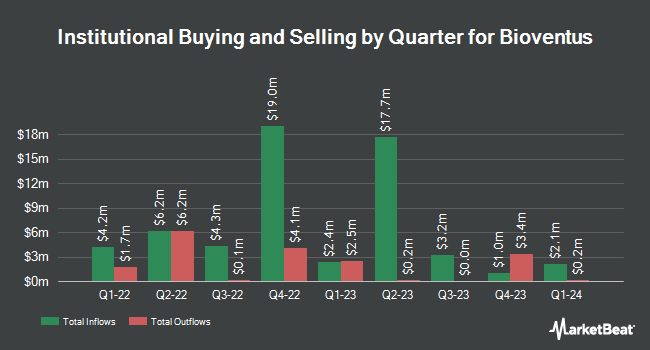

Cubist Systematic Strategies LLC boosted its stake in shares of Bioventus Inc. (NYSE:BVS - Free Report) by 314.0% during the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 153,489 shares of the company's stock after purchasing an additional 116,418 shares during the period. Cubist Systematic Strategies LLC owned about 0.19% of Bioventus worth $1,404,000 at the end of the most recent reporting period.

Other institutional investors have also recently added to or reduced their stakes in the company. Tower Research Capital LLC TRC lifted its stake in Bioventus by 106.1% in the fourth quarter. Tower Research Capital LLC TRC now owns 3,469 shares of the company's stock valued at $36,000 after acquiring an additional 1,786 shares during the last quarter. GAMMA Investing LLC lifted its stake in Bioventus by 3,228.7% in the first quarter. GAMMA Investing LLC now owns 5,792 shares of the company's stock valued at $53,000 after acquiring an additional 5,618 shares during the last quarter. Russell Investments Group Ltd. lifted its stake in Bioventus by 23,761.5% in the first quarter. Russell Investments Group Ltd. now owns 6,204 shares of the company's stock valued at $57,000 after acquiring an additional 6,178 shares during the last quarter. Sherbrooke Park Advisers LLC acquired a new stake in Bioventus in the fourth quarter valued at approximately $111,000. Finally, ProShare Advisors LLC acquired a new stake in Bioventus in the fourth quarter valued at approximately $113,000. 62.94% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Cantor Fitzgerald started coverage on shares of Bioventus in a research note on Monday, July 7th. They issued an "overweight" rating and a $12.00 target price for the company. Three analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat.com, Bioventus currently has an average rating of "Moderate Buy" and an average price target of $13.75.

Check Out Our Latest Report on Bioventus

Bioventus Stock Performance

BVS stock traded down $0.05 on Friday, reaching $7.23. 310,691 shares of the company were exchanged, compared to its average volume of 396,683. Bioventus Inc. has a 12 month low of $5.81 and a 12 month high of $14.38. The stock's fifty day moving average price is $6.96 and its 200 day moving average price is $7.48. The firm has a market capitalization of $597.77 million, a PE ratio of -11.85 and a beta of 0.84. The company has a debt-to-equity ratio of 1.85, a current ratio of 1.41 and a quick ratio of 0.99.

About Bioventus

(

Free Report)

Bioventus Inc, a medical device company, focuses on developing and commercializing treatments that engage and enhance the body's natural healing process in the United States and internationally. The company's product portfolio includes pain treatments, which comprise non-surgical pain injection therapies, as well as peripheral nerve stimulation products, such as Durolane, GELSYN-3, and SUPARTZ for the treatment of knee osteoarthritis and Stimrouter to treat chronic peripheral pain.

Featured Stories

Before you consider Bioventus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bioventus wasn't on the list.

While Bioventus currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.