Commerzbank Aktiengesellschaft FI increased its holdings in shares of Fifth Third Bancorp (NASDAQ:FITB - Free Report) by 57.7% during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 24,400 shares of the financial services provider's stock after acquiring an additional 8,927 shares during the period. Commerzbank Aktiengesellschaft FI's holdings in Fifth Third Bancorp were worth $1,004,000 at the end of the most recent quarter.

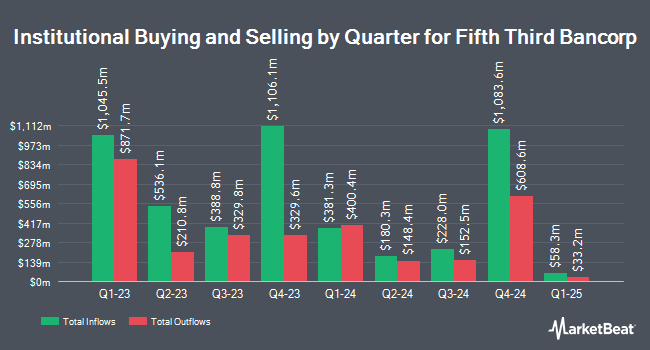

Other large investors have also bought and sold shares of the company. HWG Holdings LP bought a new stake in Fifth Third Bancorp during the 1st quarter worth approximately $27,000. Banque Transatlantique SA bought a new stake in Fifth Third Bancorp during the 1st quarter worth approximately $27,000. Larson Financial Group LLC boosted its position in Fifth Third Bancorp by 91.3% in the 1st quarter. Larson Financial Group LLC now owns 748 shares of the financial services provider's stock valued at $29,000 after buying an additional 357 shares during the last quarter. BankPlus Trust Department boosted its position in Fifth Third Bancorp by 53.0% in the 2nd quarter. BankPlus Trust Department now owns 837 shares of the financial services provider's stock valued at $34,000 after buying an additional 290 shares during the last quarter. Finally, Grove Bank & Trust boosted its position in Fifth Third Bancorp by 60.7% in the 1st quarter. Grove Bank & Trust now owns 887 shares of the financial services provider's stock valued at $35,000 after buying an additional 335 shares during the last quarter. 83.79% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages have commented on FITB. Morgan Stanley set a $60.00 price objective on Fifth Third Bancorp and gave the company an "overweight" rating in a research report on Tuesday. Truist Financial increased their price objective on Fifth Third Bancorp from $48.00 to $52.00 and gave the company a "buy" rating in a research report on Friday, September 12th. Evercore ISI increased their price objective on Fifth Third Bancorp from $45.00 to $49.00 and gave the company an "in-line" rating in a research report on Tuesday, September 30th. DA Davidson raised their price target on Fifth Third Bancorp from $47.00 to $52.00 and gave the stock a "buy" rating in a research report on Wednesday. Finally, Citigroup raised their price target on Fifth Third Bancorp from $47.00 to $50.00 and gave the stock a "neutral" rating in a research report on Tuesday, September 23rd. One analyst has rated the stock with a Strong Buy rating, sixteen have assigned a Buy rating and five have given a Hold rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $50.20.

Read Our Latest Research Report on FITB

Fifth Third Bancorp Price Performance

NASDAQ:FITB opened at $41.47 on Friday. The company has a debt-to-equity ratio of 0.76, a quick ratio of 0.81 and a current ratio of 0.81. The stock's 50-day simple moving average is $44.23 and its 200 day simple moving average is $40.72. The company has a market cap of $27.45 billion, a P/E ratio of 12.88, a P/E/G ratio of 1.41 and a beta of 0.95. Fifth Third Bancorp has a 52-week low of $32.25 and a 52-week high of $49.07.

Fifth Third Bancorp Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Shareholders of record on Tuesday, September 30th will be given a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 3.9%. This is a boost from Fifth Third Bancorp's previous quarterly dividend of $0.37. The ex-dividend date of this dividend is Tuesday, September 30th. Fifth Third Bancorp's dividend payout ratio (DPR) is presently 49.69%.

Fifth Third Bancorp declared that its Board of Directors has authorized a share repurchase program on Monday, June 16th that allows the company to buyback 100,000,000 outstanding shares. This buyback authorization allows the financial services provider to reacquire shares of its stock through open market purchases. Shares buyback programs are usually an indication that the company's leadership believes its shares are undervalued.

Fifth Third Bancorp Company Profile

(

Free Report)

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Featured Stories

Want to see what other hedge funds are holding FITB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Fifth Third Bancorp (NASDAQ:FITB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fifth Third Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fifth Third Bancorp wasn't on the list.

While Fifth Third Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.