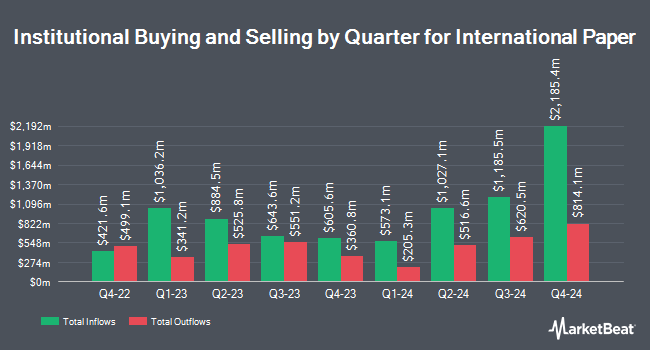

Deutsche Bank AG lifted its stake in shares of International Paper Company (NYSE:IP - Free Report) by 167.6% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,580,858 shares of the basic materials company's stock after purchasing an additional 1,616,376 shares during the quarter. Deutsche Bank AG owned about 0.49% of International Paper worth $137,689,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently made changes to their positions in the company. Bernard Wealth Management Corp. bought a new position in shares of International Paper during the 4th quarter worth about $37,000. Transce3nd LLC bought a new position in shares of International Paper during the 4th quarter worth about $38,000. Citizens National Bank Trust Department bought a new position in shares of International Paper during the 1st quarter worth about $37,000. Grove Bank & Trust lifted its position in International Paper by 472.0% in the 1st quarter. Grove Bank & Trust now owns 755 shares of the basic materials company's stock valued at $40,000 after acquiring an additional 623 shares in the last quarter. Finally, Toth Financial Advisory Corp bought a new position in International Paper in the 1st quarter valued at about $42,000. Institutional investors own 81.95% of the company's stock.

International Paper Price Performance

International Paper stock opened at $47.54 on Friday. International Paper Company has a 52 week low of $43.27 and a 52 week high of $60.36. The company's 50 day moving average price is $49.11 and its two-hundred day moving average price is $50.42. The company has a quick ratio of 0.96, a current ratio of 1.33 and a debt-to-equity ratio of 0.52. The stock has a market cap of $25.10 billion, a P/E ratio of -475.40, a P/E/G ratio of 0.57 and a beta of 1.04.

International Paper (NYSE:IP - Get Free Report) last posted its earnings results on Thursday, July 31st. The basic materials company reported $0.20 EPS for the quarter, missing the consensus estimate of $0.38 by ($0.18). International Paper had a positive return on equity of 2.63% and a negative net margin of 0.12%. The firm had revenue of $6.77 billion for the quarter, compared to the consensus estimate of $6.64 billion. During the same period in the prior year, the business earned $0.55 EPS. International Paper's quarterly revenue was up 42.9% compared to the same quarter last year. On average, equities analysts predict that International Paper Company will post 2.77 earnings per share for the current year.

International Paper Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 16th. Stockholders of record on Friday, August 15th will be paid a dividend of $0.4625 per share. The ex-dividend date is Friday, August 15th. This represents a $1.85 annualized dividend and a dividend yield of 3.9%. International Paper's dividend payout ratio (DPR) is presently -1,850.00%.

Analyst Ratings Changes

Several brokerages recently weighed in on IP. UBS Group began coverage on shares of International Paper in a research report on Wednesday, June 4th. They issued a "buy" rating and a $60.00 price target on the stock. JPMorgan Chase & Co. cut shares of International Paper from an "overweight" rating to a "neutral" rating and dropped their price target for the company from $55.00 to $54.00 in a research report on Tuesday, August 5th. Truist Financial set a $59.00 price target on shares of International Paper in a research report on Wednesday, May 28th. Wells Fargo & Company reaffirmed an "underweight" rating and issued a $43.00 price target (up previously from $40.00) on shares of International Paper in a research report on Thursday, July 10th. Finally, Wall Street Zen raised shares of International Paper from a "sell" rating to a "hold" rating in a research report on Friday, June 27th. Two equities research analysts have rated the stock with a sell rating, three have assigned a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $55.03.

Check Out Our Latest Stock Analysis on IP

International Paper Profile

(

Free Report)

International Paper Company produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa. It operates through two segments, Industrial Packaging and Global Cellulose Fibers. The company offers linerboard, medium, whitetop, recycled linerboard, recycled medium and saturating kraft; and pulp for a range of applications, such as diapers, towel and tissue products, feminine care, incontinence, and other personal care products, as well as specialty pulps for use in textiles, construction materials, paints, coatings, and others.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider International Paper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Paper wasn't on the list.

While International Paper currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.