Central Asset Investments & Management Holdings HK Ltd lowered its position in Microsoft Corporation (NASDAQ:MSFT - Free Report) by 40.0% during the first quarter, according to its most recent filing with the SEC. The firm owned 1,365 shares of the software giant's stock after selling 909 shares during the period. Microsoft accounts for approximately 0.9% of Central Asset Investments & Management Holdings HK Ltd's portfolio, making the stock its 27th largest position. Central Asset Investments & Management Holdings HK Ltd's holdings in Microsoft were worth $512,000 at the end of the most recent reporting period.

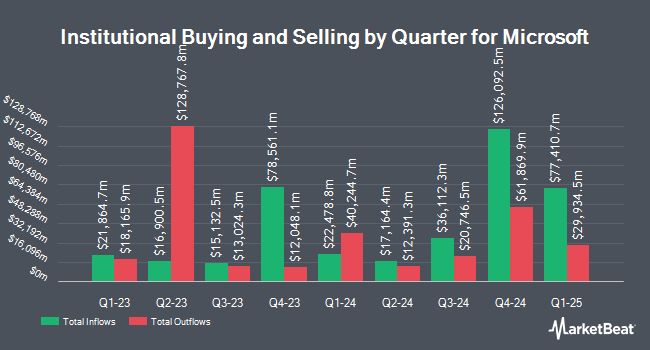

A number of other hedge funds and other institutional investors have also recently modified their holdings of MSFT. Norges Bank acquired a new position in shares of Microsoft in the 4th quarter worth approximately $44,343,058,000. Nuveen LLC acquired a new position in shares of Microsoft in the 1st quarter worth approximately $18,733,827,000. GAMMA Investing LLC lifted its position in shares of Microsoft by 40,290.4% in the 1st quarter. GAMMA Investing LLC now owns 46,695,303 shares of the software giant's stock worth $17,528,950,000 after purchasing an additional 46,579,693 shares during the period. Northern Trust Corp lifted its position in shares of Microsoft by 16.1% in the 4th quarter. Northern Trust Corp now owns 83,787,746 shares of the software giant's stock worth $35,316,535,000 after purchasing an additional 11,600,470 shares during the period. Finally, Vanguard Group Inc. lifted its position in shares of Microsoft by 1.5% in the 4th quarter. Vanguard Group Inc. now owns 684,071,705 shares of the software giant's stock worth $288,336,224,000 after purchasing an additional 10,431,988 shares during the period. Institutional investors and hedge funds own 71.13% of the company's stock.

Insider Buying and Selling

In other news, EVP Takeshi Numoto sold 4,850 shares of the firm's stock in a transaction that occurred on Tuesday, August 12th. The shares were sold at an average price of $527.32, for a total value of $2,557,502.00. Following the completion of the transaction, the executive vice president directly owned 39,111 shares in the company, valued at approximately $20,624,012.52. This trade represents a 11.03% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Satya Nadella sold 149,205 shares of Microsoft stock in a transaction that occurred on Wednesday, September 3rd. The shares were sold at an average price of $504.78, for a total transaction of $75,315,699.90. Following the sale, the chief executive officer owned 790,852 shares of the company's stock, valued at approximately $399,206,272.56. The trade was a 15.87% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.03% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

MSFT has been the topic of a number of research reports. Citigroup boosted their target price on shares of Microsoft from $605.00 to $613.00 and gave the company a "buy" rating in a research report on Tuesday, July 22nd. Truist Financial raised their target price on Microsoft from $650.00 to $675.00 and gave the company a "buy" rating in a research note on Monday, August 18th. Wall Street Zen upgraded Microsoft from a "hold" rating to a "buy" rating in a research note on Saturday, August 2nd. Barclays restated an "overweight" rating and issued a $625.00 target price on shares of Microsoft in a research note on Friday, August 29th. Finally, Scotiabank raised their target price on Microsoft from $500.00 to $650.00 and gave the company a "sector outperform" rating in a research note on Thursday, July 31st. One investment analyst has rated the stock with a Strong Buy rating, twenty-nine have assigned a Buy rating and two have assigned a Hold rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $612.54.

Read Our Latest Report on MSFT

Microsoft Stock Performance

Shares of MSFT stock opened at $498.41 on Wednesday. The firm has a 50-day moving average of $510.08 and a 200-day moving average of $452.04. The company has a market cap of $3.70 trillion, a P/E ratio of 36.54, a P/E/G ratio of 2.18 and a beta of 1.04. The company has a debt-to-equity ratio of 0.12, a current ratio of 1.35 and a quick ratio of 1.35. Microsoft Corporation has a one year low of $344.79 and a one year high of $555.45.

Microsoft (NASDAQ:MSFT - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The software giant reported $3.65 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.35 by $0.30. Microsoft had a net margin of 36.15% and a return on equity of 32.44%. The business had revenue of $76.44 billion during the quarter, compared to the consensus estimate of $73.79 billion. During the same quarter last year, the company posted $2.95 earnings per share. The firm's quarterly revenue was up 18.1% compared to the same quarter last year. Microsoft has set its Q1 2026 guidance at EPS. Equities research analysts forecast that Microsoft Corporation will post 13.08 EPS for the current fiscal year.

About Microsoft

(

Free Report)

Microsoft Corporation develops and supports software, services, devices and solutions worldwide. The Productivity and Business Processes segment offers office, exchange, SharePoint, Microsoft Teams, office 365 Security and Compliance, Microsoft viva, and Microsoft 365 copilot; and office consumer services, such as Microsoft 365 consumer subscriptions, Office licensed on-premises, and other office services.

See Also

Want to see what other hedge funds are holding MSFT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Microsoft Corporation (NASDAQ:MSFT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report