Cubist Systematic Strategies LLC lessened its stake in PRA Group, Inc. (NASDAQ:PRAA - Free Report) by 31.9% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 117,284 shares of the business services provider's stock after selling 54,948 shares during the period. Cubist Systematic Strategies LLC owned approximately 0.30% of PRA Group worth $2,418,000 at the end of the most recent reporting period.

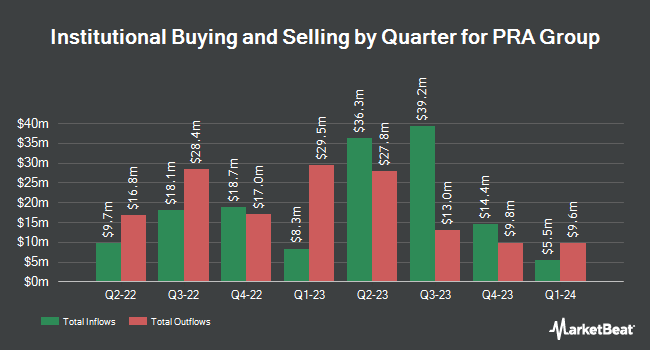

A number of other hedge funds and other institutional investors have also bought and sold shares of PRAA. Virtus Advisers LLC purchased a new position in PRA Group in the 1st quarter worth approximately $147,000. Point72 Asset Management L.P. purchased a new position in PRA Group in the 4th quarter worth approximately $155,000. State of Wyoming grew its stake in PRA Group by 9.0% in the 4th quarter. State of Wyoming now owns 10,255 shares of the business services provider's stock worth $214,000 after buying an additional 850 shares in the last quarter. Cetera Investment Advisers purchased a new position in PRA Group in the 4th quarter worth approximately $227,000. Finally, AlphaQuest LLC grew its stake in PRA Group by 43.4% in the 1st quarter. AlphaQuest LLC now owns 11,024 shares of the business services provider's stock worth $227,000 after buying an additional 3,334 shares in the last quarter. Hedge funds and other institutional investors own 97.22% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have commented on PRAA shares. JMP Securities set a $24.00 price target on shares of PRA Group and gave the stock a "market outperform" rating in a research note on Tuesday, August 5th. Wall Street Zen raised shares of PRA Group from a "sell" rating to a "hold" rating in a research note on Saturday, August 9th. Finally, Citigroup reaffirmed an "outperform" rating on shares of PRA Group in a research note on Tuesday, August 5th. Three equities research analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average price target of $27.50.

View Our Latest Stock Report on PRA Group

PRA Group Price Performance

PRAA traded down $0.50 during trading on Friday, hitting $16.82. 182,677 shares of the stock traded hands, compared to its average volume of 201,905. The firm has a market capitalization of $657.16 million, a P/E ratio of 7.22 and a beta of 1.50. The firm has a 50-day moving average of $16.22 and a 200 day moving average of $16.71. PRA Group, Inc. has a 12-month low of $12.91 and a 12-month high of $25.43.

PRA Group (NASDAQ:PRAA - Get Free Report) last announced its quarterly earnings results on Monday, August 4th. The business services provider reported $1.08 earnings per share for the quarter, beating the consensus estimate of $0.62 by $0.46. The business had revenue of $287.69 million during the quarter, compared to analysts' expectations of $279.34 million. PRA Group had a net margin of 8.10% and a return on equity of 6.52%. As a group, equities analysts predict that PRA Group, Inc. will post 2.1 EPS for the current fiscal year.

PRA Group Profile

(

Free Report)

PRA Group, Inc, a financial and business services company, engages in the purchase, collection, and management of portfolios of nonperforming loans worldwide. It is involved in the purchase of accounts that are primarily the unpaid obligations of individuals owed to credit originators, which include banks and other types of consumer, retail, and auto finance companies.

Further Reading

Before you consider PRA Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PRA Group wasn't on the list.

While PRA Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.