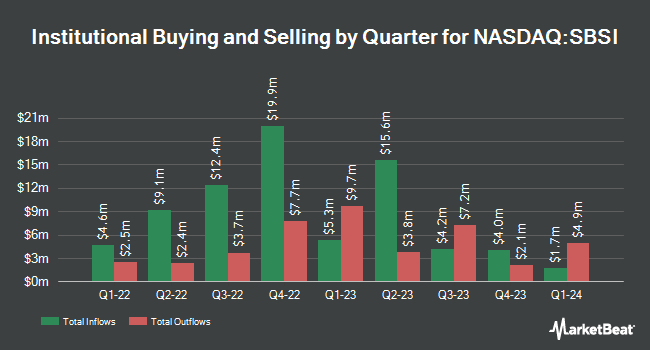

Cubist Systematic Strategies LLC bought a new position in shares of Southside Bancshares, Inc. (NASDAQ:SBSI - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm bought 13,330 shares of the bank's stock, valued at approximately $386,000.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Meeder Asset Management Inc. bought a new position in shares of Southside Bancshares during the first quarter valued at $29,000. AlphaQuest LLC lifted its holdings in Southside Bancshares by 223,400.0% during the 1st quarter. AlphaQuest LLC now owns 2,235 shares of the bank's stock valued at $65,000 after purchasing an additional 2,234 shares during the last quarter. Lazard Asset Management LLC bought a new position in Southside Bancshares during the 4th quarter valued at about $103,000. Universal Beteiligungs und Servicegesellschaft mbH bought a new position in shares of Southside Bancshares in the first quarter valued at approximately $204,000. Finally, Ieq Capital LLC bought a new position in shares of Southside Bancshares in the first quarter valued at approximately $234,000. 55.70% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Separately, Keefe, Bruyette & Woods lifted their target price on shares of Southside Bancshares from $32.00 to $33.00 and gave the company a "market perform" rating in a research note on Monday, July 28th. Three investment analysts have rated the stock with a Hold rating, According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $35.00.

Get Our Latest Stock Report on Southside Bancshares

Southside Bancshares Trading Up 0.2%

SBSI stock traded up $0.06 during trading on Wednesday, hitting $29.94. The company had a trading volume of 106,382 shares, compared to its average volume of 115,794. The company has a quick ratio of 0.76, a current ratio of 0.76 and a debt-to-equity ratio of 1.18. The firm has a 50-day moving average price of $30.37 and a 200-day moving average price of $29.28. Southside Bancshares, Inc. has a 12 month low of $25.85 and a 12 month high of $38.00. The stock has a market cap of $900.54 million, a price-to-earnings ratio of 10.29 and a beta of 0.70.

Southside Bancshares Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, September 4th. Stockholders of record on Thursday, August 21st were given a dividend of $0.36 per share. The ex-dividend date was Thursday, August 21st. This represents a $1.44 dividend on an annualized basis and a dividend yield of 4.8%. Southside Bancshares's payout ratio is presently 51.06%.

Southside Bancshares Profile

(

Free Report)

Southside Bancshares, Inc operates as the bank holding company for Southside Bank that provides a range of financial services to individuals, businesses, municipal entities, and nonprofit organizations. Its deposit products include savings, money market, and interest and noninterest bearing checking accounts, as well as certificates of deposits.

See Also

Before you consider Southside Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southside Bancshares wasn't on the list.

While Southside Bancshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.