Caisse DE Depot ET Placement DU Quebec grew its position in shares of Corpay, Inc. (NYSE:CPAY - Free Report) by 24.6% in the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 53,334 shares of the company's stock after acquiring an additional 10,533 shares during the quarter. Caisse DE Depot ET Placement DU Quebec owned about 0.08% of Corpay worth $18,599,000 as of its most recent filing with the SEC.

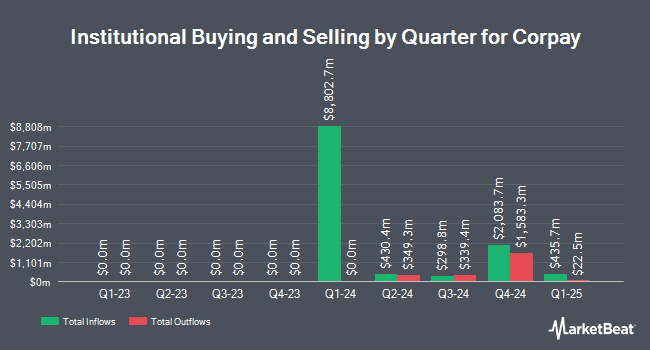

Several other institutional investors have also bought and sold shares of CPAY. Colonial Trust Co SC lifted its holdings in Corpay by 120.5% in the fourth quarter. Colonial Trust Co SC now owns 97 shares of the company's stock worth $33,000 after purchasing an additional 53 shares during the period. Zions Bancorporation National Association UT acquired a new stake in Corpay in the first quarter worth about $41,000. Rakuten Securities Inc. acquired a new stake in Corpay in the first quarter worth about $45,000. Larson Financial Group LLC lifted its holdings in Corpay by 309.5% in the first quarter. Larson Financial Group LLC now owns 172 shares of the company's stock worth $60,000 after purchasing an additional 130 shares during the period. Finally, Continuum Advisory LLC lifted its holdings in Corpay by 29.6% in the fourth quarter. Continuum Advisory LLC now owns 184 shares of the company's stock worth $62,000 after purchasing an additional 42 shares during the period. Institutional investors and hedge funds own 98.84% of the company's stock.

Corpay Trading Up 0.1%

NYSE CPAY traded up $0.47 on Monday, hitting $325.64. 220,596 shares of the company were exchanged, compared to its average volume of 512,177. The company's 50 day moving average price is $325.77 and its 200-day moving average price is $331.88. The company has a debt-to-equity ratio of 1.48, a current ratio of 1.12 and a quick ratio of 1.12. The firm has a market capitalization of $22.99 billion, a P/E ratio of 22.12, a price-to-earnings-growth ratio of 1.24 and a beta of 1.00. Corpay, Inc. has a twelve month low of $269.02 and a twelve month high of $400.81.

Corpay (NYSE:CPAY - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported $5.13 earnings per share (EPS) for the quarter, topping the consensus estimate of $5.11 by $0.02. The firm had revenue of $1.10 billion for the quarter, compared to the consensus estimate of $1.09 billion. Corpay had a return on equity of 39.13% and a net margin of 25.17%.The business's revenue for the quarter was up 12.9% compared to the same quarter last year. During the same quarter in the previous year, the company earned $4.55 EPS. Analysts predict that Corpay, Inc. will post 19.76 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on the stock. Morgan Stanley reduced their price objective on shares of Corpay from $360.00 to $356.00 and set an "equal weight" rating for the company in a report on Monday, August 11th. Robert W. Baird set a $440.00 price objective on shares of Corpay in a report on Tuesday, June 10th. UBS Group dropped their price target on shares of Corpay from $365.00 to $340.00 and set a "neutral" rating on the stock in a research report on Thursday, August 7th. Raymond James Financial set a $392.00 price target on shares of Corpay and gave the stock an "outperform" rating in a research report on Thursday, August 7th. Finally, Wall Street Zen cut shares of Corpay from a "buy" rating to a "hold" rating in a research report on Saturday, August 16th. Nine investment analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $399.43.

Read Our Latest Report on Corpay

Corpay Profile

(

Free Report)

Corpay, Inc operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally. The company offers vehicle payment solutions, which include fuel, tolls, parking, fleet maintenance, and long-haul transportation services, as well as prepaid food and transportation vouchers and cards.

Featured Articles

Before you consider Corpay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corpay wasn't on the list.

While Corpay currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.