Crake Asset Management LLP lifted its stake in Amazon.com, Inc. (NASDAQ:AMZN) by 4.5% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 676,500 shares of the e-commerce giant's stock after acquiring an additional 29,000 shares during the quarter. Amazon.com accounts for about 10.4% of Crake Asset Management LLP's investment portfolio, making the stock its 3rd largest holding. Crake Asset Management LLP's holdings in Amazon.com were worth $128,711,000 as of its most recent filing with the Securities & Exchange Commission.

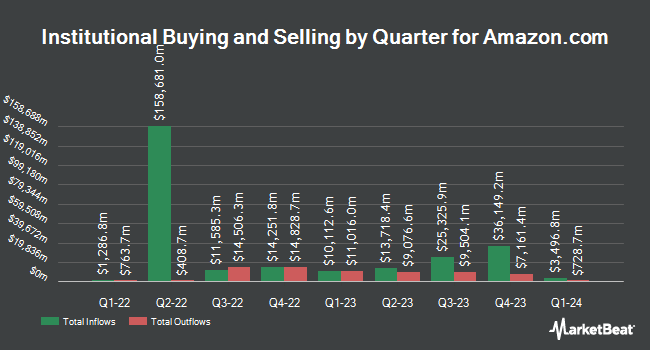

Other institutional investors and hedge funds also recently made changes to their positions in the company. Castlekeep Investment Advisors LLC purchased a new position in shares of Amazon.com in the fourth quarter worth approximately $25,000. Cooksen Wealth LLC purchased a new position in Amazon.com during the first quarter valued at approximately $36,000. Inlight Wealth Management LLC purchased a new position in Amazon.com during the first quarter valued at approximately $40,000. Capitol Family Office Inc. purchased a new position in Amazon.com during the first quarter valued at approximately $42,000. Finally, Harbor Investment Advisory LLC lifted its holdings in Amazon.com by 0.7% during the first quarter. Harbor Investment Advisory LLC now owns 304,091 shares of the e-commerce giant's stock valued at $58,000 after purchasing an additional 2,145 shares in the last quarter. Hedge funds and other institutional investors own 72.20% of the company's stock.

Insider Activity at Amazon.com

In related news, CEO Douglas J. Herrington sold 2,500 shares of Amazon.com stock in a transaction dated Tuesday, September 2nd. The shares were sold at an average price of $223.49, for a total transaction of $558,725.00. Following the completion of the sale, the chief executive officer owned 518,007 shares in the company, valued at $115,769,384.43. This trade represents a 0.48% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CEO Andrew R. Jassy sold 19,872 shares of Amazon.com stock in a transaction dated Thursday, August 21st. The shares were sold at an average price of $221.58, for a total transaction of $4,403,237.76. Following the sale, the chief executive officer owned 2,178,502 shares of the company's stock, valued at $482,712,473.16. The trade was a 0.90% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 25,097,911 shares of company stock worth $5,676,032,574 over the last ninety days. 9.70% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on the stock. Evercore ISI reaffirmed an "outperform" rating and set a $280.00 price target on shares of Amazon.com in a report on Wednesday, August 13th. JPMorgan Chase & Co. lifted their price target on shares of Amazon.com from $255.00 to $265.00 and gave the company an "overweight" rating in a report on Friday, August 1st. Wall Street Zen raised shares of Amazon.com from a "hold" rating to a "buy" rating in a report on Saturday, August 2nd. Wells Fargo & Company boosted their target price on shares of Amazon.com from $238.00 to $245.00 and gave the stock an "equal weight" rating in a report on Tuesday, July 29th. Finally, Deutsche Bank Aktiengesellschaft boosted their target price on shares of Amazon.com from $230.00 to $266.00 in a report on Tuesday, July 22nd. Two research analysts have rated the stock with a Strong Buy rating, forty-six have given a Buy rating and two have issued a Hold rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus price target of $262.87.

Check Out Our Latest Analysis on AMZN

Amazon.com Price Performance

AMZN stock opened at $228.15 on Friday. Amazon.com, Inc. has a 12 month low of $161.38 and a 12 month high of $242.52. The company has a current ratio of 1.02, a quick ratio of 0.81 and a debt-to-equity ratio of 0.15. The company has a 50-day moving average price of $226.87 and a 200 day moving average price of $208.62. The stock has a market cap of $2.43 trillion, a PE ratio of 34.78, a P/E/G ratio of 1.54 and a beta of 1.30.

Amazon.com (NASDAQ:AMZN - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The e-commerce giant reported $1.68 EPS for the quarter, topping analysts' consensus estimates of $1.31 by $0.37. Amazon.com had a net margin of 10.54% and a return on equity of 23.84%. The firm had revenue of $167.70 billion during the quarter, compared to analysts' expectations of $161.80 billion. During the same period in the previous year, the company earned $1.26 EPS. The firm's revenue for the quarter was up 13.3% compared to the same quarter last year. Amazon.com has set its Q3 2025 guidance at EPS. Equities research analysts anticipate that Amazon.com, Inc. will post 6.31 earnings per share for the current year.

Amazon.com Company Profile

(

Free Report)

Amazon.com, Inc engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Echo, Ring, Blink, and eero; and develops and produces media content.

Recommended Stories

Want to see what other hedge funds are holding AMZN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Amazon.com, Inc. (NASDAQ:AMZN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.