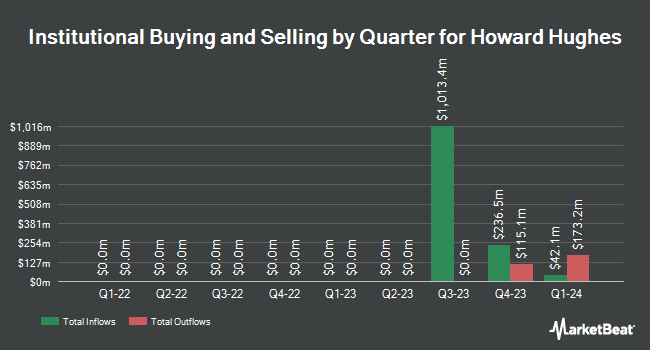

Clear Creek Financial Management LLC purchased a new position in Howard Hughes Holdings Inc. (NYSE:HHH - Free Report) during the 2nd quarter, according to its most recent 13F filing with the SEC. The firm purchased 8,167 shares of the company's stock, valued at approximately $551,000.

Several other hedge funds and other institutional investors have also made changes to their positions in the stock. Dimensional Fund Advisors LP boosted its position in shares of Howard Hughes by 0.4% in the 1st quarter. Dimensional Fund Advisors LP now owns 2,495,852 shares of the company's stock worth $184,894,000 after purchasing an additional 10,405 shares during the last quarter. Egerton Capital UK LLP boosted its position in shares of Howard Hughes by 169.5% in the 1st quarter. Egerton Capital UK LLP now owns 1,196,288 shares of the company's stock worth $88,621,000 after purchasing an additional 752,325 shares during the last quarter. American Century Companies Inc. boosted its position in shares of Howard Hughes by 24.8% in the 1st quarter. American Century Companies Inc. now owns 779,879 shares of the company's stock worth $57,773,000 after purchasing an additional 155,110 shares during the last quarter. Victory Capital Management Inc. boosted its position in shares of Howard Hughes by 2.0% in the 1st quarter. Victory Capital Management Inc. now owns 300,963 shares of the company's stock worth $22,295,000 after purchasing an additional 5,872 shares during the last quarter. Finally, First Manhattan CO. LLC. boosted its position in shares of Howard Hughes by 8.4% in the 1st quarter. First Manhattan CO. LLC. now owns 267,978 shares of the company's stock worth $19,852,000 after purchasing an additional 20,684 shares during the last quarter. 93.83% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several research analysts have recently issued reports on HHH shares. Weiss Ratings restated a "hold (c-)" rating on shares of Howard Hughes in a research report on Wednesday. Wall Street Zen lowered Howard Hughes from a "hold" rating to a "sell" rating in a report on Saturday, August 9th. JPMorgan Chase & Co. lifted their target price on Howard Hughes from $76.00 to $85.00 and gave the stock a "neutral" rating in a report on Friday, August 29th. Finally, Zacks Research upgraded Howard Hughes from a "hold" rating to a "strong-buy" rating in a report on Monday, September 22nd. One research analyst has rated the stock with a Strong Buy rating, two have given a Buy rating and two have issued a Hold rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $83.33.

Read Our Latest Stock Report on HHH

Insider Activity at Howard Hughes

In other news, Director Anthony Williams sold 1,100 shares of the business's stock in a transaction dated Friday, September 26th. The stock was sold at an average price of $79.58, for a total value of $87,538.00. Following the sale, the director directly owned 8,102 shares in the company, valued at $644,757.16. The trade was a 11.95% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. 48.00% of the stock is currently owned by company insiders.

Howard Hughes Stock Performance

Shares of Howard Hughes stock opened at $78.39 on Friday. The firm has a market cap of $4.66 billion, a price-to-earnings ratio of 17.15 and a beta of 1.23. The stock's 50-day moving average is $77.70 and its 200-day moving average is $71.87. Howard Hughes Holdings Inc. has a one year low of $61.40 and a one year high of $87.77. The company has a debt-to-equity ratio of 1.85, a current ratio of 1.18 and a quick ratio of 1.18.

Howard Hughes Profile

(

Free Report)

Howard Hughes Holdings Inc, together with its subsidiaries, operates as a real estate development company in the United States. It operates in four segments: Operating Assets; Master Planned Communities (MPCs); Seaport; and Strategic Developments. The Operating Assets segment consists of developed or acquired retail, office, and multi-family properties along with other retail investments.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Howard Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howard Hughes wasn't on the list.

While Howard Hughes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.