WCM Investment Management LLC lowered its position in shares of Coupang, Inc. (NYSE:CPNG - Free Report) by 1.0% in the second quarter, according to the company in its most recent disclosure with the SEC. The firm owned 49,168,456 shares of the company's stock after selling 494,841 shares during the quarter. Coupang accounts for about 3.4% of WCM Investment Management LLC's investment portfolio, making the stock its 8th biggest holding. WCM Investment Management LLC owned about 2.71% of Coupang worth $1,514,880,000 at the end of the most recent reporting period.

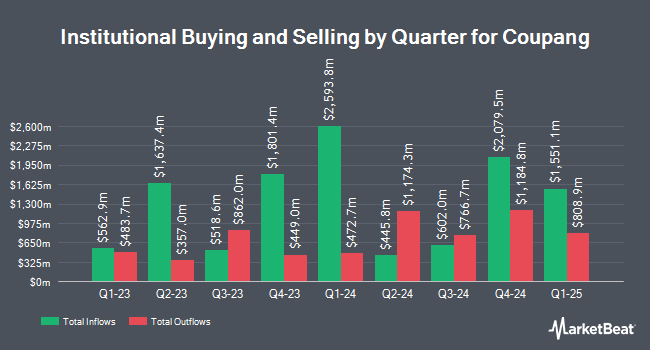

A number of other institutional investors have also recently bought and sold shares of CPNG. Dodge & Cox boosted its holdings in shares of Coupang by 101.6% in the first quarter. Dodge & Cox now owns 40,784,920 shares of the company's stock valued at $894,413,000 after buying an additional 20,555,600 shares during the period. GQG Partners LLC acquired a new position in shares of Coupang in the first quarter valued at approximately $168,127,000. Massachusetts Financial Services Co. MA boosted its holdings in shares of Coupang by 436.6% in the first quarter. Massachusetts Financial Services Co. MA now owns 8,686,580 shares of the company's stock valued at $190,497,000 after buying an additional 7,067,830 shares during the period. Nuveen LLC acquired a new position in shares of Coupang in the first quarter valued at approximately $75,775,000. Finally, Altimeter Capital Management LP boosted its holdings in shares of Coupang by 24.3% in the first quarter. Altimeter Capital Management LP now owns 7,441,445 shares of the company's stock valued at $163,191,000 after buying an additional 1,455,555 shares during the period. Institutional investors and hedge funds own 83.72% of the company's stock.

Coupang Stock Performance

Shares of CPNG stock opened at $31.56 on Thursday. The company's fifty day simple moving average is $30.64 and its 200-day simple moving average is $28.11. The company has a quick ratio of 0.84, a current ratio of 1.09 and a debt-to-equity ratio of 0.18. The firm has a market cap of $57.53 billion, a PE ratio of 157.79 and a beta of 1.18. Coupang, Inc. has a 12 month low of $19.02 and a 12 month high of $34.08.

Coupang (NYSE:CPNG - Get Free Report) last announced its quarterly earnings data on Tuesday, August 5th. The company reported $0.02 EPS for the quarter, missing analysts' consensus estimates of $0.07 by ($0.05). Coupang had a return on equity of 7.47% and a net margin of 1.13%.The business had revenue of $8.52 billion during the quarter, compared to the consensus estimate of $8.34 billion. During the same period in the prior year, the firm earned $0.07 EPS. The business's revenue for the quarter was up 16.4% compared to the same quarter last year. Equities research analysts expect that Coupang, Inc. will post 0.17 EPS for the current fiscal year.

Insider Activity

In other Coupang news, Director Pedro Franceschi sold 21,428 shares of the company's stock in a transaction on Thursday, September 11th. The shares were sold at an average price of $32.05, for a total transaction of $686,767.40. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CFO Gaurav Anand sold 75,350 shares of the company's stock in a transaction on Monday, August 11th. The stock was sold at an average price of $27.79, for a total transaction of $2,093,976.50. Following the sale, the chief financial officer directly owned 2,016,940 shares in the company, valued at $56,050,762.60. This trade represents a 3.60% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 988,983 shares of company stock valued at $31,203,966. 12.78% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Several research analysts have recently weighed in on the stock. Nomura upgraded shares of Coupang from a "neutral" rating to a "buy" rating and set a $35.00 price target for the company in a report on Wednesday, August 6th. Zacks Research cut shares of Coupang from a "hold" rating to a "strong sell" rating in a report on Monday, October 6th. Nomura Securities upgraded shares of Coupang to a "strong-buy" rating in a report on Wednesday, August 6th. Wall Street Zen lowered shares of Coupang from a "buy" rating to a "hold" rating in a research report on Sunday, July 20th. Finally, Morgan Stanley boosted their price objective on shares of Coupang from $32.00 to $35.00 and gave the stock an "overweight" rating in a research report on Wednesday, August 20th. One research analyst has rated the stock with a Strong Buy rating, six have assigned a Buy rating, three have given a Hold rating and one has assigned a Sell rating to the company. According to MarketBeat.com, Coupang presently has a consensus rating of "Moderate Buy" and an average target price of $33.50.

Read Our Latest Stock Report on CPNG

About Coupang

(

Free Report)

Coupang, Inc, together with its subsidiaries owns and operates retail business through its mobile applications and Internet websites primarily in South Korea. The company operates through Product Commerce and Developing Offerings segments. It sells various products and services in the categories of home goods and décor products, apparel, beauty products, fresh food and groceries, sporting goods, electronics, and everyday consumables, as well as travel, and restaurant order and delivery services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Coupang, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coupang wasn't on the list.

While Coupang currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.