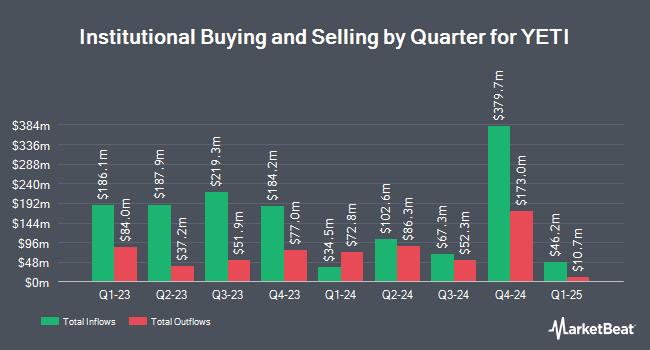

Corient IA LLC bought a new stake in YETI Holdings, Inc. (NYSE:YETI - Free Report) in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 7,500 shares of the company's stock, valued at approximately $248,000.

Other institutional investors also recently modified their holdings of the company. Pinebridge Investments L.P. raised its stake in shares of YETI by 42.7% in the fourth quarter. Pinebridge Investments L.P. now owns 38,074 shares of the company's stock valued at $1,466,000 after acquiring an additional 11,391 shares during the last quarter. Tower Research Capital LLC TRC increased its holdings in shares of YETI by 1,172.7% in the fourth quarter. Tower Research Capital LLC TRC now owns 15,807 shares of the company's stock valued at $609,000 after purchasing an additional 14,565 shares in the last quarter. Homestead Advisers Corp increased its holdings in shares of YETI by 15.2% in the first quarter. Homestead Advisers Corp now owns 95,300 shares of the company's stock valued at $3,154,000 after purchasing an additional 12,600 shares in the last quarter. Boothbay Fund Management LLC increased its holdings in shares of YETI by 983.0% in the fourth quarter. Boothbay Fund Management LLC now owns 120,973 shares of the company's stock valued at $4,659,000 after purchasing an additional 109,803 shares in the last quarter. Finally, Envestnet Asset Management Inc. increased its holdings in shares of YETI by 44.5% in the first quarter. Envestnet Asset Management Inc. now owns 321,065 shares of the company's stock valued at $10,627,000 after purchasing an additional 98,884 shares in the last quarter.

YETI Trading Up 5.1%

Shares of YETI stock traded up $1.7450 on Friday, hitting $35.6750. The stock had a trading volume of 1,875,751 shares, compared to its average volume of 2,161,172. The company has a current ratio of 2.52, a quick ratio of 1.48 and a debt-to-equity ratio of 0.09. YETI Holdings, Inc. has a twelve month low of $26.61 and a twelve month high of $45.25. The company has a fifty day moving average price of $33.62 and a two-hundred day moving average price of $32.73. The firm has a market cap of $2.90 billion, a P/E ratio of 16.99, a PEG ratio of 2.41 and a beta of 1.84.

YETI (NYSE:YETI - Get Free Report) last posted its earnings results on Thursday, August 7th. The company reported $0.66 earnings per share for the quarter, topping the consensus estimate of $0.54 by $0.12. The firm had revenue of $445.89 million for the quarter, compared to analyst estimates of $461.73 million. YETI had a return on equity of 24.60% and a net margin of 9.73%.The company's revenue for the quarter was down 3.8% on a year-over-year basis. During the same period in the previous year, the company posted $0.70 earnings per share. YETI has set its FY 2025 guidance at 2.340-2.480 EPS. As a group, analysts forecast that YETI Holdings, Inc. will post 2.57 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of analysts recently weighed in on YETI shares. Canaccord Genuity Group raised their price target on shares of YETI from $33.00 to $34.00 and gave the company a "hold" rating in a report on Friday, August 8th. Cowen reissued a "hold" rating on shares of YETI in a report on Friday, August 8th. Citigroup raised their price target on shares of YETI from $36.00 to $44.00 and gave the company a "buy" rating in a report on Wednesday, July 23rd. Raymond James Financial reissued an "outperform" rating and issued a $37.00 price target (up previously from $34.00) on shares of YETI in a report on Friday, August 8th. Finally, Stifel Nicolaus raised their price target on shares of YETI from $31.00 to $33.00 and gave the company a "hold" rating in a report on Friday, August 8th. Five analysts have rated the stock with a Buy rating and nine have given a Hold rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $38.54.

Check Out Our Latest Report on YETI

About YETI

(

Free Report)

YETI Holdings, Inc designs, retails, and distributes products for the outdoor and recreation market under the YETI brand. It offers coolers and equipment, including hard and soft coolers, cargo, bags, outdoor living, and associated accessories, as well as backpacks, duffel bags, luggage, packing cubes, carryalls, camp chairs, blankets, dog beds, dog bowls, and gear cases under the LoadOut, Panga, Crossroads, Camino, Hondo Base, Trailhead, Lowlands, Boomer, and SideKick Dry brands.

Further Reading

Before you consider YETI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and YETI wasn't on the list.

While YETI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.