Cerity Partners LLC acquired a new stake in Qifu Technology, Inc. (NASDAQ:QFIN - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 8,312 shares of the company's stock, valued at approximately $373,000.

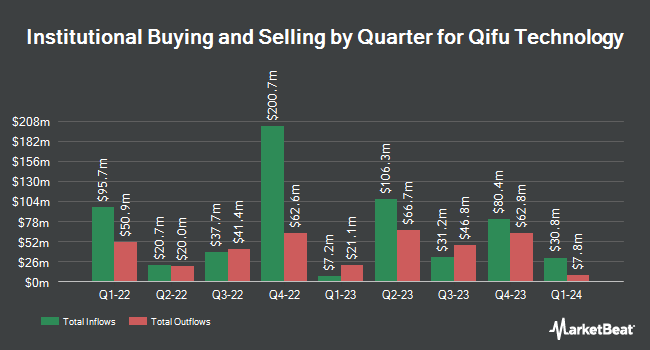

A number of other institutional investors and hedge funds have also recently made changes to their positions in QFIN. Raymond James Financial Inc. acquired a new stake in Qifu Technology during the fourth quarter worth approximately $298,000. HighTower Advisors LLC bought a new stake in shares of Qifu Technology during the 4th quarter valued at $563,000. American Century Companies Inc. lifted its position in shares of Qifu Technology by 12.8% during the 4th quarter. American Century Companies Inc. now owns 553,797 shares of the company's stock valued at $21,255,000 after acquiring an additional 62,837 shares during the period. KLP Kapitalforvaltning AS acquired a new stake in shares of Qifu Technology during the 4th quarter worth $1,105,000. Finally, LPL Financial LLC increased its position in shares of Qifu Technology by 90.7% in the fourth quarter. LPL Financial LLC now owns 24,179 shares of the company's stock worth $928,000 after purchasing an additional 11,502 shares during the period. Institutional investors and hedge funds own 74.81% of the company's stock.

Analyst Ratings Changes

Several brokerages have recently issued reports on QFIN. JPMorgan Chase & Co. initiated coverage on Qifu Technology in a research note on Wednesday, July 2nd. They issued an "overweight" rating and a $65.00 price target on the stock. Wall Street Zen lowered shares of Qifu Technology from a "strong-buy" rating to a "buy" rating in a research note on Friday, July 18th.

Get Our Latest Stock Report on Qifu Technology

Qifu Technology Stock Down 2.1%

QFIN stock traded down $0.73 during trading on Wednesday, reaching $34.31. 1,559,615 shares of the stock were exchanged, compared to its average volume of 1,927,272. The firm's 50 day moving average is $41.91 and its 200 day moving average is $41.51. The firm has a market cap of $5.41 billion, a P/E ratio of 5.26, a price-to-earnings-growth ratio of 0.43 and a beta of 0.48. The company has a current ratio of 3.08, a quick ratio of 3.08 and a debt-to-equity ratio of 0.21. Qifu Technology, Inc. has a twelve month low of $18.13 and a twelve month high of $48.94.

Qifu Technology (NASDAQ:QFIN - Get Free Report) last released its quarterly earnings results on Monday, May 19th. The company reported $1.74 EPS for the quarter, beating analysts' consensus estimates of $1.72 by $0.02. Qifu Technology had a return on equity of 29.73% and a net margin of 38.99%. The business had revenue of $646.19 million during the quarter, compared to analyst estimates of $4.61 billion. As a group, research analysts forecast that Qifu Technology, Inc. will post 5.71 EPS for the current year.

Qifu Technology Profile

(

Free Report)

Qifu Technology, Inc, through its subsidiaries, operates credit-tech platform under the 360 Jietiao brand in the People's Republic of China. It provides credit-driven services that matches borrowers with financial institutions to conduct customer acquisition, initial and credit screening, advanced risk assessment, credit assessment, fund matching, and other post-facilitation services; and platform services, including loan facilitation and post-facilitation services to financial institution partners under intelligence credit engine, referral services, and risk management software-as-a-service.

Further Reading

Before you consider Qfin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qfin wasn't on the list.

While Qfin currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.