Congress Asset Management Co. grew its holdings in Enpro Inc. (NYSE:NPO - Free Report) by 0.8% during the second quarter, according to the company in its most recent filing with the SEC. The fund owned 341,565 shares of the industrial products company's stock after acquiring an additional 2,801 shares during the quarter. Congress Asset Management Co. owned about 1.62% of Enpro worth $65,427,000 at the end of the most recent reporting period.

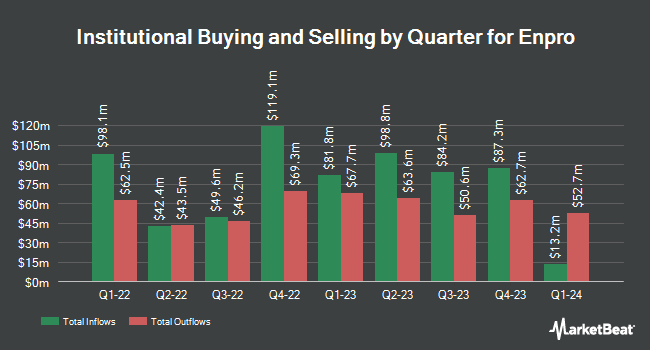

Other hedge funds and other institutional investors have also made changes to their positions in the company. Opal Wealth Advisors LLC acquired a new stake in Enpro during the first quarter worth approximately $32,000. Maseco LLP purchased a new position in shares of Enpro in the 2nd quarter valued at $36,000. UMB Bank n.a. raised its stake in Enpro by 57.7% during the 2nd quarter. UMB Bank n.a. now owns 328 shares of the industrial products company's stock worth $63,000 after acquiring an additional 120 shares in the last quarter. GAMMA Investing LLC lifted its position in Enpro by 94.5% in the first quarter. GAMMA Investing LLC now owns 498 shares of the industrial products company's stock valued at $81,000 after acquiring an additional 242 shares during the last quarter. Finally, BI Asset Management Fondsmaeglerselskab A S acquired a new position in Enpro in the first quarter valued at $115,000. Institutional investors and hedge funds own 98.31% of the company's stock.

Analysts Set New Price Targets

NPO has been the subject of a number of research analyst reports. Wall Street Zen raised Enpro from a "hold" rating to a "buy" rating in a research report on Sunday, August 3rd. Oppenheimer increased their price objective on Enpro from $215.00 to $240.00 and gave the company an "outperform" rating in a report on Wednesday, August 6th. Finally, KeyCorp lifted their target price on shares of Enpro from $220.00 to $240.00 and gave the company an "overweight" rating in a report on Wednesday, August 6th. One investment analyst has rated the stock with a Strong Buy rating and two have given a Buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average target price of $240.00.

Get Our Latest Stock Analysis on Enpro

Enpro Trading Up 0.9%

Shares of Enpro stock opened at $220.86 on Friday. The company has a 50-day moving average of $218.95 and a two-hundred day moving average of $190.09. Enpro Inc. has a 12-month low of $133.50 and a 12-month high of $231.94. The company has a current ratio of 2.49, a quick ratio of 1.65 and a debt-to-equity ratio of 0.31. The stock has a market cap of $4.65 billion, a PE ratio of 55.22, a price-to-earnings-growth ratio of 2.19 and a beta of 1.57.

Enpro (NYSE:NPO - Get Free Report) last posted its earnings results on Tuesday, August 5th. The industrial products company reported $2.03 EPS for the quarter, missing analysts' consensus estimates of $2.08 by ($0.05). Enpro had a return on equity of 10.49% and a net margin of 7.83%.The firm had revenue of $288.10 million for the quarter, compared to analysts' expectations of $283.83 million. During the same quarter in the previous year, the firm posted $2.08 earnings per share. The firm's revenue for the quarter was up 6.0% compared to the same quarter last year. Enpro has set its FY 2025 guidance at 7.600-8.10 EPS. On average, research analysts anticipate that Enpro Inc. will post 7.38 EPS for the current fiscal year.

Enpro Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, September 17th. Shareholders of record on Wednesday, September 3rd were issued a $0.31 dividend. This represents a $1.24 annualized dividend and a dividend yield of 0.6%. The ex-dividend date of this dividend was Wednesday, September 3rd. Enpro's dividend payout ratio is 31.00%.

Insider Activity at Enpro

In other news, EVP Robert Savage Mclean sold 2,541 shares of the business's stock in a transaction on Wednesday, August 20th. The stock was sold at an average price of $223.77, for a total value of $568,599.57. Following the completion of the transaction, the executive vice president directly owned 29,116 shares of the company's stock, valued at $6,515,287.32. The trade was a 8.03% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. 1.60% of the stock is owned by corporate insiders.

Enpro Company Profile

(

Free Report)

Enpro Inc design, develops, manufactures, and markets proprietary, value-added products and solutions to safeguard critical environments in the United States, Europe, and internationally. It operates through two segments, Sealing Technologies and Advanced Surface Technologies. The Sealing Technologies segment offers single-use hygienic seals, tubing, components and assemblies; metallic, non-metallic, and composite material gaskets; dynamic seals; compression packing; hydraulic components; expansion joints; and wall penetration products for chemical and petrochemical processing, pulp and paper processing, nuclear energy, hydrogen, natural gas, food and biopharmaceutical processing, primary metal manufacturing, mining, water and waste treatment, commercial vehicle, aerospace, medical, filtration, and semiconductor fabrication industries.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Enpro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enpro wasn't on the list.

While Enpro currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.