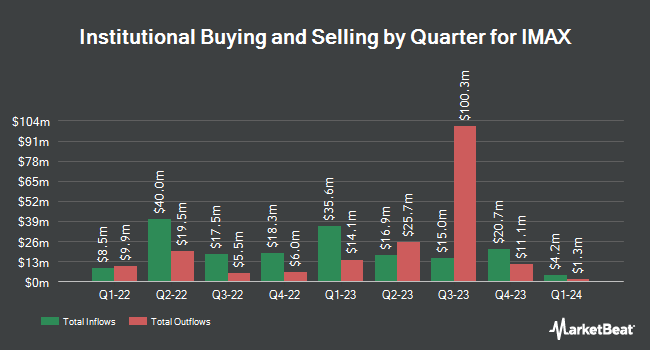

Cubist Systematic Strategies LLC purchased a new stake in IMAX Corporation (NYSE:IMAX - Free Report) in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 182,683 shares of the company's stock, valued at approximately $4,814,000. Cubist Systematic Strategies LLC owned approximately 0.34% of IMAX as of its most recent SEC filing.

Other hedge funds have also recently bought and sold shares of the company. Creative Financial Designs Inc. ADV acquired a new stake in shares of IMAX in the first quarter valued at approximately $59,000. Y Intercept Hong Kong Ltd acquired a new stake in shares of IMAX in the first quarter valued at approximately $202,000. Fox Run Management L.L.C. acquired a new stake in shares of IMAX in the first quarter valued at approximately $289,000. North Star Investment Management Corp. acquired a new stake in shares of IMAX in the first quarter valued at approximately $290,000. Finally, ProShare Advisors LLC acquired a new stake in shares of IMAX in the fourth quarter valued at approximately $309,000. 93.51% of the stock is currently owned by institutional investors.

Insider Activity

In other news, insider Kenneth Ian Weissman sold 15,072 shares of IMAX stock in a transaction on Thursday, August 14th. The stock was sold at an average price of $25.65, for a total value of $386,596.80. Following the transaction, the insider owned 26,133 shares in the company, valued at approximately $670,311.45. This trade represents a 36.58% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders own 24.08% of the company's stock.

IMAX Price Performance

IMAX stock traded up $1.23 during mid-day trading on Monday, reaching $31.01. 1,425,303 shares of the company were exchanged, compared to its average volume of 947,815. The company has a fifty day simple moving average of $27.03 and a 200-day simple moving average of $26.20. IMAX Corporation has a 12 month low of $18.76 and a 12 month high of $31.37. The firm has a market cap of $1.67 billion, a PE ratio of 51.69, a PEG ratio of 2.02 and a beta of 0.68.

IMAX (NYSE:IMAX - Get Free Report) last posted its quarterly earnings data on Thursday, July 24th. The company reported $0.26 EPS for the quarter, topping analysts' consensus estimates of $0.19 by $0.07. IMAX had a return on equity of 8.62% and a net margin of 9.04%.The firm had revenue of $91.68 million for the quarter, compared to analyst estimates of $93.04 million. During the same quarter last year, the company earned $0.18 EPS. The company's revenue was up 3.1% on a year-over-year basis. Sell-side analysts anticipate that IMAX Corporation will post 0.91 earnings per share for the current year.

IMAX declared that its Board of Directors has initiated a stock buyback plan on Thursday, June 12th that allows the company to repurchase $100.00 million in outstanding shares. This repurchase authorization allows the company to buy up to 6.5% of its stock through open market purchases. Stock repurchase plans are often an indication that the company's board believes its stock is undervalued.

Wall Street Analyst Weigh In

IMAX has been the subject of several research reports. Wells Fargo & Company lifted their price target on IMAX from $30.00 to $34.00 and gave the stock an "overweight" rating in a report on Friday, July 25th. B. Riley reissued a "buy" rating and set a $36.00 price target on shares of IMAX in a report on Friday, May 16th. Rosenblatt Securities lifted their price target on IMAX from $35.00 to $37.00 and gave the stock a "buy" rating in a report on Friday, July 25th. Barrington Research reissued an "outperform" rating and set a $32.00 price target on shares of IMAX in a report on Thursday, July 24th. Finally, Roth Capital reissued a "buy" rating and set a $36.00 price target on shares of IMAX in a report on Wednesday, July 9th. One investment analyst has rated the stock with a Strong Buy rating, eight have issued a Buy rating, one has assigned a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $32.80.

Check Out Our Latest Stock Analysis on IMAX

About IMAX

(

Free Report)

IMAX Corporation, together with its subsidiaries, operates as a technology platform for entertainment and events worldwide. The company operates in two segments, Content Solutions and Technology Products and Services. The company offers IMAX DMR, a proprietary technology that digitally remasters films and other content into IMAX formats for distribution to the IMAX network; IMAX Enhanced that provides end-to-end technology across streaming content and entertainment devices at home; and SSIMWAVE, an AI-driven video quality solutions for media and entertainment companies.

Recommended Stories

Before you consider IMAX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IMAX wasn't on the list.

While IMAX currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.