Comerica Bank decreased its stake in shares of F5, Inc. (NASDAQ:FFIV - Free Report) by 51.3% during the first quarter, according to its most recent filing with the SEC. The institutional investor owned 20,727 shares of the network technology company's stock after selling 21,869 shares during the period. Comerica Bank's holdings in F5 were worth $5,519,000 as of its most recent SEC filing.

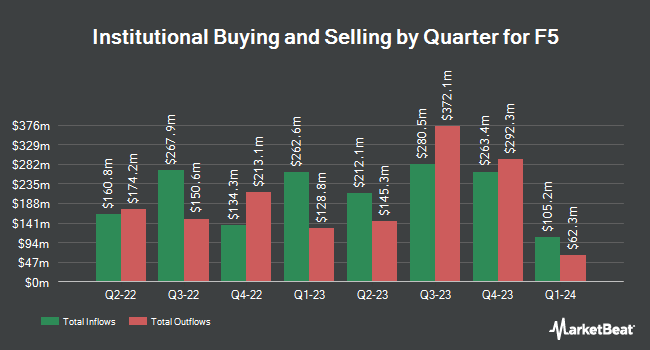

A number of other institutional investors have also added to or reduced their stakes in the stock. Colonial Trust Co SC lifted its holdings in F5 by 5.2% during the 4th quarter. Colonial Trust Co SC now owns 685 shares of the network technology company's stock worth $172,000 after purchasing an additional 34 shares in the last quarter. Coldstream Capital Management Inc. raised its holdings in shares of F5 by 3.7% in the 4th quarter. Coldstream Capital Management Inc. now owns 954 shares of the network technology company's stock valued at $240,000 after acquiring an additional 34 shares in the last quarter. Spire Wealth Management raised its holdings in shares of F5 by 11.9% in the 1st quarter. Spire Wealth Management now owns 451 shares of the network technology company's stock valued at $120,000 after acquiring an additional 48 shares in the last quarter. Horizon Investments LLC raised its holdings in shares of F5 by 6.3% in the 1st quarter. Horizon Investments LLC now owns 845 shares of the network technology company's stock valued at $225,000 after acquiring an additional 50 shares in the last quarter. Finally, BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp raised its holdings in shares of F5 by 0.4% in the 1st quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 11,210 shares of the network technology company's stock valued at $2,985,000 after acquiring an additional 50 shares in the last quarter. Hedge funds and other institutional investors own 90.66% of the company's stock.

Analyst Ratings Changes

FFIV has been the topic of several recent analyst reports. Barclays raised their price target on F5 from $274.00 to $321.00 and gave the company an "equal weight" rating in a report on Thursday, July 31st. JPMorgan Chase & Co. raised their price target on F5 from $285.00 to $305.00 and gave the company a "neutral" rating in a report on Thursday, July 17th. Wall Street Zen cut F5 from a "strong-buy" rating to a "buy" rating in a report on Thursday, May 22nd. Wolfe Research initiated coverage on F5 in a report on Monday, July 7th. They issued an "outperform" rating on the stock. Finally, Royal Bank Of Canada increased their price objective on F5 from $314.00 to $326.00 and gave the company a "sector perform" rating in a research report on Thursday, July 31st. Three equities research analysts have rated the stock with a Buy rating, seven have issued a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat.com, F5 has a consensus rating of "Hold" and a consensus target price of $309.89.

Check Out Our Latest Report on F5

Insiders Place Their Bets

In other news, EVP Chad Michael Whalen sold 5,297 shares of F5 stock in a transaction that occurred on Monday, August 11th. The stock was sold at an average price of $322.24, for a total value of $1,706,905.28. Following the sale, the executive vice president directly owned 23,591 shares in the company, valued at approximately $7,601,963.84. This trade represents a 18.34% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Elizabeth Buse sold 1,500 shares of F5 stock in a transaction that occurred on Wednesday, June 11th. The stock was sold at an average price of $293.53, for a total value of $440,295.00. Following the completion of the sale, the director owned 5,013 shares in the company, valued at approximately $1,471,465.89. This represents a 23.03% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 10,744 shares of company stock valued at $3,347,605 in the last 90 days. 0.52% of the stock is owned by corporate insiders.

F5 Stock Performance

FFIV traded down $6.11 on Tuesday, hitting $307.03. 185,710 shares of the company were exchanged, compared to its average volume of 537,188. The firm has a fifty day simple moving average of $306.71 and a two-hundred day simple moving average of $286.66. F5, Inc. has a 12 month low of $197.34 and a 12 month high of $334.00. The stock has a market capitalization of $17.64 billion, a PE ratio of 27.14, a price-to-earnings-growth ratio of 3.61 and a beta of 1.08.

F5 (NASDAQ:FFIV - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The network technology company reported $4.16 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.49 by $0.67. F5 had a return on equity of 21.77% and a net margin of 22.06%.The business had revenue of $780.37 million for the quarter, compared to analyst estimates of $750.64 million. During the same period last year, the company earned $3.36 EPS. F5's revenue for the quarter was up 12.2% compared to the same quarter last year. F5 has set its FY 2025 guidance at 15.240-15.380 EPS. Q4 2025 guidance at 3.870-3.990 EPS. On average, equities analysts expect that F5, Inc. will post 11.2 earnings per share for the current year.

F5 Company Profile

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

Recommended Stories

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.