American Century Companies Inc. boosted its holdings in shares of Diageo plc (NYSE:DEO - Free Report) by 3.8% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 106,859 shares of the company's stock after acquiring an additional 3,894 shares during the period. American Century Companies Inc.'s holdings in Diageo were worth $11,198,000 at the end of the most recent reporting period.

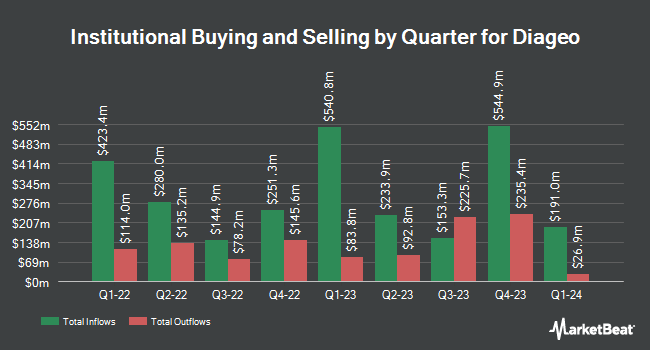

Several other hedge funds have also bought and sold shares of DEO. Venturi Wealth Management LLC lifted its holdings in shares of Diageo by 3.6% during the first quarter. Venturi Wealth Management LLC now owns 2,582 shares of the company's stock valued at $271,000 after purchasing an additional 89 shares during the last quarter. Aptus Capital Advisors LLC grew its stake in shares of Diageo by 5.4% in the 4th quarter. Aptus Capital Advisors LLC now owns 1,867 shares of the company's stock worth $237,000 after buying an additional 95 shares during the last quarter. Grove Bank & Trust raised its stake in Diageo by 1.3% during the first quarter. Grove Bank & Trust now owns 7,560 shares of the company's stock valued at $792,000 after buying an additional 98 shares during the last quarter. Malaga Cove Capital LLC raised its stake in Diageo by 3.3% during the fourth quarter. Malaga Cove Capital LLC now owns 3,101 shares of the company's stock valued at $394,000 after buying an additional 100 shares during the last quarter. Finally, Pinnacle West Asset Management Inc. boosted its holdings in Diageo by 3.2% in the first quarter. Pinnacle West Asset Management Inc. now owns 3,240 shares of the company's stock worth $340,000 after acquiring an additional 100 shares in the last quarter. Institutional investors own 8.97% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently issued reports on DEO shares. The Goldman Sachs Group raised Diageo from a "sell" rating to a "neutral" rating in a research report on Thursday, August 7th. Morgan Stanley reissued an "underweight" rating on shares of Diageo in a research report on Monday, May 12th. Four investment analysts have rated the stock with a Buy rating, three have assigned a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $129.00.

Get Our Latest Stock Analysis on DEO

Diageo Stock Performance

Shares of DEO traded down $0.43 during mid-day trading on Monday, hitting $111.74. 937,904 shares of the company traded hands, compared to its average volume of 1,355,816. The stock has a market cap of $62.16 billion, a price-to-earnings ratio of 16.31, a P/E/G ratio of 3.99 and a beta of 0.59. The company has a debt-to-equity ratio of 1.64, a quick ratio of 0.64 and a current ratio of 1.63. The stock has a 50-day moving average price of $106.25 and a two-hundred day moving average price of $107.91. Diageo plc has a 1 year low of $96.45 and a 1 year high of $142.73.

Diageo Increases Dividend

The company also recently disclosed a semi-annual dividend, which will be paid on Thursday, December 4th. Investors of record on Friday, October 17th will be given a dividend of $2.5192 per share. This represents a yield of 370.0%. This is a boost from Diageo's previous semi-annual dividend of $1.62. The ex-dividend date is Friday, October 17th. Diageo's dividend payout ratio (DPR) is currently 46.42%.

Diageo Company Profile

(

Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

Read More

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.