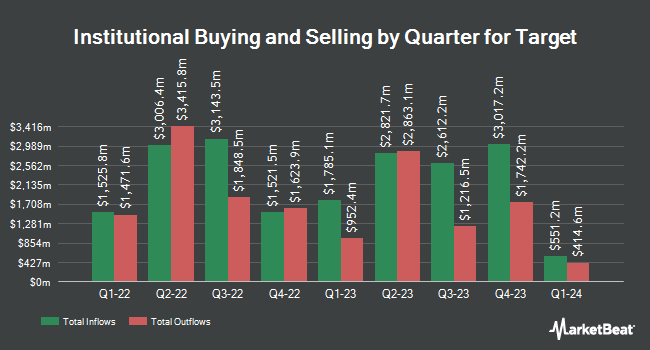

Columbia Asset Management trimmed its position in Target Co. (NYSE:TGT - Free Report) by 49.1% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 36,667 shares of the retailer's stock after selling 35,368 shares during the quarter. Columbia Asset Management's holdings in Target were worth $3,827,000 at the end of the most recent reporting period.

Other institutional investors have also added to or reduced their stakes in the company. Capital World Investors increased its stake in shares of Target by 6.3% in the 4th quarter. Capital World Investors now owns 21,930,569 shares of the retailer's stock valued at $2,964,565,000 after purchasing an additional 1,306,552 shares during the last quarter. FMR LLC boosted its stake in Target by 13.6% in the fourth quarter. FMR LLC now owns 11,338,729 shares of the retailer's stock valued at $1,532,769,000 after buying an additional 1,358,348 shares in the last quarter. Geode Capital Management LLC boosted its stake in Target by 5.0% in the fourth quarter. Geode Capital Management LLC now owns 9,885,015 shares of the retailer's stock valued at $1,332,317,000 after buying an additional 470,990 shares in the last quarter. Norges Bank bought a new position in Target in the fourth quarter valued at about $757,892,000. Finally, Northern Trust Corp raised its stake in Target by 16.3% during the fourth quarter. Northern Trust Corp now owns 5,376,640 shares of the retailer's stock worth $726,814,000 after acquiring an additional 754,883 shares in the last quarter. 79.73% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

TGT has been the topic of a number of research analyst reports. Robert W. Baird set a $100.00 price target on shares of Target in a research note on Thursday, May 22nd. Royal Bank of Canada cut their target price on shares of Target from $112.00 to $103.00 and set an "outperform" rating on the stock in a research report on Thursday, May 22nd. Truist Financial upped their price target on shares of Target from $82.00 to $90.00 and gave the stock a "hold" rating in a report on Thursday, May 22nd. Roth Capital set a $122.00 price objective on Target in a report on Wednesday, March 5th. Finally, Cfra Research cut Target from a "moderate buy" rating to a "hold" rating in a report on Thursday, April 17th. One analyst has rated the stock with a sell rating, twenty-five have issued a hold rating and nine have assigned a buy rating to the stock. Based on data from MarketBeat.com, Target currently has a consensus rating of "Hold" and an average target price of $116.70.

View Our Latest Stock Analysis on Target

Insider Activity

In other news, insider Brian C. Cornell sold 45,000 shares of the business's stock in a transaction dated Wednesday, May 28th. The shares were sold at an average price of $96.18, for a total transaction of $4,328,100.00. Following the completion of the sale, the insider now directly owns 246,453 shares of the company's stock, valued at $23,703,849.54. The trade was a 15.44% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 0.16% of the stock is currently owned by company insiders.

Target Trading Down 0.5%

TGT stock traded down $0.46 during mid-day trading on Thursday, reaching $93.49. The company's stock had a trading volume of 4,759,471 shares, compared to its average volume of 6,037,022. Target Co. has a 12 month low of $87.35 and a 12 month high of $167.40. The company has a current ratio of 0.94, a quick ratio of 0.25 and a debt-to-equity ratio of 0.99. The business's 50 day moving average price is $95.60 and its 200 day moving average price is $117.00. The company has a market cap of $42.48 billion, a price-to-earnings ratio of 9.91, a price-to-earnings-growth ratio of 1.94 and a beta of 1.22.

Target (NYSE:TGT - Get Free Report) last released its quarterly earnings data on Wednesday, May 21st. The retailer reported $1.30 earnings per share for the quarter, missing the consensus estimate of $1.65 by ($0.35). Target had a net margin of 4.06% and a return on equity of 31.11%. The company had revenue of $24.20 billion during the quarter, compared to the consensus estimate of $24.54 billion. During the same quarter in the prior year, the firm earned $2.03 EPS. The business's revenue was down 2.8% compared to the same quarter last year. On average, equities research analysts predict that Target Co. will post 8.69 EPS for the current year.

Target Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Sunday, June 1st. Stockholders of record on Wednesday, May 14th were paid a $1.12 dividend. The ex-dividend date of this dividend was Wednesday, May 14th. This represents a $4.48 annualized dividend and a dividend yield of 4.79%. Target's dividend payout ratio is presently 49.23%.

Target Company Profile

(

Free Report)

Target Corporation operates as a general merchandise retailer in the United States. The company offers apparel for women, men, boys, girls, toddlers, and infants and newborns, as well as jewelry, accessories, and shoes; and beauty and personal care, baby gear, cleaning, paper products, and pet supplies.

Featured Articles

Before you consider Target, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Target wasn't on the list.

While Target currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report