Corient IA LLC bought a new position in shares of Ormat Technologies, Inc. (NYSE:ORA - Free Report) during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 4,000 shares of the energy company's stock, valued at approximately $283,000.

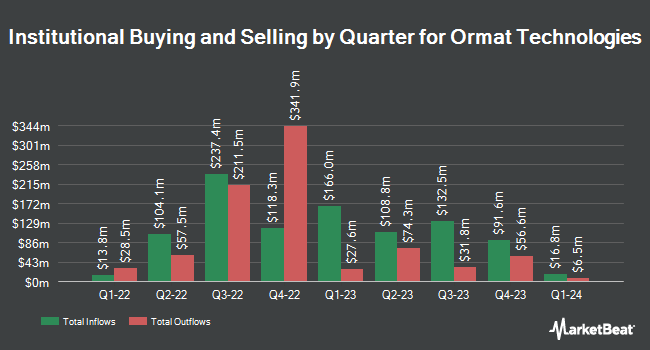

Other hedge funds and other institutional investors have also bought and sold shares of the company. Dimensional Fund Advisors LP grew its stake in Ormat Technologies by 19.1% in the 1st quarter. Dimensional Fund Advisors LP now owns 1,890,235 shares of the energy company's stock worth $133,770,000 after buying an additional 303,756 shares in the last quarter. Van Berkom & Associates Inc. grew its stake in Ormat Technologies by 2.7% in the 1st quarter. Van Berkom & Associates Inc. now owns 1,280,026 shares of the energy company's stock worth $90,587,000 after buying an additional 33,719 shares in the last quarter. Harel Insurance Investments & Financial Services Ltd. grew its stake in Ormat Technologies by 273,109.4% in the 1st quarter. Harel Insurance Investments & Financial Services Ltd. now owns 956,233 shares of the energy company's stock worth $67,673,000 after buying an additional 955,883 shares in the last quarter. Northern Trust Corp grew its stake in Ormat Technologies by 11.7% in the 4th quarter. Northern Trust Corp now owns 858,674 shares of the energy company's stock worth $58,149,000 after buying an additional 90,100 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. grew its stake in Ormat Technologies by 0.3% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 620,772 shares of the energy company's stock worth $43,932,000 after buying an additional 1,835 shares in the last quarter. Institutional investors own 95.49% of the company's stock.

Ormat Technologies Trading Up 2.5%

ORA traded up $2.2990 during trading on Friday, hitting $94.8990. 584,692 shares of the stock traded hands, compared to its average volume of 547,319. The firm has a market capitalization of $5.76 billion, a P/E ratio of 44.14, a price-to-earnings-growth ratio of 4.31 and a beta of 0.68. The company has a debt-to-equity ratio of 0.77, a current ratio of 0.70 and a quick ratio of 0.64. The firm has a 50-day moving average of $87.65 and a 200 day moving average of $76.78. Ormat Technologies, Inc. has a 12-month low of $61.58 and a 12-month high of $95.37.

Ormat Technologies (NYSE:ORA - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The energy company reported $0.48 earnings per share for the quarter, beating the consensus estimate of $0.37 by $0.11. The business had revenue of $234.02 million during the quarter, compared to analysts' expectations of $225.26 million. Ormat Technologies had a net margin of 14.49% and a return on equity of 5.47%. The firm's revenue for the quarter was up 9.9% compared to the same quarter last year. During the same quarter in the prior year, the company posted $0.37 EPS. Equities research analysts anticipate that Ormat Technologies, Inc. will post 1.94 EPS for the current year.

Ormat Technologies Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, September 3rd. Shareholders of record on Wednesday, August 20th will be given a dividend of $0.12 per share. The ex-dividend date of this dividend is Wednesday, August 20th. This represents a $0.48 annualized dividend and a yield of 0.5%. Ormat Technologies's dividend payout ratio is presently 22.33%.

Insider Activity

In other Ormat Technologies news, Director Stanley Stern sold 547 shares of the stock in a transaction on Friday, June 20th. The shares were sold at an average price of $85.54, for a total transaction of $46,790.38. Following the completion of the sale, the director owned 6,137 shares of the company's stock, valued at $524,958.98. This represents a 8.18% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Michal Marom sold 895 shares of the company's stock in a transaction on Thursday, May 29th. The stock was sold at an average price of $73.47, for a total transaction of $65,755.65. Following the completion of the transaction, the director owned 3,080 shares of the company's stock, valued at $226,287.60. This trade represents a 22.52% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 4,038 shares of company stock worth $337,192. 0.56% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of research firms have commented on ORA. Oppenheimer reissued an "outperform" rating and issued a $100.00 price target on shares of Ormat Technologies in a research note on Friday, August 8th. Cowen reaffirmed a "hold" rating on shares of Ormat Technologies in a research note on Friday, August 8th. Robert W. Baird raised shares of Ormat Technologies from a "neutral" rating to an "outperform" rating and upped their price objective for the company from $87.00 to $103.00 in a research note on Wednesday, July 30th. Baird R W raised shares of Ormat Technologies from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, July 30th. Finally, Barclays cut their price objective on shares of Ormat Technologies from $90.00 to $89.00 and set an "overweight" rating for the company in a research note on Friday, August 8th. One equities research analyst has rated the stock with a Strong Buy rating, seven have assigned a Buy rating and four have issued a Hold rating to the stock. According to MarketBeat, Ormat Technologies has an average rating of "Moderate Buy" and a consensus target price of $93.30.

View Our Latest Stock Report on Ormat Technologies

Ormat Technologies Company Profile

(

Free Report)

Ormat Technologies, Inc engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, and internationally. It operates in three segments: Electricity, Product, and Energy Storage. The Electricity segment develops, builds, owns, and operates geothermal, solar photovoltaic, and recovered energy-based power plants; and sells electricity.

Read More

Before you consider Ormat Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ormat Technologies wasn't on the list.

While Ormat Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report