Counterpoint Mutual Funds LLC purchased a new position in SunCoke Energy, Inc. (NYSE:SXC - Free Report) during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 39,511 shares of the energy company's stock, valued at approximately $339,000.

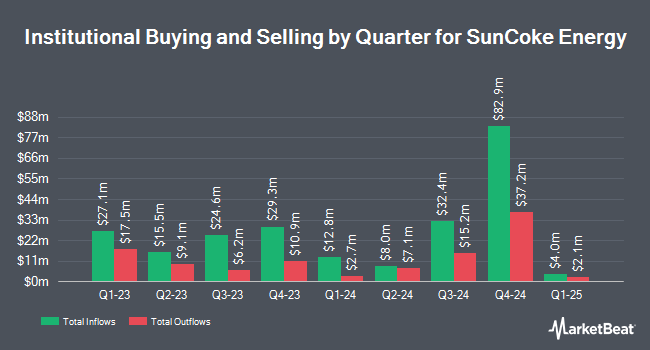

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. GAMMA Investing LLC grew its holdings in SunCoke Energy by 41.8% during the 2nd quarter. GAMMA Investing LLC now owns 5,330 shares of the energy company's stock worth $46,000 after acquiring an additional 1,571 shares in the last quarter. Exchange Traded Concepts LLC grew its holdings in SunCoke Energy by 14.1% during the 2nd quarter. Exchange Traded Concepts LLC now owns 204,017 shares of the energy company's stock worth $1,753,000 after acquiring an additional 25,158 shares in the last quarter. Wealth Enhancement Advisory Services LLC grew its holdings in SunCoke Energy by 138.6% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 27,556 shares of the energy company's stock worth $240,000 after acquiring an additional 16,008 shares in the last quarter. Baron Wealth Management LLC grew its holdings in SunCoke Energy by 13.0% during the 2nd quarter. Baron Wealth Management LLC now owns 18,350 shares of the energy company's stock worth $158,000 after acquiring an additional 2,104 shares in the last quarter. Finally, Veracity Capital LLC grew its holdings in SunCoke Energy by 5.8% during the 2nd quarter. Veracity Capital LLC now owns 48,396 shares of the energy company's stock worth $416,000 after acquiring an additional 2,659 shares in the last quarter. 90.45% of the stock is currently owned by institutional investors.

SunCoke Energy Stock Up 2.7%

Shares of SunCoke Energy stock opened at $8.11 on Thursday. The company has a debt-to-equity ratio of 0.70, a current ratio of 2.61 and a quick ratio of 1.45. SunCoke Energy, Inc. has a 1 year low of $7.18 and a 1 year high of $12.82. The firm's 50-day moving average is $7.81 and its two-hundred day moving average is $8.43. The stock has a market cap of $686.22 million, a price-to-earnings ratio of 9.42 and a beta of 1.07.

SunCoke Energy (NYSE:SXC - Get Free Report) last issued its earnings results on Wednesday, July 30th. The energy company reported $0.02 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.15 by ($0.13). SunCoke Energy had a return on equity of 10.43% and a net margin of 3.99%.The business had revenue of $434.10 million for the quarter, compared to the consensus estimate of $348.05 million. During the same quarter in the previous year, the company earned $0.25 earnings per share. The firm's revenue was down 7.8% on a year-over-year basis. As a group, research analysts expect that SunCoke Energy, Inc. will post 0.71 earnings per share for the current fiscal year.

SunCoke Energy Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 2nd. Stockholders of record on Friday, August 15th were issued a $0.12 dividend. This represents a $0.48 dividend on an annualized basis and a dividend yield of 5.9%. The ex-dividend date was Friday, August 15th. SunCoke Energy's dividend payout ratio (DPR) is currently 55.81%.

About SunCoke Energy

(

Free Report)

SunCoke Energy, Inc operates as an independent producer of coke in the Americas and Brazil. The company operates through three segments: Domestic Coke, Brazil Coke, and Logistics. It offers metallurgical and thermal coal. The company also provides handling and/or mixing services to steel, coke, electric utility, coal producing, and other manufacturing based customers.

Read More

Want to see what other hedge funds are holding SXC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for SunCoke Energy, Inc. (NYSE:SXC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SunCoke Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SunCoke Energy wasn't on the list.

While SunCoke Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.