Cubist Systematic Strategies LLC acquired a new position in shares of Spok Holdings, Inc. (NASDAQ:SPOK - Free Report) in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund acquired 36,604 shares of the Wireless communications provider's stock, valued at approximately $602,000. Cubist Systematic Strategies LLC owned 0.18% of Spok as of its most recent SEC filing.

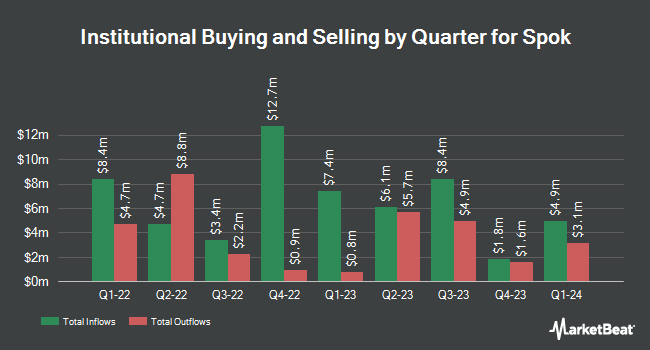

A number of other hedge funds have also made changes to their positions in SPOK. CWM LLC lifted its holdings in shares of Spok by 309.2% during the 1st quarter. CWM LLC now owns 1,743 shares of the Wireless communications provider's stock valued at $29,000 after acquiring an additional 1,317 shares in the last quarter. SBI Securities Co. Ltd. raised its position in Spok by 62.2% in the first quarter. SBI Securities Co. Ltd. now owns 2,200 shares of the Wireless communications provider's stock valued at $36,000 after purchasing an additional 844 shares during the period. US Bancorp DE lifted its stake in shares of Spok by 862.1% during the first quarter. US Bancorp DE now owns 2,790 shares of the Wireless communications provider's stock worth $46,000 after purchasing an additional 2,500 shares in the last quarter. Nisa Investment Advisors LLC lifted its stake in shares of Spok by 12,125.8% during the first quarter. Nisa Investment Advisors LLC now owns 3,790 shares of the Wireless communications provider's stock worth $62,000 after purchasing an additional 3,759 shares in the last quarter. Finally, Lazard Asset Management LLC boosted its position in shares of Spok by 30.8% in the fourth quarter. Lazard Asset Management LLC now owns 5,868 shares of the Wireless communications provider's stock worth $94,000 after buying an additional 1,383 shares during the period. Hedge funds and other institutional investors own 50.81% of the company's stock.

Insiders Place Their Bets

In related news, COO Michael W. Wallace sold 10,806 shares of the business's stock in a transaction dated Monday, August 25th. The stock was sold at an average price of $17.87, for a total value of $193,103.22. Following the transaction, the chief operating officer owned 40,369 shares in the company, valued at approximately $721,394.03. The trade was a 21.12% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO Vincent D. Kelly sold 25,000 shares of the stock in a transaction dated Thursday, August 21st. The shares were sold at an average price of $17.69, for a total value of $442,250.00. Following the completion of the transaction, the chief executive officer directly owned 102,817 shares of the company's stock, valued at $1,818,832.73. This represents a 19.56% decrease in their position. The disclosure for this sale can be found here. Insiders own 7.37% of the company's stock.

Spok Stock Performance

Shares of NASDAQ:SPOK traded down $0.12 during mid-day trading on Tuesday, hitting $17.35. 69,616 shares of the company traded hands, compared to its average volume of 115,238. The firm's 50 day simple moving average is $17.87 and its 200 day simple moving average is $16.80. The firm has a market cap of $357.24 million, a P/E ratio of 20.90 and a beta of 0.55. Spok Holdings, Inc. has a 52-week low of $13.55 and a 52-week high of $19.31.

Spok (NASDAQ:SPOK - Get Free Report) last issued its quarterly earnings data on Wednesday, July 30th. The Wireless communications provider reported $0.22 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.18 by $0.04. The company had revenue of $35.69 million during the quarter, compared to the consensus estimate of $35.00 million. Spok had a net margin of 12.12% and a return on equity of 11.11%. Spok has set its FY 2025 guidance at EPS. Equities research analysts expect that Spok Holdings, Inc. will post 0.76 EPS for the current fiscal year.

Spok Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 9th. Investors of record on Tuesday, August 19th were paid a dividend of $0.3125 per share. The ex-dividend date of this dividend was Tuesday, August 19th. This represents a $1.25 annualized dividend and a yield of 7.2%. Spok's payout ratio is 150.60%.

Spok Profile

(

Free Report)

Spok Holdings, Inc, through its subsidiary, Spok, Inc, provides healthcare communication solutions in the United States, Europe, Canada, Australia, Asia, and the Middle East. The company's products and services enhance workflows for clinicians and support administrative compliance. It delivers clinical information to care teams when and where it matters to enhance patient outcomes; and provides GenA Pager, a one-way alphanumeric pager.

Featured Articles

Before you consider Spok, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spok wasn't on the list.

While Spok currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.