Cubist Systematic Strategies LLC lowered its stake in Uniti Group Inc. (NASDAQ:UNIT - Free Report) by 14.1% during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 383,694 shares of the real estate investment trust's stock after selling 63,110 shares during the quarter. Cubist Systematic Strategies LLC owned about 0.16% of Uniti Group worth $1,934,000 as of its most recent SEC filing.

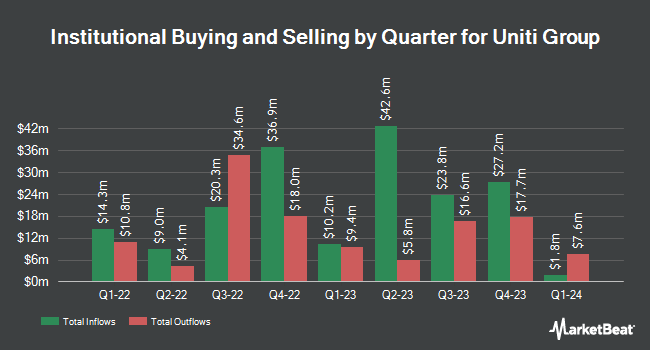

Other hedge funds have also bought and sold shares of the company. Allspring Global Investments Holdings LLC lifted its stake in Uniti Group by 53.9% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 32,531 shares of the real estate investment trust's stock worth $170,000 after purchasing an additional 11,395 shares in the last quarter. Panagora Asset Management Inc. lifted its stake in Uniti Group by 287.9% in the 1st quarter. Panagora Asset Management Inc. now owns 318,066 shares of the real estate investment trust's stock worth $1,603,000 after purchasing an additional 236,061 shares in the last quarter. Nuveen LLC purchased a new stake in Uniti Group in the 1st quarter worth $6,158,000. Vanguard Group Inc. lifted its stake in Uniti Group by 0.4% in the 1st quarter. Vanguard Group Inc. now owns 36,996,734 shares of the real estate investment trust's stock worth $186,464,000 after purchasing an additional 151,070 shares in the last quarter. Finally, Russell Investments Group Ltd. lifted its stake in Uniti Group by 457.8% in the 1st quarter. Russell Investments Group Ltd. now owns 127,265 shares of the real estate investment trust's stock worth $641,000 after purchasing an additional 104,451 shares in the last quarter. Hedge funds and other institutional investors own 87.51% of the company's stock.

Analysts Set New Price Targets

UNIT has been the topic of several research analyst reports. Citigroup reiterated a "neutral" rating and issued a $5.30 price target on shares of Uniti Group in a research note on Friday, May 16th. Wells Fargo & Company boosted their price target on shares of Uniti Group from $4.50 to $7.50 and gave the stock an "equal weight" rating in a research note on Thursday, August 7th. Wall Street Zen cut shares of Uniti Group from a "hold" rating to a "sell" rating in a research report on Saturday, August 9th. Finally, Zacks Research cut shares of Uniti Group from a "hold" rating to a "strong sell" rating in a research report on Wednesday. One research analyst has rated the stock with a Strong Buy rating, three have given a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $6.70.

Read Our Latest Research Report on Uniti Group

Uniti Group Stock Down 2.4%

Uniti Group stock traded down $0.17 during midday trading on Friday, reaching $6.94. The stock had a trading volume of 1,770,345 shares, compared to its average volume of 3,238,550. Uniti Group Inc. has a 52-week low of $5.68 and a 52-week high of $12.62. The firm has a market cap of $1.03 billion, a price-to-earnings ratio of 25.22 and a beta of 1.50. The company has a fifty day moving average of $5.98 and a 200 day moving average of $5.10.

Uniti Group (NASDAQ:UNIT - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The real estate investment trust reported $0.36 earnings per share for the quarter, missing analysts' consensus estimates of $0.42 by ($0.06). Uniti Group had a negative return on equity of 1.43% and a net margin of 2.96%.The firm had revenue of $300.73 million during the quarter, compared to analysts' expectations of $304.06 million. During the same period last year, the company earned $0.34 earnings per share. The business's revenue for the quarter was up 2.0% compared to the same quarter last year. Uniti Group has set its FY 2025 guidance at EPS. Equities research analysts predict that Uniti Group Inc. will post 1.28 EPS for the current year.

About Uniti Group

(

Free Report)

Uniti Group, Inc is a real estate investment trust company, which engages in the acquisition, construction, and leasing of properties. It operates through the following business segments: Uniti Leasing, Uniti Fiber, and Corporate. The Uniti Leasing segment involves mission-critical communications assets on exclusive or shared-tenant basis, and dark fiber network.

Featured Articles

Before you consider Uniti Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uniti Group wasn't on the list.

While Uniti Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.