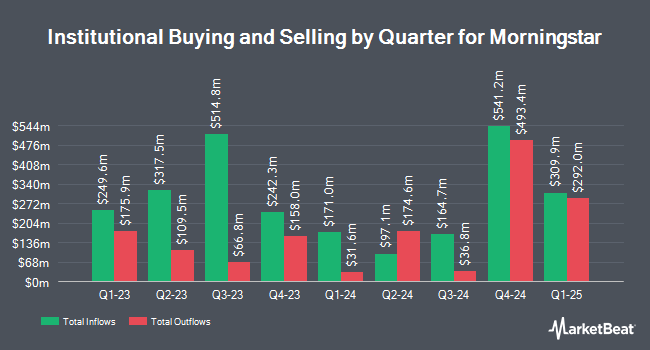

Cwm LLC boosted its stake in shares of Morningstar, Inc. (NASDAQ:MORN - Free Report) by 241.2% during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,262 shares of the business services provider's stock after purchasing an additional 3,013 shares during the period. Cwm LLC's holdings in Morningstar were worth $1,338,000 at the end of the most recent reporting period.

A number of other large investors have also added to or reduced their stakes in the stock. Millennium Management LLC lifted its holdings in shares of Morningstar by 88.0% during the 1st quarter. Millennium Management LLC now owns 540,795 shares of the business services provider's stock valued at $162,168,000 after buying an additional 253,137 shares during the period. Nuveen LLC purchased a new stake in Morningstar during the first quarter valued at $38,269,000. Assenagon Asset Management S.A. bought a new position in Morningstar in the second quarter valued at about $33,098,000. Panagora Asset Management Inc. boosted its position in Morningstar by 4,970.8% in the first quarter. Panagora Asset Management Inc. now owns 56,692 shares of the business services provider's stock worth $17,000,000 after purchasing an additional 55,574 shares during the last quarter. Finally, Cubist Systematic Strategies LLC increased its position in shares of Morningstar by 688.9% during the 1st quarter. Cubist Systematic Strategies LLC now owns 45,055 shares of the business services provider's stock valued at $13,511,000 after purchasing an additional 39,344 shares during the last quarter. Institutional investors own 57.02% of the company's stock.

Morningstar Stock Performance

MORN opened at $218.20 on Tuesday. The company has a 50 day simple moving average of $243.97 and a two-hundred day simple moving average of $275.26. The company has a debt-to-equity ratio of 0.52, a current ratio of 1.13 and a quick ratio of 1.13. The firm has a market cap of $9.20 billion, a P/E ratio of 23.24 and a beta of 1.00. Morningstar, Inc. has a 1-year low of $210.02 and a 1-year high of $365.00.

Morningstar (NASDAQ:MORN - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The business services provider reported $2.40 EPS for the quarter, beating the consensus estimate of $2.21 by $0.19. Morningstar had a net margin of 17.22% and a return on equity of 23.54%. The firm had revenue of $605.10 million for the quarter, compared to the consensus estimate of $605.84 million.

Insider Activity at Morningstar

In other news, Chairman Joseph D. Mansueto sold 7,250 shares of the company's stock in a transaction dated Tuesday, August 12th. The stock was sold at an average price of $256.50, for a total value of $1,859,625.00. Following the completion of the transaction, the chairman owned 9,373,175 shares of the company's stock, valued at $2,404,219,387.50. This represents a 0.08% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Insiders sold 85,500 shares of company stock valued at $22,341,957 in the last quarter. 36.20% of the stock is owned by insiders.

Analysts Set New Price Targets

MORN has been the subject of several recent research reports. Wall Street Zen lowered shares of Morningstar from a "buy" rating to a "hold" rating in a research report on Saturday, July 5th. Weiss Ratings reissued a "hold (c)" rating on shares of Morningstar in a research report on Wednesday, October 8th. One investment analyst has rated the stock with a Buy rating and one has assigned a Hold rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $355.00.

Check Out Our Latest Stock Analysis on MORN

Morningstar Profile

(

Free Report)

Morningstar, Inc provides independent investment insights in the United States, Asia. Australia, Continental Europe, the United Kingdom, and internationally. The company operates in five segments: Morningstar Data and Analytics; PitchBook; Morningstar Wealth; Morningstar Credit; and Morningstar Retirement.

See Also

Want to see what other hedge funds are holding MORN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Morningstar, Inc. (NASDAQ:MORN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Morningstar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morningstar wasn't on the list.

While Morningstar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.