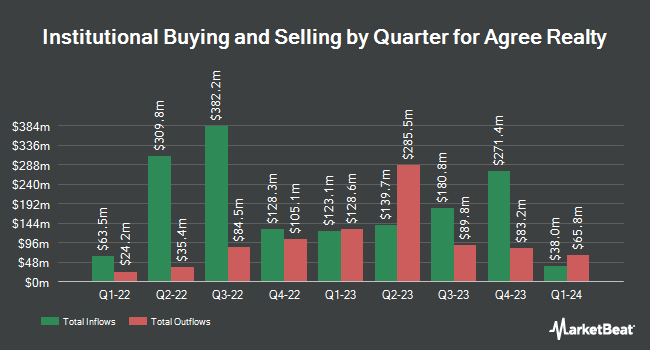

Other institutional investors and hedge funds also recently bought and sold shares of the company. Millennium Management LLC lifted its position in Agree Realty by 1,036.9% in the 4th quarter. Millennium Management LLC now owns 1,171,297 shares of the real estate investment trust's stock worth $82,518,000 after buying an additional 1,068,271 shares in the last quarter. Nuveen LLC purchased a new position in Agree Realty in the first quarter valued at about $64,759,000. Northern Trust Corp grew its stake in Agree Realty by 89.2% in the fourth quarter. Northern Trust Corp now owns 1,523,280 shares of the real estate investment trust's stock valued at $107,315,000 after purchasing an additional 718,114 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its stake in Agree Realty by 524.2% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 707,421 shares of the real estate investment trust's stock valued at $49,838,000 after purchasing an additional 594,080 shares in the last quarter. Finally, Alyeska Investment Group L.P. raised its holdings in Agree Realty by 122.4% during the fourth quarter. Alyeska Investment Group L.P. now owns 1,070,951 shares of the real estate investment trust's stock valued at $75,448,000 after buying an additional 589,349 shares in the last quarter. Hedge funds and other institutional investors own 97.83% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have weighed in on the company. Truist Financial set a $84.00 target price on Agree Realty in a report on Friday, August 8th. Barclays cut their target price on Agree Realty from $78.00 to $77.00 and set an "equal weight" rating on the stock in a report on Wednesday, August 20th. Mizuho cut their target price on Agree Realty from $81.00 to $78.00 and set a "neutral" rating on the stock in a report on Monday, June 16th. BTIG Research lowered Agree Realty from a "buy" rating to a "neutral" rating in a report on Wednesday, May 7th. Finally, JMP Securities restated a "market perform" rating on shares of Agree Realty in a report on Monday, June 30th. Nine analysts have rated the stock with a Buy rating and six have given a Hold rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $80.50.

Get Our Latest Report on ADC

Insider Activity at Agree Realty

In other Agree Realty news, CEO Joey Agree acquired 4,108 shares of Agree Realty stock in a transaction dated Wednesday, August 13th. The stock was bought at an average cost of $72.15 per share, with a total value of $296,392.20. Following the acquisition, the chief executive officer owned 633,060 shares of the company's stock, valued at approximately $45,675,279. The trade was a 0.65% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Over the last ninety days, insiders have bought 6,950 shares of company stock worth $501,296. 1.80% of the stock is currently owned by company insiders.

Agree Realty Stock Performance

Shares of NYSE:ADC traded down $0.32 on Tuesday, hitting $72.17. 1,447,155 shares of the company were exchanged, compared to its average volume of 958,233. The company's 50 day moving average price is $73.04 and its two-hundred day moving average price is $74.26. Agree Realty Corporation has a one year low of $67.58 and a one year high of $79.65. The company has a debt-to-equity ratio of 0.59, a quick ratio of 0.71 and a current ratio of 0.71. The firm has a market capitalization of $7.99 billion, a price-to-earnings ratio of 17.30, a PEG ratio of 2.42 and a beta of 0.55.

Agree Realty (NYSE:ADC - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The real estate investment trust reported $1.06 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.05 by $0.01. The company had revenue of $175.53 million for the quarter, compared to the consensus estimate of $173.95 million. Agree Realty had a net margin of 28.16% and a return on equity of 3.47%. The business's revenue was up 15.0% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $1.04 EPS. Agree Realty has set its FY 2025 guidance at 4.290-4.320 EPS. Research analysts expect that Agree Realty Corporation will post 4.27 earnings per share for the current year.

Agree Realty Dividend Announcement

The firm also recently disclosed a monthly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, August 29th will be issued a dividend of $0.256 per share. This represents a c) dividend on an annualized basis and a dividend yield of 4.3%. The ex-dividend date of this dividend is Friday, August 29th. Agree Realty's dividend payout ratio (DPR) is presently 182.74%.

About Agree Realty

(

Free Report)

Agree Realty Corporation is a publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants. As of December 31, 2023, the Company owned and operated a portfolio of 2,135 properties, located in 49 states and containing approximately 44.2 million square feet of gross leasable area.

Featured Stories

Before you consider Agree Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agree Realty wasn't on the list.

While Agree Realty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.