Cubist Systematic Strategies LLC boosted its holdings in shares of Oportun Financial Corporation (NASDAQ:OPRT - Free Report) by 164.1% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 140,199 shares of the company's stock after acquiring an additional 87,119 shares during the quarter. Cubist Systematic Strategies LLC owned approximately 0.37% of Oportun Financial worth $770,000 at the end of the most recent reporting period.

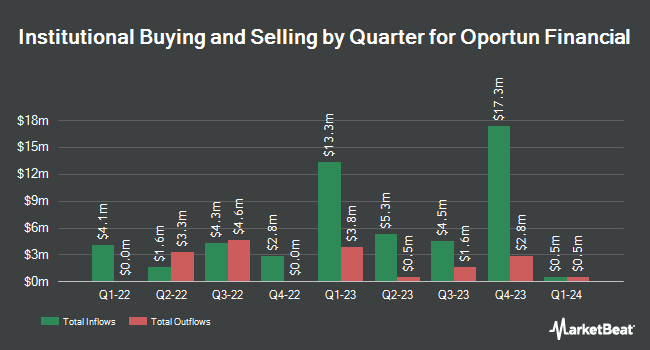

Several other hedge funds and other institutional investors have also modified their holdings of the stock. D. E. Shaw & Co. Inc. acquired a new stake in Oportun Financial during the fourth quarter worth $319,000. Millennium Management LLC lifted its position in Oportun Financial by 7.4% during the 4th quarter. Millennium Management LLC now owns 1,502,970 shares of the company's stock valued at $5,832,000 after purchasing an additional 104,186 shares during the period. Jane Street Group LLC bought a new stake in shares of Oportun Financial in the 4th quarter valued at about $219,000. Jump Financial LLC bought a new stake in shares of Oportun Financial in the 1st quarter valued at about $395,000. Finally, Two Sigma Advisers LP increased its stake in shares of Oportun Financial by 11.7% in the 4th quarter. Two Sigma Advisers LP now owns 508,500 shares of the company's stock valued at $1,973,000 after acquiring an additional 53,400 shares during the last quarter. Institutional investors and hedge funds own 82.70% of the company's stock.

Oportun Financial Stock Up 0.6%

Shares of Oportun Financial stock traded up $0.04 on Monday, reaching $6.69. The company's stock had a trading volume of 378,471 shares, compared to its average volume of 610,714. The company has a market capitalization of $294.43 million, a price-to-earnings ratio of -33.45 and a beta of 1.33. The firm's fifty day simple moving average is $6.35 and its two-hundred day simple moving average is $6.14. Oportun Financial Corporation has a 52 week low of $2.40 and a 52 week high of $9.24.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on OPRT shares. Wall Street Zen raised Oportun Financial from a "buy" rating to a "strong-buy" rating in a report on Saturday, August 9th. JPMorgan Chase & Co. lifted their price objective on Oportun Financial from $7.00 to $8.00 and gave the stock a "neutral" rating in a research note on Friday, July 11th. Finally, Stephens initiated coverage on Oportun Financial in a report on Thursday, June 12th. They set an "overweight" rating and a $10.00 price target for the company. One analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating and three have given a Hold rating to the stock. Based on data from MarketBeat, Oportun Financial presently has a consensus rating of "Moderate Buy" and a consensus price target of $9.33.

Read Our Latest Report on OPRT

Insider Activity at Oportun Financial

In related news, insider Kathleen I. Layton sold 4,214 shares of the business's stock in a transaction dated Wednesday, September 10th. The stock was sold at an average price of $6.64, for a total value of $27,980.96. Following the sale, the insider directly owned 159,184 shares in the company, valued at approximately $1,056,981.76. The trade was a 2.58% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 9.30% of the company's stock.

About Oportun Financial

(

Free Report)

Oportun Financial Corporation provides financial services. The company offers personal loans and credit cards. It serves customers through online and over the phone, as well as through retail and Lending as a Service partner locations. The company was founded in 2005 and is headquartered in San Carlos, California.

See Also

Before you consider Oportun Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oportun Financial wasn't on the list.

While Oportun Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.