City Center Advisors LLC acquired a new position in Aurinia Pharmaceuticals Inc (NASDAQ:AUPH - Free Report) TSE: AUP during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 26,155 shares of the biotechnology company's stock, valued at approximately $222,000.

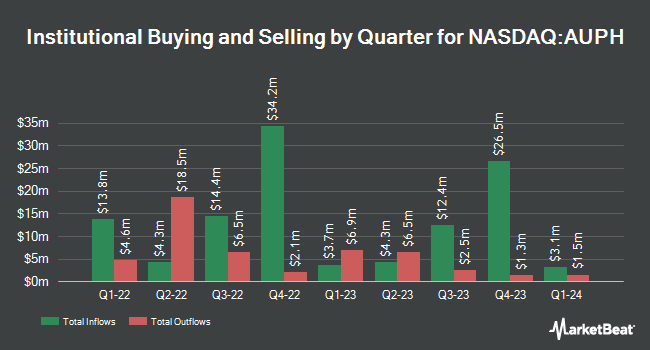

A number of other hedge funds have also recently added to or reduced their stakes in AUPH. Northern Trust Corp increased its holdings in Aurinia Pharmaceuticals by 5.9% in the fourth quarter. Northern Trust Corp now owns 1,054,365 shares of the biotechnology company's stock worth $9,468,000 after buying an additional 58,676 shares during the last quarter. Ameriprise Financial Inc. increased its holdings in Aurinia Pharmaceuticals by 249.5% in the fourth quarter. Ameriprise Financial Inc. now owns 37,796 shares of the biotechnology company's stock worth $339,000 after buying an additional 26,981 shares during the last quarter. Balyasny Asset Management L.P. acquired a new position in Aurinia Pharmaceuticals in the fourth quarter worth approximately $427,000. Cetera Investment Advisers increased its holdings in Aurinia Pharmaceuticals by 3.2% in the fourth quarter. Cetera Investment Advisers now owns 64,638 shares of the biotechnology company's stock worth $580,000 after buying an additional 2,000 shares during the last quarter. Finally, Deutsche Bank AG increased its holdings in Aurinia Pharmaceuticals by 54.8% in the fourth quarter. Deutsche Bank AG now owns 142,869 shares of the biotechnology company's stock worth $1,283,000 after buying an additional 50,575 shares during the last quarter. Institutional investors and hedge funds own 36.83% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities analysts recently commented on the company. HC Wainwright restated a "buy" rating and issued a $17.00 price objective on shares of Aurinia Pharmaceuticals in a report on Wednesday, July 30th. Royal Bank Of Canada increased their price target on Aurinia Pharmaceuticals from $8.00 to $9.00 and gave the company an "outperform" rating in a report on Friday, August 1st. Two investment analysts have rated the stock with a Buy rating, According to MarketBeat, the stock currently has an average rating of "Buy" and an average target price of $13.00.

View Our Latest Stock Analysis on AUPH

Insider Buying and Selling at Aurinia Pharmaceuticals

In other Aurinia Pharmaceuticals news, Director Kevin Tang acquired 200,000 shares of Aurinia Pharmaceuticals stock in a transaction dated Tuesday, August 5th. The stock was bought at an average cost of $11.68 per share, with a total value of $2,336,000.00. Following the completion of the transaction, the director owned 11,329,500 shares of the company's stock, valued at $132,328,560. The trade was a 1.80% increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders purchased 1,300,000 shares of company stock valued at $13,590,000 over the last three months. 12.20% of the stock is currently owned by corporate insiders.

Aurinia Pharmaceuticals Stock Performance

Shares of AUPH traded up $0.15 during mid-day trading on Friday, hitting $13.04. The company's stock had a trading volume of 719,095 shares, compared to its average volume of 1,616,531. Aurinia Pharmaceuticals Inc has a one year low of $6.55 and a one year high of $13.04. The company has a debt-to-equity ratio of 0.18, a quick ratio of 4.63 and a current ratio of 5.23. The firm has a market capitalization of $1.72 billion, a PE ratio of 30.30 and a beta of 1.26. The stock's 50-day moving average is $11.12 and its two-hundred day moving average is $9.11.

Aurinia Pharmaceuticals (NASDAQ:AUPH - Get Free Report) TSE: AUP last posted its quarterly earnings data on Thursday, July 31st. The biotechnology company reported $0.16 earnings per share for the quarter, missing the consensus estimate of $0.17 by ($0.01). Aurinia Pharmaceuticals had a net margin of 23.31% and a return on equity of 20.06%. The business had revenue of $70.01 million during the quarter, compared to the consensus estimate of $64.27 million. Aurinia Pharmaceuticals has set its FY 2025 guidance at EPS. As a group, sell-side analysts anticipate that Aurinia Pharmaceuticals Inc will post 0.11 EPS for the current year.

Aurinia Pharmaceuticals Profile

(

Free Report)

Aurinia Pharmaceuticals Inc, a commercial-stage biopharmaceutical company, focuses on developing and commercializing therapies to treat various diseases with unmet medical need in the United States. It offers LUPKYNIS for the treatment of adult patients with active lupus nephritis. It has a collaboration and license agreement with Otsuka Pharmaceutical Co, Ltd.

Recommended Stories

Before you consider Aurinia Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aurinia Pharmaceuticals wasn't on the list.

While Aurinia Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.