Charles Schwab Investment Management Inc. grew its position in shares of Accenture PLC (NYSE:ACN - Free Report) by 3.3% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 5,129,053 shares of the information technology services provider's stock after buying an additional 164,573 shares during the period. Charles Schwab Investment Management Inc. owned approximately 0.82% of Accenture worth $1,600,470,000 at the end of the most recent quarter.

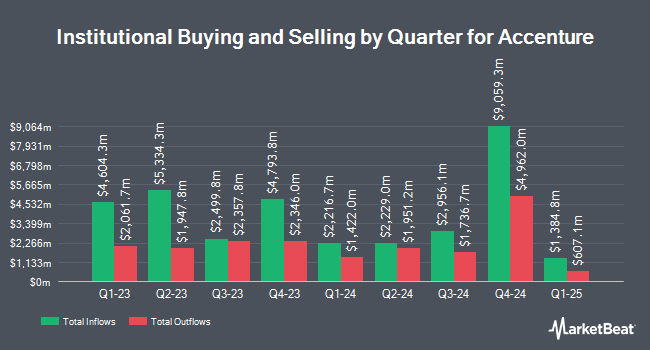

Several other large investors have also recently added to or reduced their stakes in the company. Mpwm Advisory Solutions LLC bought a new position in shares of Accenture in the fourth quarter worth $30,000. Park Square Financial Group LLC bought a new position in shares of Accenture in the fourth quarter worth $31,000. Inlight Wealth Management LLC bought a new position in shares of Accenture in the first quarter worth $32,000. Capital A Wealth Management LLC bought a new position in shares of Accenture in the fourth quarter worth $34,000. Finally, Navigoe LLC bought a new position in shares of Accenture in the fourth quarter worth $37,000. Institutional investors own 75.14% of the company's stock.

Analyst Ratings Changes

Several analysts recently weighed in on the company. Morgan Stanley reduced their price objective on Accenture from $340.00 to $325.00 and set an "equal weight" rating on the stock in a research note on Tuesday, June 24th. Guggenheim reduced their price objective on Accenture from $360.00 to $335.00 and set a "buy" rating on the stock in a research note on Monday, June 23rd. Argus set a $370.00 price objective on Accenture in a research note on Tuesday, June 24th. Piper Sandler reduced their price objective on Accenture from $364.00 to $355.00 and set an "overweight" rating on the stock in a research note on Wednesday, April 16th. Finally, BMO Capital Markets reduced their price objective on Accenture from $355.00 to $325.00 and set a "market perform" rating on the stock in a research note on Monday, June 23rd. One analyst has rated the stock with a sell rating, eight have given a hold rating, fifteen have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $360.21.

Check Out Our Latest Stock Analysis on ACN

Accenture Trading Down 1.1%

Shares of ACN traded down $2.65 during mid-day trading on Friday, reaching $239.07. 3,810,701 shares of the company were exchanged, compared to its average volume of 4,579,456. Accenture PLC has a 52 week low of $238.03 and a 52 week high of $398.35. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.46 and a current ratio of 1.46. The stock has a market capitalization of $149.74 billion, a PE ratio of 19.03, a PEG ratio of 2.20 and a beta of 1.29. The business has a 50 day simple moving average of $291.16 and a two-hundred day simple moving average of $315.89.

Accenture (NYSE:ACN - Get Free Report) last issued its quarterly earnings data on Friday, June 20th. The information technology services provider reported $3.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.32 by $0.17. Accenture had a return on equity of 26.55% and a net margin of 11.61%. The company had revenue of $17.73 billion during the quarter, compared to the consensus estimate of $17.26 billion. During the same period last year, the company earned $3.13 earnings per share. The firm's revenue was up 7.7% compared to the same quarter last year. On average, analysts predict that Accenture PLC will post 12.73 earnings per share for the current fiscal year.

Accenture Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, August 15th. Shareholders of record on Thursday, July 10th will be issued a $1.48 dividend. This represents a $5.92 dividend on an annualized basis and a yield of 2.5%. The ex-dividend date is Thursday, July 10th. Accenture's payout ratio is presently 47.13%.

Insiders Place Their Bets

In other Accenture news, COO John F. Walsh sold 2,500 shares of Accenture stock in a transaction that occurred on Tuesday, May 13th. The stock was sold at an average price of $325.00, for a total value of $812,500.00. Following the completion of the sale, the chief operating officer directly owned 15,882 shares in the company, valued at approximately $5,161,650. The trade was a 13.60% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Mauro Macchi sold 500 shares of the business's stock in a transaction that occurred on Friday, July 11th. The shares were sold at an average price of $282.34, for a total value of $141,170.00. Following the sale, the chief executive officer owned 2,283 shares of the company's stock, valued at approximately $644,582.22. This represents a 17.97% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 5,454 shares of company stock valued at $1,646,780. Company insiders own 0.02% of the company's stock.

Accenture Profile

(

Free Report)

Accenture plc, a professional services company, provides strategy and consulting, industry X, song, and technology and operation services worldwide. The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software and quality engineering, data management; intelligent automation comprising robotic process automation, natural language processing, and virtual agents; and application management services, as well as software engineering services; strategy and consulting services; data and analytics strategy, data discovery and augmentation, data management and beyond, data democratization, and industrialized solutions comprising turnkey analytics and artificial intelligence (AI) solutions; metaverse; and sustainability services.

Featured Articles

Before you consider Accenture, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Accenture wasn't on the list.

While Accenture currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report