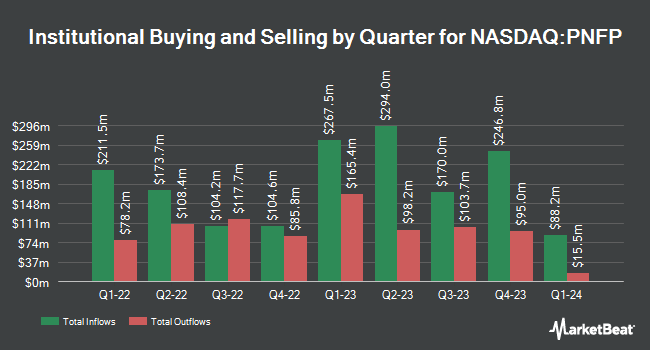

Citigroup Inc. trimmed its position in Pinnacle Financial Partners, Inc. (NASDAQ:PNFP - Free Report) by 14.3% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 69,220 shares of the financial services provider's stock after selling 11,507 shares during the period. Citigroup Inc. owned approximately 0.09% of Pinnacle Financial Partners worth $7,340,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also bought and sold shares of the company. Golden State Wealth Management LLC bought a new stake in Pinnacle Financial Partners during the first quarter worth about $48,000. Kapitalo Investimentos Ltda bought a new stake in Pinnacle Financial Partners during the fourth quarter worth about $78,000. UMB Bank n.a. raised its holdings in Pinnacle Financial Partners by 16.6% during the first quarter. UMB Bank n.a. now owns 858 shares of the financial services provider's stock worth $91,000 after acquiring an additional 122 shares in the last quarter. GAMMA Investing LLC raised its holdings in Pinnacle Financial Partners by 51.7% during the first quarter. GAMMA Investing LLC now owns 1,616 shares of the financial services provider's stock worth $171,000 after acquiring an additional 551 shares in the last quarter. Finally, Portside Wealth Group LLC bought a new stake in Pinnacle Financial Partners during the first quarter worth about $210,000. Institutional investors own 87.40% of the company's stock.

Pinnacle Financial Partners Price Performance

NASDAQ:PNFP traded down $0.46 during trading hours on Thursday, reaching $92.39. 1,066,729 shares of the company were exchanged, compared to its average volume of 2,158,676. The company has a market capitalization of $7.17 billion, a P/E ratio of 12.25 and a beta of 1.03. Pinnacle Financial Partners, Inc. has a 1-year low of $81.57 and a 1-year high of $131.91. The company has a debt-to-equity ratio of 0.34, a current ratio of 0.89 and a quick ratio of 0.88. The business has a 50 day moving average of $103.47 and a 200 day moving average of $105.31.

Pinnacle Financial Partners (NASDAQ:PNFP - Get Free Report) last issued its quarterly earnings results on Tuesday, July 15th. The financial services provider reported $2.00 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.92 by $0.08. The business had revenue of $504.99 million for the quarter, compared to the consensus estimate of $495.27 million. Pinnacle Financial Partners had a return on equity of 9.60% and a net margin of 18.69%.The firm's quarterly revenue was up 15.1% compared to the same quarter last year. During the same quarter in the prior year, the business posted $1.63 earnings per share. Research analysts forecast that Pinnacle Financial Partners, Inc. will post 7.85 EPS for the current year.

Pinnacle Financial Partners Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, August 29th. Stockholders of record on Friday, August 1st will be paid a $0.24 dividend. This represents a $0.96 dividend on an annualized basis and a dividend yield of 1.0%. The ex-dividend date is Friday, August 1st. Pinnacle Financial Partners's dividend payout ratio is presently 12.73%.

Insider Activity

In other news, Director G Kennedy Thompson purchased 10,000 shares of the company's stock in a transaction dated Friday, August 1st. The stock was bought at an average cost of $85.65 per share, for a total transaction of $856,500.00. Following the purchase, the director owned 28,372 shares of the company's stock, valued at approximately $2,430,061.80. The trade was a 54.43% increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Thomas C. Farnsworth III bought 1,000 shares of the stock in a transaction that occurred on Friday, August 1st. The shares were bought at an average cost of $84.94 per share, with a total value of $84,940.00. Following the completion of the transaction, the director owned 28,277 shares in the company, valued at $2,401,848.38. The trade was a 3.67% increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last ninety days, insiders bought 12,174 shares of company stock worth $1,047,079. Insiders own 1.46% of the company's stock.

Analyst Ratings Changes

Several research firms have issued reports on PNFP. Stephens dropped their price objective on Pinnacle Financial Partners from $133.00 to $104.00 and set an "equal weight" rating on the stock in a research note on Tuesday, July 29th. Wells Fargo & Company dropped their price objective on Pinnacle Financial Partners from $125.00 to $110.00 and set an "equal weight" rating on the stock in a research note on Friday, July 25th. Jefferies Financial Group restated a "hold" rating and issued a $110.00 price objective (down previously from $145.00) on shares of Pinnacle Financial Partners in a research note on Friday, July 25th. UBS Group restated a "neutral" rating and issued a $121.00 price objective on shares of Pinnacle Financial Partners in a research note on Wednesday, July 9th. Finally, Hovde Group downgraded Pinnacle Financial Partners from a "strong-buy" rating to a "hold" rating in a research report on Friday, July 25th. Four investment analysts have rated the stock with a Buy rating and six have issued a Hold rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus price target of $114.80.

View Our Latest Analysis on Pinnacle Financial Partners

Pinnacle Financial Partners Profile

(

Free Report)

Pinnacle Financial Partners, Inc, together with its subsidiaries, operates as the bank holding company for Pinnacle Bank that provides various banking products and services to individuals, businesses, and professional entities in the United States. The company accepts various deposits, including savings, noninterest-bearing and interest-bearing checking, money market, and certificate of deposit accounts; and provides treasury management services, which includes online wire origination, enhanced ACH origination services, positive pay, zero balance and sweep accounts, automated bill pay services, electronic receivables processing, lockbox processing, and merchant card acceptance services.

See Also

Before you consider Pinnacle Financial Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinnacle Financial Partners wasn't on the list.

While Pinnacle Financial Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report