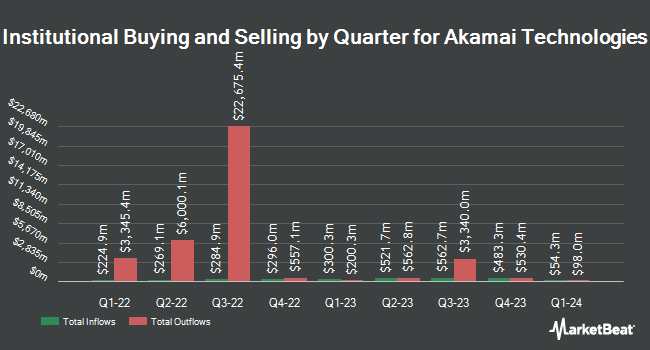

Connor Clark & Lunn Investment Management Ltd. raised its holdings in Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 5,385.9% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 353,734 shares of the technology infrastructure company's stock after purchasing an additional 347,286 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.24% of Akamai Technologies worth $28,476,000 as of its most recent SEC filing.

Several other institutional investors have also recently bought and sold shares of the business. MassMutual Private Wealth & Trust FSB grew its stake in shares of Akamai Technologies by 54.8% during the first quarter. MassMutual Private Wealth & Trust FSB now owns 438 shares of the technology infrastructure company's stock worth $35,000 after purchasing an additional 155 shares during the period. Itau Unibanco Holding S.A. grew its stake in shares of Akamai Technologies by 99.6% during the fourth quarter. Itau Unibanco Holding S.A. now owns 469 shares of the technology infrastructure company's stock worth $45,000 after purchasing an additional 234 shares during the period. Bank Julius Baer & Co. Ltd Zurich acquired a new stake in shares of Akamai Technologies during the first quarter worth $49,000. LRI Investments LLC grew its stake in Akamai Technologies by 500.0% in the fourth quarter. LRI Investments LLC now owns 624 shares of the technology infrastructure company's stock valued at $60,000 after acquiring an additional 520 shares during the period. Finally, TruNorth Capital Management LLC acquired a new position in Akamai Technologies in the first quarter valued at about $65,000. Institutional investors own 94.28% of the company's stock.

Akamai Technologies Price Performance

Shares of NASDAQ AKAM traded down $1.20 during mid-day trading on Thursday, hitting $74.24. 551,270 shares of the stock traded hands, compared to its average volume of 2,422,243. The company has a market cap of $10.64 billion, a PE ratio of 26.33, a price-to-earnings-growth ratio of 2.79 and a beta of 0.76. The company has a debt-to-equity ratio of 0.92, a current ratio of 2.31 and a quick ratio of 1.18. Akamai Technologies, Inc. has a twelve month low of $67.51 and a twelve month high of $106.80. The firm has a 50 day simple moving average of $77.88 and a two-hundred day simple moving average of $81.09.

Akamai Technologies (NASDAQ:AKAM - Get Free Report) last issued its earnings results on Thursday, August 7th. The technology infrastructure company reported $1.73 EPS for the quarter, beating analysts' consensus estimates of $1.55 by $0.18. The business had revenue of $1.04 billion during the quarter, compared to analyst estimates of $1.02 billion. Akamai Technologies had a return on equity of 14.26% and a net margin of 10.40%. The firm's revenue was up 6.5% compared to the same quarter last year. During the same period in the previous year, the company posted $1.58 EPS. As a group, equities research analysts forecast that Akamai Technologies, Inc. will post 4.6 EPS for the current fiscal year.

Insider Transactions at Akamai Technologies

In other Akamai Technologies news, EVP Paul C. Joseph sold 5,000 shares of Akamai Technologies stock in a transaction dated Tuesday, July 15th. The stock was sold at an average price of $77.74, for a total transaction of $388,700.00. Following the completion of the transaction, the executive vice president owned 32,349 shares in the company, valued at approximately $2,514,811.26. The trade was a 13.39% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Kim Salem-Jackson sold 13,157 shares of Akamai Technologies stock in a transaction dated Tuesday, May 27th. The shares were sold at an average price of $76.33, for a total value of $1,004,273.81. Following the transaction, the executive vice president owned 43,575 shares of the company's stock, valued at $3,326,079.75. This trade represents a 23.19% decrease in their position. The disclosure for this sale can be found here. 2.00% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of research analysts have issued reports on AKAM shares. KeyCorp began coverage on Akamai Technologies in a research note on Friday, June 6th. They issued an "underweight" rating and a $63.00 target price for the company. Morgan Stanley cut Akamai Technologies from an "equal weight" rating to an "underweight" rating and set a $85.00 price objective for the company. in a research report on Tuesday, August 5th. Raymond James Financial reduced their price objective on Akamai Technologies from $110.00 to $84.00 and set an "outperform" rating for the company in a research report on Friday, August 8th. UBS Group upped their price objective on Akamai Technologies from $85.00 to $90.00 and gave the stock a "neutral" rating in a research report on Friday, May 9th. Finally, Scotiabank reduced their price objective on Akamai Technologies from $105.00 to $95.00 and set a "sector outperform" rating for the company in a research report on Friday, August 8th. Four investment analysts have rated the stock with a sell rating, eight have assigned a hold rating, eight have issued a buy rating and two have given a strong buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average price target of $94.89.

View Our Latest Stock Analysis on AKAM

Akamai Technologies Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Featured Articles

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.