Connor Clark & Lunn Investment Management Ltd. raised its stake in shares of Lindblad Expeditions (NASDAQ:LIND - Free Report) by 6.5% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The fund owned 532,525 shares of the company's stock after purchasing an additional 32,652 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned 0.97% of Lindblad Expeditions worth $4,937,000 at the end of the most recent reporting period.

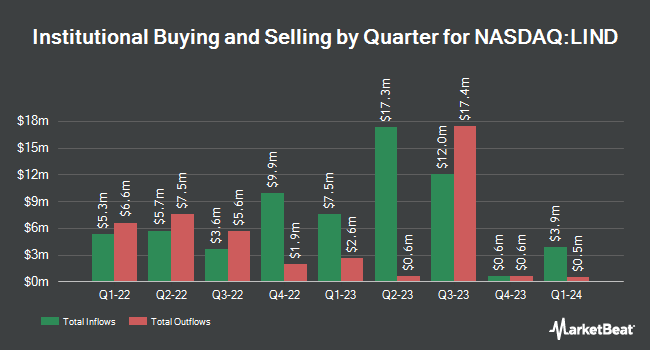

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Vanguard Group Inc. increased its position in Lindblad Expeditions by 2.5% during the first quarter. Vanguard Group Inc. now owns 2,270,726 shares of the company's stock worth $21,050,000 after purchasing an additional 55,003 shares during the last quarter. Mackenzie Financial Corp increased its position in shares of Lindblad Expeditions by 67.7% in the first quarter. Mackenzie Financial Corp now owns 76,552 shares of the company's stock worth $710,000 after acquiring an additional 30,912 shares in the last quarter. New York State Common Retirement Fund increased its position in shares of Lindblad Expeditions by 106.9% in the first quarter. New York State Common Retirement Fund now owns 684,851 shares of the company's stock worth $6,349,000 after acquiring an additional 353,817 shares in the last quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA increased its position in shares of Lindblad Expeditions by 7.0% in the first quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 60,593 shares of the company's stock worth $533,000 after acquiring an additional 3,950 shares in the last quarter. Finally, North Star Investment Management Corp. acquired a new stake in shares of Lindblad Expeditions in the first quarter worth $1,872,000. Institutional investors and hedge funds own 75.94% of the company's stock.

Analysts Set New Price Targets

LIND has been the subject of several recent research reports. Stifel Nicolaus set a $18.00 price objective on shares of Lindblad Expeditions and gave the stock a "buy" rating in a research report on Tuesday, August 5th. Wall Street Zen lowered shares of Lindblad Expeditions from a "buy" rating to a "hold" rating in a research report on Saturday, August 2nd. Finally, Craig Hallum set a $16.00 price objective on shares of Lindblad Expeditions and gave the stock a "buy" rating in a research report on Friday, May 23rd.

Get Our Latest Report on LIND

Lindblad Expeditions Stock Performance

Shares of LIND stock traded up $0.23 on Friday, hitting $13.50. The stock had a trading volume of 465,053 shares, compared to its average volume of 371,824. The firm has a market capitalization of $739.65 million, a price-to-earnings ratio of -45.00 and a beta of 2.71. The stock's 50 day moving average is $12.17 and its 200-day moving average is $10.95. Lindblad Expeditions has a 52-week low of $7.27 and a 52-week high of $14.34.

Lindblad Expeditions (NASDAQ:LIND - Get Free Report) last announced its earnings results on Monday, August 4th. The company reported ($0.18) earnings per share for the quarter, beating the consensus estimate of ($0.29) by $0.11. The firm had revenue of $167.95 million during the quarter, compared to analysts' expectations of $158.97 million. Equities analysts expect that Lindblad Expeditions will post -0.43 earnings per share for the current year.

Insider Buying and Selling at Lindblad Expeditions

In other news, CEO Benjamin Bressler sold 167,494 shares of the company's stock in a transaction on Tuesday, August 5th. The shares were sold at an average price of $13.05, for a total value of $2,185,796.70. Following the completion of the transaction, the chief executive officer directly owned 23,466 shares in the company, valued at approximately $306,231.30. This represents a 87.71% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Insiders have sold 222,386 shares of company stock valued at $2,900,718 in the last ninety days. 34.00% of the stock is currently owned by corporate insiders.

Lindblad Expeditions Company Profile

(

Free Report)

Lindblad Expeditions Holdings, Inc provides marine expedition adventures and travel experience worldwide. It operates through Lindblad and Land Experiences segment. Lindblad segment provides ship-based expeditions aboard customized, nimble, and intimately-scaled vessels, which offers up-close experiences in the planet's wild and remote places, and capitals of culture; and offers expedition ship which is equipped with state-of-the-art tools for in-depth exploration with infrastructure and ports, such as Antarctica and the Arctic, and places that accessed by a ship comprising Galápagos Islands, Alaska, Baja California's Sea of Cortez and Panama, and foster engagement activities.

Featured Stories

Before you consider Lindblad Expeditions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lindblad Expeditions wasn't on the list.

While Lindblad Expeditions currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.