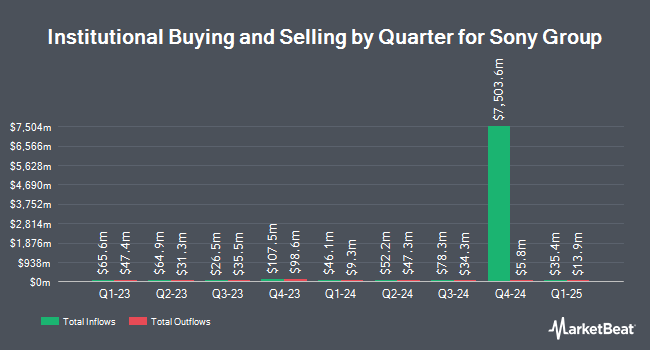

Charles Schwab Investment Management Inc. increased its position in Sony Corporation (NYSE:SONY - Free Report) by 17.0% during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 562,803 shares of the company's stock after acquiring an additional 81,673 shares during the period. Charles Schwab Investment Management Inc.'s holdings in Sony were worth $14,290,000 at the end of the most recent reporting period.

A number of other large investors have also modified their holdings of SONY. Capital Analysts LLC grew its position in Sony by 400.0% in the 4th quarter. Capital Analysts LLC now owns 1,170 shares of the company's stock valued at $25,000 after buying an additional 936 shares in the last quarter. City Holding Co. bought a new position in shares of Sony during the 1st quarter valued at about $30,000. Bartlett & CO. Wealth Management LLC bought a new position in shares of Sony during the 1st quarter valued at about $31,000. Ameliora Wealth Management Ltd. bought a new position in shares of Sony during the 1st quarter valued at about $56,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its position in shares of Sony by 155.4% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 2,268 shares of the company's stock valued at $48,000 after purchasing an additional 1,380 shares in the last quarter. Institutional investors and hedge funds own 14.05% of the company's stock.

Analyst Ratings Changes

Separately, Wall Street Zen lowered shares of Sony from a "buy" rating to a "hold" rating in a research report on Thursday, May 22nd. One equities research analyst has rated the stock with a Strong Buy rating, four have issued a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average price target of $28.00.

Read Our Latest Stock Analysis on SONY

Sony Stock Up 0.8%

Shares of NYSE SONY traded up $0.22 during mid-day trading on Thursday, reaching $28.06. The company had a trading volume of 2,323,890 shares, compared to its average volume of 5,118,742. The stock has a fifty day moving average of $25.74 and a two-hundred day moving average of $25.05. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.03 and a current ratio of 1.09. The company has a market capitalization of $169.67 billion, a price-to-earnings ratio of 22.27 and a beta of 0.91. Sony Corporation has a 12-month low of $17.42 and a 12-month high of $29.16.

Sony (NYSE:SONY - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported $0.30 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.24 by $0.06. The business had revenue of $17.79 billion during the quarter, compared to analyst estimates of $18.88 billion. Sony had a net margin of 9.14% and a return on equity of 13.88%. During the same period in the prior year, the firm earned $189.90 earnings per share. Sony has set its FY 2025 guidance at EPS. As a group, equities research analysts expect that Sony Corporation will post 1.23 EPS for the current year.

Sony Company Profile

(

Free Report)

Sony Group Corporation designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally. The company distributes software titles and add-on content through digital networks; network services related to game, video, and music content; and home gaming consoles, packaged and game software, and peripheral devices.

Featured Articles

Before you consider Sony, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sony wasn't on the list.

While Sony currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.