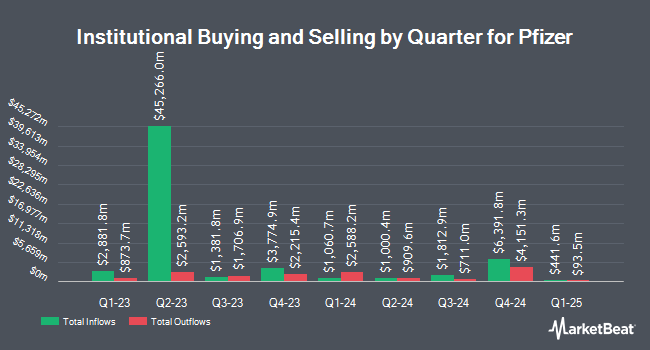

Cwm LLC raised its position in Pfizer Inc. (NYSE:PFE - Free Report) by 6.0% in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,488,909 shares of the biopharmaceutical company's stock after acquiring an additional 84,187 shares during the quarter. Cwm LLC's holdings in Pfizer were worth $36,091,000 as of its most recent SEC filing.

A number of other institutional investors also recently added to or reduced their stakes in PFE. Pacer Advisors Inc. raised its holdings in Pfizer by 856.8% during the first quarter. Pacer Advisors Inc. now owns 20,053,828 shares of the biopharmaceutical company's stock worth $508,164,000 after purchasing an additional 17,957,928 shares in the last quarter. Amundi raised its holdings in Pfizer by 43.4% during the first quarter. Amundi now owns 52,090,403 shares of the biopharmaceutical company's stock worth $1,265,277,000 after purchasing an additional 15,758,846 shares in the last quarter. Nuveen LLC acquired a new stake in Pfizer during the first quarter worth approximately $389,861,000. Goldman Sachs Group Inc. raised its holdings in Pfizer by 51.9% during the first quarter. Goldman Sachs Group Inc. now owns 26,456,457 shares of the biopharmaceutical company's stock worth $670,407,000 after purchasing an additional 9,041,990 shares in the last quarter. Finally, Vanguard Group Inc. raised its holdings in Pfizer by 0.9% during the first quarter. Vanguard Group Inc. now owns 523,165,127 shares of the biopharmaceutical company's stock worth $13,257,004,000 after purchasing an additional 4,629,976 shares in the last quarter. Hedge funds and other institutional investors own 68.36% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have weighed in on PFE shares. UBS Group reissued a "neutral" rating and set a $28.00 price objective on shares of Pfizer in a report on Wednesday, October 1st. Citigroup raised their price objective on shares of Pfizer from $25.00 to $26.00 and gave the stock a "neutral" rating in a report on Wednesday, August 6th. Bank of America raised their price objective on shares of Pfizer from $28.00 to $30.00 and gave the stock a "neutral" rating in a report on Friday, October 3rd. Wall Street Zen cut shares of Pfizer from a "buy" rating to a "hold" rating in a report on Sunday, September 28th. Finally, Weiss Ratings reaffirmed a "hold (c-)" rating on shares of Pfizer in a report on Wednesday. Two research analysts have rated the stock with a Strong Buy rating, four have assigned a Buy rating, twelve have assigned a Hold rating and one has issued a Sell rating to the company. According to MarketBeat.com, Pfizer presently has a consensus rating of "Hold" and a consensus target price of $28.35.

Check Out Our Latest Stock Report on PFE

Pfizer Stock Performance

Shares of Pfizer stock opened at $24.81 on Friday. The firm's fifty day simple moving average is $24.86 and its 200-day simple moving average is $24.13. Pfizer Inc. has a 12 month low of $20.92 and a 12 month high of $29.82. The company has a debt-to-equity ratio of 0.65, a current ratio of 1.16 and a quick ratio of 0.85. The stock has a market capitalization of $141.03 billion, a price-to-earnings ratio of 13.19, a PEG ratio of 0.81 and a beta of 0.55.

Pfizer (NYSE:PFE - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The biopharmaceutical company reported $0.78 earnings per share for the quarter, beating analysts' consensus estimates of $0.58 by $0.20. Pfizer had a net margin of 16.84% and a return on equity of 21.42%. The firm had revenue of $14.65 billion for the quarter, compared to analyst estimates of $13.43 billion. During the same period last year, the firm posted $0.60 EPS. Pfizer's quarterly revenue was up 10.3% on a year-over-year basis. Pfizer has set its FY 2025 guidance at 2.900-3.100 EPS. As a group, equities analysts forecast that Pfizer Inc. will post 2.95 earnings per share for the current year.

Pfizer Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 1st. Shareholders of record on Friday, November 7th will be given a dividend of $0.43 per share. This represents a $1.72 annualized dividend and a dividend yield of 6.9%. The ex-dividend date is Friday, November 7th. Pfizer's payout ratio is presently 91.49%.

Pfizer Company Profile

(

Free Report)

Pfizer Inc discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States, Europe, and internationally. The company offers medicines and vaccines in various therapeutic areas, including cardiovascular metabolic, migraine, and women's health under the Eliquis, Nurtec ODT/Vydura, Zavzpret, and the Premarin family brands; infectious diseases with unmet medical needs under the Prevnar family, Abrysvo, Nimenrix, FSME/IMMUN-TicoVac, and Trumenba brands; and COVID-19 prevention and treatment, and potential future mRNA and antiviral products under the Comirnaty and Paxlovid brands.

See Also

Want to see what other hedge funds are holding PFE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Pfizer Inc. (NYSE:PFE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pfizer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pfizer wasn't on the list.

While Pfizer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.