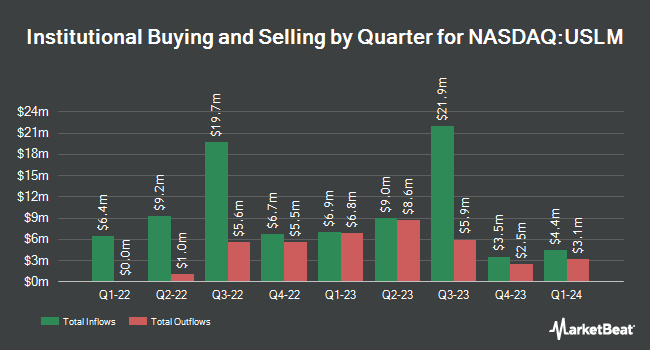

Connor Clark & Lunn Investment Management Ltd. acquired a new stake in shares of United States Lime & Minerals, Inc. (NASDAQ:USLM - Free Report) in the first quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 2,754 shares of the construction company's stock, valued at approximately $243,000.

A number of other large investors also recently bought and sold shares of the business. Vanguard Group Inc. boosted its holdings in United States Lime & Minerals by 13.2% during the 1st quarter. Vanguard Group Inc. now owns 808,373 shares of the construction company's stock valued at $71,444,000 after acquiring an additional 94,149 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in United States Lime & Minerals by 6.0% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 507,541 shares of the construction company's stock valued at $67,372,000 after purchasing an additional 28,947 shares in the last quarter. Select Equity Group L.P. lifted its holdings in shares of United States Lime & Minerals by 46.3% in the 4th quarter. Select Equity Group L.P. now owns 328,354 shares of the construction company's stock worth $43,586,000 after buying an additional 103,948 shares during the period. Northern Trust Corp grew its position in shares of United States Lime & Minerals by 5.1% during the 4th quarter. Northern Trust Corp now owns 111,932 shares of the construction company's stock worth $14,858,000 after buying an additional 5,447 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. grew its position in shares of United States Lime & Minerals by 4.5% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 100,474 shares of the construction company's stock worth $8,880,000 after buying an additional 4,318 shares in the last quarter. Hedge funds and other institutional investors own 27.12% of the company's stock.

Wall Street Analyst Weigh In

Separately, Wall Street Zen downgraded United States Lime & Minerals from a "buy" rating to a "hold" rating in a research report on Saturday, August 2nd.

Check Out Our Latest Research Report on USLM

United States Lime & Minerals Trading Down 2.3%

USLM opened at $112.44 on Thursday. United States Lime & Minerals, Inc. has a 12-month low of $74.90 and a 12-month high of $159.53. The business's fifty day simple moving average is $105.37 and its 200-day simple moving average is $99.89. The company has a market capitalization of $3.22 billion, a price-to-earnings ratio of 25.79 and a beta of 0.98.

United States Lime & Minerals (NASDAQ:USLM - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The construction company reported $1.07 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.14 by ($0.07). The firm had revenue of $91.52 million for the quarter, compared to the consensus estimate of $101.00 million. United States Lime & Minerals had a return on equity of 24.24% and a net margin of 35.57%.

United States Lime & Minerals Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, September 12th. Stockholders of record on Friday, August 22nd will be given a $0.06 dividend. This represents a $0.24 annualized dividend and a dividend yield of 0.2%. The ex-dividend date of this dividend is Friday, August 22nd. United States Lime & Minerals's payout ratio is presently 5.50%.

About United States Lime & Minerals

(

Free Report)

United States Lime & Minerals, Inc engages in the manufacture and sale of lime and limestone products. Its products include High Calcium Quicklime, Hydrated Lime, Lime Kiln Dust, Lime Slurry, and High Calcium Limestone. The company was founded in 1948 and is headquartered in Dallas, TX.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider United States Lime & Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United States Lime & Minerals wasn't on the list.

While United States Lime & Minerals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.