Deutsche Bank AG lessened its stake in shares of Waters Corporation (NYSE:WAT - Free Report) by 2.6% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 259,985 shares of the medical instruments supplier's stock after selling 6,962 shares during the quarter. Deutsche Bank AG owned about 0.44% of Waters worth $95,823,000 as of its most recent filing with the SEC.

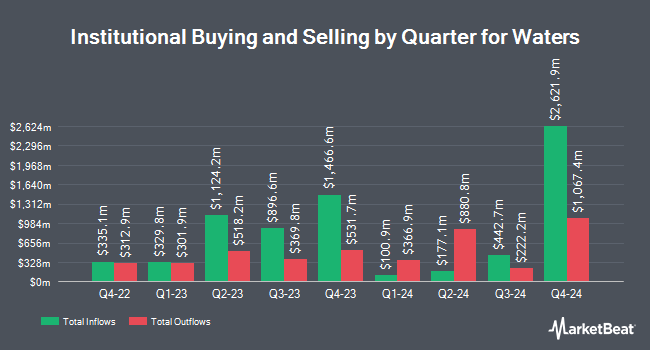

Other large investors also recently made changes to their positions in the company. QRG Capital Management Inc. boosted its stake in shares of Waters by 85.7% during the 1st quarter. QRG Capital Management Inc. now owns 1,642 shares of the medical instruments supplier's stock worth $605,000 after acquiring an additional 758 shares in the last quarter. Cambridge Investment Research Advisors Inc. boosted its stake in shares of Waters by 4.6% during the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 2,986 shares of the medical instruments supplier's stock worth $1,101,000 after acquiring an additional 130 shares in the last quarter. Janney Montgomery Scott LLC lifted its position in shares of Waters by 4.1% during the 1st quarter. Janney Montgomery Scott LLC now owns 4,813 shares of the medical instruments supplier's stock worth $1,774,000 after purchasing an additional 189 shares during the last quarter. CX Institutional acquired a new position in shares of Waters during the 1st quarter worth about $75,000. Finally, Wealth Enhancement Advisory Services LLC lifted its position in shares of Waters by 169.1% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 11,619 shares of the medical instruments supplier's stock worth $4,283,000 after purchasing an additional 7,301 shares during the last quarter. Institutional investors own 94.01% of the company's stock.

Waters Trading Up 1.1%

Waters stock opened at $280.96 on Monday. The business has a 50 day moving average price of $325.40 and a two-hundred day moving average price of $349.97. The company has a quick ratio of 1.22, a current ratio of 1.75 and a debt-to-equity ratio of 0.55. The stock has a market cap of $16.72 billion, a price-to-earnings ratio of 25.33, a price-to-earnings-growth ratio of 2.62 and a beta of 1.04. Waters Corporation has a 12 month low of $275.05 and a 12 month high of $423.56.

Waters (NYSE:WAT - Get Free Report) last issued its earnings results on Monday, August 4th. The medical instruments supplier reported $2.95 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.93 by $0.02. Waters had a return on equity of 38.60% and a net margin of 21.71%. The business had revenue of $771.33 million during the quarter, compared to analysts' expectations of $745.96 million. During the same period in the prior year, the firm posted $2.63 EPS. Waters's quarterly revenue was up 8.8% compared to the same quarter last year. As a group, equities analysts forecast that Waters Corporation will post 12.86 EPS for the current year.

Analyst Upgrades and Downgrades

WAT has been the subject of several research analyst reports. Robert W. Baird cut their price objective on Waters from $374.00 to $352.00 and set an "outperform" rating for the company in a research report on Wednesday, July 16th. Bank of America boosted their price objective on Waters from $370.00 to $375.00 and gave the stock a "neutral" rating in a research report on Thursday, June 26th. Deutsche Bank Aktiengesellschaft cut their price objective on Waters from $375.00 to $315.00 and set a "hold" rating for the company in a research report on Tuesday, August 5th. Sanford C. Bernstein set a $400.00 price objective on Waters and gave the stock an "outperform" rating in a research report on Wednesday, April 16th. Finally, Wells Fargo & Company cut their price objective on Waters from $330.00 to $315.00 and set an "equal weight" rating for the company in a research report on Tuesday, August 5th. Ten research analysts have rated the stock with a hold rating, five have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $378.73.

Check Out Our Latest Analysis on Waters

Waters Profile

(

Free Report)

Waters Corporation provides analytical workflow solutions in Asia, the Americas, and Europe. It operates through two segments: Waters and TA. The company designs, manufactures, sells, and services high and ultra-performance liquid chromatography, as well as mass spectrometry (MS) technology systems and support products, including chromatography columns, other consumable products, and post-warranty service plans.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Waters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waters wasn't on the list.

While Waters currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.