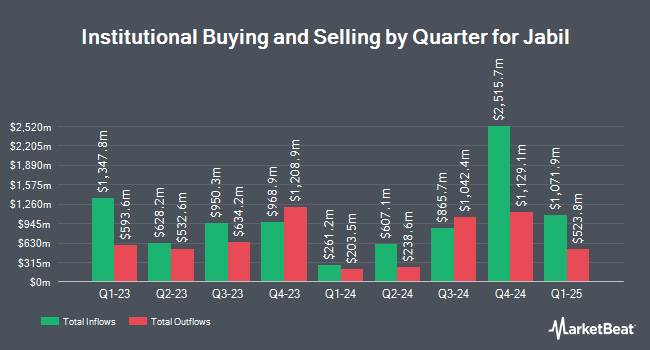

Choreo LLC decreased its holdings in Jabil, Inc. (NYSE:JBL - Free Report) by 34.9% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 2,087 shares of the technology company's stock after selling 1,118 shares during the quarter. Choreo LLC's holdings in Jabil were worth $284,000 as of its most recent filing with the SEC.

Several other large investors have also recently bought and sold shares of JBL. Creative Financial Designs Inc. ADV acquired a new stake in shares of Jabil during the first quarter valued at $27,000. Harbor Capital Advisors Inc. boosted its stake in shares of Jabil by 110.5% during the first quarter. Harbor Capital Advisors Inc. now owns 221 shares of the technology company's stock valued at $30,000 after acquiring an additional 116 shares during the last quarter. Golden State Wealth Management LLC boosted its stake in shares of Jabil by 2,400.0% during the first quarter. Golden State Wealth Management LLC now owns 275 shares of the technology company's stock valued at $37,000 after acquiring an additional 264 shares during the last quarter. True Wealth Design LLC boosted its stake in shares of Jabil by 3,411.1% during the fourth quarter. True Wealth Design LLC now owns 316 shares of the technology company's stock valued at $45,000 after acquiring an additional 307 shares during the last quarter. Finally, Wayfinding Financial LLC acquired a new stake in shares of Jabil during the first quarter valued at $52,000. Hedge funds and other institutional investors own 93.39% of the company's stock.

Insider Buying and Selling at Jabil

In other news, Chairman Mark T. Mondello sold 150,000 shares of Jabil stock in a transaction on Tuesday, June 17th. The stock was sold at an average price of $193.33, for a total transaction of $28,999,500.00. Following the transaction, the chairman owned 1,560,192 shares in the company, valued at approximately $301,631,919.36. The trade was a 8.77% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, EVP Steven D. Borges sold 22,443 shares of Jabil stock in a transaction on Wednesday, June 18th. The shares were sold at an average price of $200.01, for a total value of $4,488,824.43. Following the transaction, the executive vice president owned 102,803 shares in the company, valued at $20,561,628.03. This represents a 17.92% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 322,847 shares of company stock valued at $63,849,847 in the last ninety days. Company insiders own 1.73% of the company's stock.

Analysts Set New Price Targets

Several equities analysts recently weighed in on the company. Barclays increased their target price on Jabil from $206.00 to $223.00 and gave the stock an "overweight" rating in a research report on Tuesday, June 17th. JPMorgan Chase & Co. increased their target price on Jabil from $214.00 to $256.00 and gave the stock an "overweight" rating in a research report on Thursday, July 17th. UBS Group increased their target price on Jabil from $157.00 to $208.00 and gave the stock a "neutral" rating in a research report on Wednesday, June 18th. Argus upgraded Jabil from a "hold" rating to a "buy" rating in a research report on Wednesday, June 18th. Finally, Wall Street Zen downgraded Jabil from a "strong-buy" rating to a "buy" rating in a research report on Saturday, July 12th. One equities research analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Buy" and an average price target of $231.71.

View Our Latest Stock Report on Jabil

Jabil Price Performance

JBL stock traded down $4.55 during trading on Friday, hitting $218.62. The company had a trading volume of 1,370,839 shares, compared to its average volume of 1,423,933. The firm has a market capitalization of $23.46 billion, a price-to-earnings ratio of 42.45, a P/E/G ratio of 1.58 and a beta of 1.20. The business has a 50 day moving average of $203.08 and a 200 day moving average of $168.48. Jabil, Inc. has a fifty-two week low of $95.85 and a fifty-two week high of $232.84. The company has a current ratio of 0.98, a quick ratio of 0.64 and a debt-to-equity ratio of 1.85.

Jabil (NYSE:JBL - Get Free Report) last posted its quarterly earnings data on Tuesday, June 17th. The technology company reported $2.55 EPS for the quarter, topping analysts' consensus estimates of $2.28 by $0.27. Jabil had a return on equity of 60.19% and a net margin of 2.02%. The company had revenue of $7.83 billion for the quarter, compared to the consensus estimate of $7.03 billion. During the same quarter in the previous year, the business earned $1.89 EPS. The company's quarterly revenue was up 15.7% compared to the same quarter last year. As a group, research analysts predict that Jabil, Inc. will post 8.05 earnings per share for the current year.

Jabil Company Profile

(

Free Report)

Jabil Inc provides manufacturing services and solutions worldwide. It operates in two segments, Electronics Manufacturing Services and Diversified Manufacturing Services. The company offers electronics design, production, and product management services; electronic circuit design services, such as application-specific integrated circuit design, firmware development, and rapid prototyping services; and designs plastic and metal enclosures that include the electro-mechanics, such as the printed circuit board assemblies (PCBA).

Featured Stories

Before you consider Jabil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jabil wasn't on the list.

While Jabil currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.