Deutsche Bank AG lessened its holdings in shares of The Charles Schwab Corporation (NYSE:SCHW - Free Report) by 2.8% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,126,807 shares of the financial services provider's stock after selling 148,220 shares during the period. Deutsche Bank AG owned approximately 0.28% of Charles Schwab worth $401,326,000 at the end of the most recent quarter.

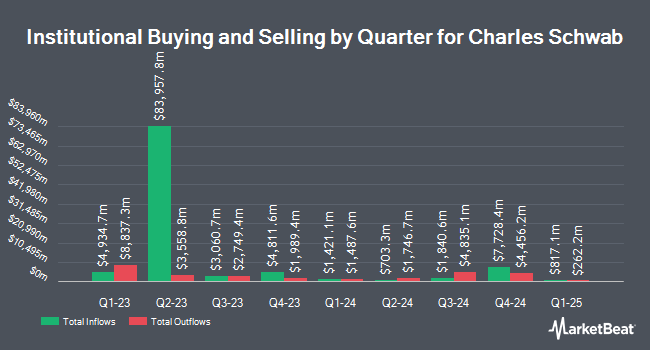

Other institutional investors have also modified their holdings of the company. Sheaff Brock Investment Advisors LLC lifted its holdings in shares of Charles Schwab by 1.6% in the first quarter. Sheaff Brock Investment Advisors LLC now owns 7,986 shares of the financial services provider's stock valued at $625,000 after purchasing an additional 129 shares in the last quarter. HM Payson & Co. raised its position in Charles Schwab by 0.7% in the 1st quarter. HM Payson & Co. now owns 19,271 shares of the financial services provider's stock valued at $1,509,000 after buying an additional 130 shares during the last quarter. Cornerstone Wealth Management LLC lifted its stake in Charles Schwab by 2.1% in the 1st quarter. Cornerstone Wealth Management LLC now owns 6,551 shares of the financial services provider's stock valued at $513,000 after acquiring an additional 132 shares in the last quarter. Journey Strategic Wealth LLC boosted its position in Charles Schwab by 3.1% during the 1st quarter. Journey Strategic Wealth LLC now owns 4,486 shares of the financial services provider's stock worth $351,000 after acquiring an additional 135 shares during the last quarter. Finally, Premier Path Wealth Partners LLC grew its stake in shares of Charles Schwab by 1.8% during the 1st quarter. Premier Path Wealth Partners LLC now owns 7,817 shares of the financial services provider's stock worth $612,000 after acquiring an additional 140 shares in the last quarter. Institutional investors own 84.38% of the company's stock.

Insider Activity at Charles Schwab

In other Charles Schwab news, insider Jonathan S. Beatty sold 2,850 shares of the company's stock in a transaction on Friday, May 30th. The stock was sold at an average price of $87.57, for a total value of $249,574.50. Following the transaction, the insider directly owned 15,219 shares of the company's stock, valued at $1,332,727.83. This represents a 15.77% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. Also, insider Paul V. Woolway sold 3,290 shares of the stock in a transaction on Friday, August 1st. The stock was sold at an average price of $96.06, for a total value of $316,037.40. Following the transaction, the insider owned 41,188 shares in the company, valued at $3,956,519.28. The trade was a 7.40% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 308,016 shares of company stock valued at $29,341,433. Insiders own 6.30% of the company's stock.

Analysts Set New Price Targets

A number of analysts have recently commented on SCHW shares. Citigroup boosted their price objective on shares of Charles Schwab from $105.00 to $110.00 and gave the stock a "buy" rating in a research report on Monday, July 21st. TD Securities lifted their price target on shares of Charles Schwab from $95.00 to $113.00 and gave the company a "buy" rating in a research note on Tuesday, May 20th. Cowen restated a "buy" rating on shares of Charles Schwab in a research note on Tuesday, May 20th. Truist Financial lifted their target price on Charles Schwab from $100.00 to $107.00 and gave the company a "buy" rating in a research report on Monday, July 21st. Finally, Wells Fargo & Company set a $102.00 target price on Charles Schwab and gave the stock an "overweight" rating in a report on Friday, July 18th. Two research analysts have rated the stock with a sell rating, four have assigned a hold rating and sixteen have given a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $99.35.

View Our Latest Analysis on Charles Schwab

Charles Schwab Trading Down 0.8%

Shares of Charles Schwab stock opened at $95.91 on Friday. The company has a debt-to-equity ratio of 0.53, a current ratio of 0.53 and a quick ratio of 0.53. The business has a fifty day simple moving average of $91.98 and a two-hundred day simple moving average of $84.24. The Charles Schwab Corporation has a 1 year low of $61.16 and a 1 year high of $99.59. The company has a market capitalization of $174.26 billion, a price-to-earnings ratio of 25.78, a P/E/G ratio of 0.93 and a beta of 0.96.

Charles Schwab (NYSE:SCHW - Get Free Report) last posted its earnings results on Friday, July 18th. The financial services provider reported $1.14 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.10 by $0.04. The company had revenue of $5.85 billion during the quarter, compared to analysts' expectations of $5.64 billion. Charles Schwab had a net margin of 33.68% and a return on equity of 19.73%. Charles Schwab's quarterly revenue was up 24.8% compared to the same quarter last year. During the same quarter last year, the company posted $0.73 EPS. Research analysts forecast that The Charles Schwab Corporation will post 4.22 EPS for the current year.

Charles Schwab declared that its board has approved a stock buyback plan on Thursday, July 24th that allows the company to repurchase $20.00 billion in outstanding shares. This repurchase authorization allows the financial services provider to repurchase up to 11.6% of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's board believes its stock is undervalued.

Charles Schwab Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, August 22nd. Stockholders of record on Friday, August 8th will be issued a dividend of $0.27 per share. This represents a $1.08 dividend on an annualized basis and a dividend yield of 1.1%. The ex-dividend date is Friday, August 8th. Charles Schwab's payout ratio is currently 29.03%.

Charles Schwab Profile

(

Free Report)

The Charles Schwab Corporation, together with its subsidiaries, operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally. The company operates in two segments, Investor Services and Advisor Services.

See Also

Want to see what other hedge funds are holding SCHW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Charles Schwab Corporation (NYSE:SCHW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report