CreativeOne Wealth LLC boosted its holdings in Zoom Communications, Inc. (NASDAQ:ZM - Free Report) by 75.8% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 17,613 shares of the company's stock after acquiring an additional 7,597 shares during the period. CreativeOne Wealth LLC's holdings in Zoom Communications were worth $1,299,000 as of its most recent filing with the Securities and Exchange Commission.

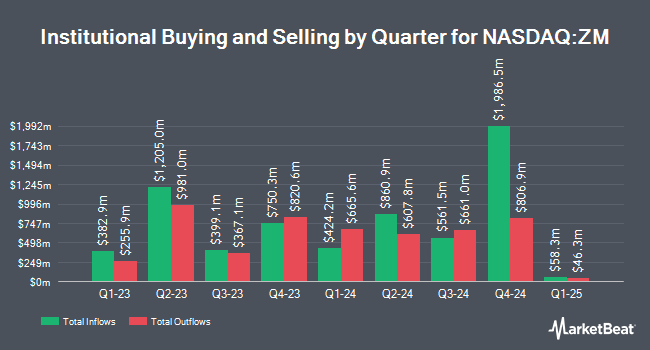

Other large investors have also added to or reduced their stakes in the company. SouthState Corp bought a new stake in Zoom Communications in the 1st quarter valued at $25,000. Wayfinding Financial LLC bought a new position in Zoom Communications during the 1st quarter worth $25,000. Raiffeisen Bank International AG bought a new position in Zoom Communications during the 4th quarter worth $30,000. MassMutual Private Wealth & Trust FSB increased its position in Zoom Communications by 177.0% during the 1st quarter. MassMutual Private Wealth & Trust FSB now owns 385 shares of the company's stock worth $28,000 after buying an additional 246 shares during the period. Finally, Colonial Trust Co SC bought a new position in Zoom Communications during the 4th quarter worth $32,000. Institutional investors own 66.54% of the company's stock.

Insider Transactions at Zoom Communications

In other Zoom Communications news, CEO Eric S. Yuan sold 33,691 shares of Zoom Communications stock in a transaction dated Monday, July 14th. The stock was sold at an average price of $74.79, for a total value of $2,519,749.89. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Janet Napolitano sold 2,617 shares of Zoom Communications stock in a transaction dated Friday, June 13th. The shares were sold at an average price of $76.78, for a total value of $200,933.26. Following the completion of the transaction, the director owned 4,728 shares in the company, valued at approximately $363,015.84. This represents a 35.63% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 93,017 shares of company stock valued at $7,052,757. Company insiders own 11.51% of the company's stock.

Zoom Communications Stock Performance

Shares of NASDAQ ZM opened at $81.42 on Friday. Zoom Communications, Inc. has a 52 week low of $64.41 and a 52 week high of $92.80. The stock has a market capitalization of $24.63 billion, a P/E ratio of 21.48, a PEG ratio of 12.41 and a beta of 0.68. The stock's fifty day moving average is $75.37 and its 200 day moving average is $76.53.

Analysts Set New Price Targets

Several research firms have weighed in on ZM. Wells Fargo & Company increased their price objective on Zoom Communications from $75.00 to $80.00 and gave the stock an "equal weight" rating in a research report on Thursday, May 22nd. Robert W. Baird lowered their price objective on Zoom Communications from $100.00 to $95.00 and set an "outperform" rating on the stock in a research report on Friday, August 22nd. Needham & Company LLC reiterated a "buy" rating and set a $100.00 price objective on shares of Zoom Communications in a research report on Friday, August 22nd. Stifel Nicolaus lowered their price objective on Zoom Communications from $85.00 to $80.00 and set a "hold" rating on the stock in a research report on Friday, August 22nd. Finally, JMP Securities reiterated a "market perform" rating on shares of Zoom Communications in a research report on Friday, August 22nd. One investment analyst has rated the stock with a Strong Buy rating, ten have given a Buy rating, fifteen have assigned a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $90.30.

Get Our Latest Stock Analysis on ZM

Zoom Communications Company Profile

(

Free Report)

Zoom Video Communications, Inc provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

Featured Stories

Want to see what other hedge funds are holding ZM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Zoom Communications, Inc. (NASDAQ:ZM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zoom Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoom Communications wasn't on the list.

While Zoom Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.