Cerity Partners LLC bought a new stake in shares of KE Holdings Inc. Sponsored ADR (NYSE:BEKE - Free Report) during the 1st quarter, according to its most recent filing with the SEC. The firm bought 14,437 shares of the company's stock, valued at approximately $290,000.

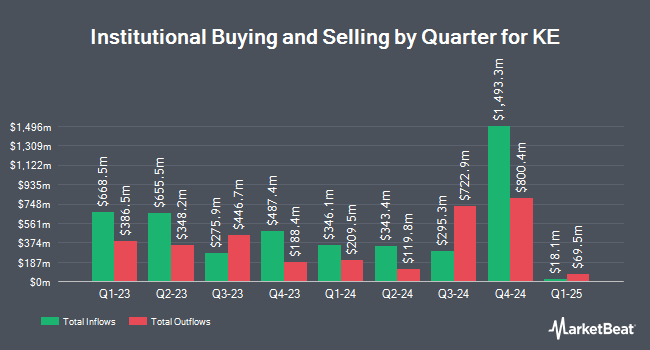

Several other hedge funds have also modified their holdings of the stock. First Affirmative Financial Network raised its holdings in shares of KE by 4.2% during the 1st quarter. First Affirmative Financial Network now owns 14,887 shares of the company's stock valued at $299,000 after buying an additional 599 shares during the period. GAMMA Investing LLC acquired a new stake in KE during the 1st quarter valued at approximately $34,000. Sumitomo Mitsui DS Asset Management Company Ltd grew its stake in KE by 1.1% during the 1st quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 169,159 shares of the company's stock valued at $3,398,000 after purchasing an additional 1,774 shares in the last quarter. Oppenheimer Asset Management Inc. grew its stake in KE by 1.1% during the 1st quarter. Oppenheimer Asset Management Inc. now owns 296,970 shares of the company's stock valued at $5,966,000 after purchasing an additional 3,312 shares in the last quarter. Finally, Wealthquest Corp acquired a new stake in KE during the 1st quarter valued at approximately $79,000. 39.34% of the stock is currently owned by hedge funds and other institutional investors.

KE Price Performance

Shares of BEKE traded down $0.12 during midday trading on Thursday, reaching $18.48. The stock had a trading volume of 1,359,034 shares, compared to its average volume of 8,877,870. KE Holdings Inc. Sponsored ADR has a 52 week low of $12.92 and a 52 week high of $26.05. The firm's 50 day moving average price is $18.60 and its 200-day moving average price is $19.44. The company has a market capitalization of $22.32 billion, a P/E ratio of 34.84, a P/E/G ratio of 1.41 and a beta of -0.76.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on the company. Wall Street Zen lowered KE from a "buy" rating to a "hold" rating in a research note on Sunday, June 22nd. UBS Group upgraded KE from a "neutral" rating to a "buy" rating and boosted their price objective for the company from $22.10 to $23.00 in a research report on Friday, May 16th. Finally, Citigroup reduced their price objective on KE from $25.80 to $24.80 and set a "buy" rating for the company in a research report on Friday, May 16th. One equities research analyst has rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat.com, KE has a consensus rating of "Moderate Buy" and an average target price of $27.16.

Read Our Latest Research Report on BEKE

KE Company Profile

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

Featured Stories

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.