Cubist Systematic Strategies LLC acquired a new stake in Tiptree Financial Inc. (NASDAQ:TIPT - Free Report) in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 26,598 shares of the financial services provider's stock, valued at approximately $641,000. Cubist Systematic Strategies LLC owned about 0.07% of Tiptree Financial as of its most recent SEC filing.

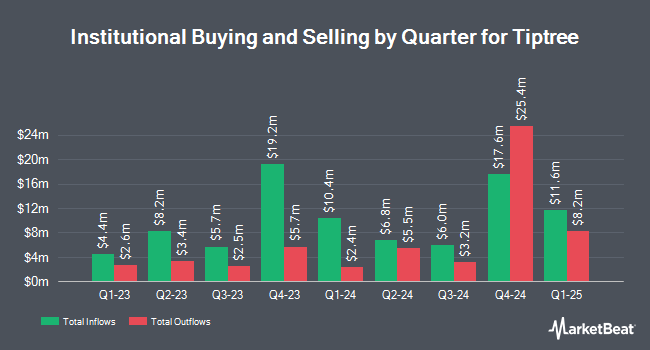

A number of other hedge funds also recently made changes to their positions in TIPT. Nuveen LLC acquired a new stake in shares of Tiptree Financial in the first quarter valued at approximately $5,346,000. Vanguard Group Inc. increased its stake in shares of Tiptree Financial by 2.2% during the first quarter. Vanguard Group Inc. now owns 1,291,675 shares of the financial services provider's stock worth $31,116,000 after purchasing an additional 28,373 shares during the period. American Century Companies Inc. bought a new position in shares of Tiptree Financial during the first quarter worth approximately $587,000. Mercer Global Advisors Inc. ADV bought a new position in shares of Tiptree Financial during the fourth quarter worth approximately $436,000. Finally, Northern Trust Corp increased its stake in shares of Tiptree Financial by 9.6% during the fourth quarter. Northern Trust Corp now owns 226,469 shares of the financial services provider's stock worth $4,724,000 after purchasing an additional 19,773 shares during the period. 37.78% of the stock is owned by institutional investors and hedge funds.

Tiptree Financial Price Performance

Tiptree Financial stock traded down $1.79 during mid-day trading on Monday, reaching $23.70. 286,248 shares of the company were exchanged, compared to its average volume of 154,923. The company has a fifty day simple moving average of $22.19 and a 200-day simple moving average of $22.45. Tiptree Financial Inc. has a 12 month low of $18.25 and a 12 month high of $26.90. The firm has a market cap of $888.75 million, a PE ratio of 18.81 and a beta of 1.23.

Tiptree Financial (NASDAQ:TIPT - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The financial services provider reported $0.52 EPS for the quarter. Tiptree Financial had a return on equity of 13.90% and a net margin of 2.77%.The firm had revenue of $528.75 million for the quarter.

Tiptree Financial Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, August 25th. Shareholders of record on Monday, August 18th were paid a dividend of $0.06 per share. This represents a $0.24 dividend on an annualized basis and a yield of 1.0%. The ex-dividend date was Monday, August 18th. Tiptree Financial's dividend payout ratio (DPR) is 19.05%.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded Tiptree Financial from a "hold" rating to a "buy" rating in a research note on Saturday, August 2nd.

Check Out Our Latest Stock Analysis on Tiptree Financial

Tiptree Financial Company Profile

(

Free Report)

Tiptree Inc, through its subsidiaries, provides specialty insurance products and related services primarily in the United States. It operates through two segments: Insurance and Mortgage. The company offers niche; commercial lines insurance products, including professional liability, general liability, contractual liability protection, property and other short-tail, and alternative risks insurance products; and personal lines insurance products, such as credit protection surrounding loan payments.

Featured Articles

Before you consider Tiptree Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tiptree Financial wasn't on the list.

While Tiptree Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.