Dimensional Fund Advisors LP raised its stake in Autoliv, Inc. (NYSE:ALV - Free Report) by 14.4% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,857,069 shares of the auto parts company's stock after acquiring an additional 233,469 shares during the quarter. Dimensional Fund Advisors LP owned about 2.40% of Autoliv worth $164,257,000 at the end of the most recent reporting period.

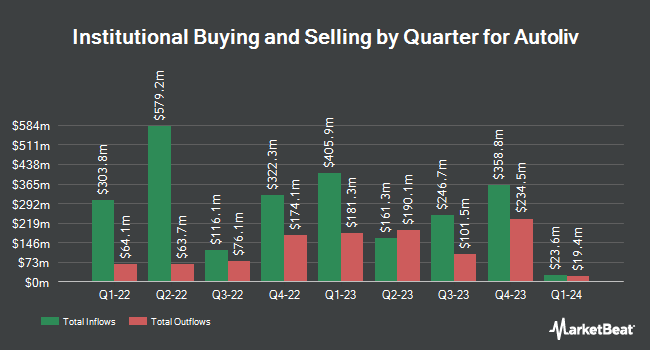

A number of other institutional investors also recently made changes to their positions in the company. SouthState Corp acquired a new position in shares of Autoliv in the first quarter valued at approximately $25,000. GAMMA Investing LLC boosted its stake in Autoliv by 122.9% in the 1st quarter. GAMMA Investing LLC now owns 370 shares of the auto parts company's stock valued at $33,000 after purchasing an additional 204 shares during the period. FNY Investment Advisers LLC acquired a new position in Autoliv in the 1st quarter valued at $44,000. Signaturefd LLC increased its position in Autoliv by 63.4% during the 1st quarter. Signaturefd LLC now owns 678 shares of the auto parts company's stock worth $60,000 after buying an additional 263 shares during the period. Finally, UMB Bank n.a. lifted its holdings in shares of Autoliv by 188.6% during the first quarter. UMB Bank n.a. now owns 788 shares of the auto parts company's stock worth $70,000 after buying an additional 515 shares in the last quarter. Institutional investors own 69.57% of the company's stock.

Autoliv Price Performance

Shares of ALV stock traded up $0.1210 on Monday, hitting $124.3410. 591,036 shares of the company's stock were exchanged, compared to its average volume of 592,431. The company has a 50 day moving average of $115.10 and a 200 day moving average of $101.84. The stock has a market cap of $9.55 billion, a P/E ratio of 13.60, a price-to-earnings-growth ratio of 1.29 and a beta of 1.39. The company has a debt-to-equity ratio of 0.55, a current ratio of 0.93 and a quick ratio of 0.70. Autoliv, Inc. has a 12 month low of $75.49 and a 12 month high of $124.82.

Autoliv (NYSE:ALV - Get Free Report) last issued its earnings results on Friday, July 18th. The auto parts company reported $2.21 EPS for the quarter, topping the consensus estimate of $2.07 by $0.14. The firm had revenue of $2.71 billion during the quarter, compared to the consensus estimate of $2.57 billion. Autoliv had a return on equity of 30.73% and a net margin of 6.83%.The business's quarterly revenue was up 4.2% on a year-over-year basis. During the same quarter in the previous year, the firm earned $1.87 earnings per share. On average, equities research analysts predict that Autoliv, Inc. will post 9.51 EPS for the current year.

Autoliv announced that its board has authorized a stock buyback plan on Wednesday, June 4th that permits the company to buyback $2.50 billion in outstanding shares. This buyback authorization permits the auto parts company to reacquire up to 31.3% of its shares through open market purchases. Shares buyback plans are generally an indication that the company's leadership believes its stock is undervalued.

Autoliv Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 23rd. Investors of record on Friday, September 5th will be paid a $0.85 dividend. This represents a $3.40 annualized dividend and a yield of 2.7%. The ex-dividend date of this dividend is Friday, September 5th. This is a positive change from Autoliv's previous quarterly dividend of $0.70. Autoliv's payout ratio is currently 30.63%.

Insiders Place Their Bets

In other Autoliv news, Director Jan Carlson sold 1,555 shares of the business's stock in a transaction on Wednesday, June 11th. The shares were sold at an average price of $108.32, for a total transaction of $168,437.60. Following the sale, the director owned 77,493 shares of the company's stock, valued at approximately $8,394,041.76. The trade was a 1.97% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. 0.30% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several equities analysts recently commented on the stock. Mizuho upped their price target on shares of Autoliv from $95.00 to $112.00 and gave the company an "outperform" rating in a research note on Friday, May 16th. BNP Paribas Exane raised shares of Autoliv from a "neutral" rating to an "outperform" rating and set a $123.00 price objective for the company in a report on Friday, May 9th. Robert W. Baird lowered their target price on shares of Autoliv from $126.00 to $124.00 and set a "neutral" rating on the stock in a report on Monday, July 21st. Royal Bank Of Canada assumed coverage on shares of Autoliv in a research report on Wednesday, June 25th. They issued an "outperform" rating and a $133.00 price target for the company. Finally, UBS Group increased their price target on Autoliv from $103.00 to $123.00 and gave the stock a "buy" rating in a research report on Wednesday, May 28th. Two analysts have rated the stock with a Strong Buy rating, twelve have given a Buy rating and five have assigned a Hold rating to the company's stock. According to MarketBeat, Autoliv has a consensus rating of "Moderate Buy" and a consensus target price of $120.64.

Read Our Latest Report on ALV

About Autoliv

(

Free Report)

Autoliv, Inc, through its subsidiaries, develops, manufactures, and supplies passive safety systems to the automotive industry in Europe, the Americas, China, Japan, and rest of Asia. It offers passive safety systems, including modules and components for frontal-impact airbag protection systems, side-impact airbag protection systems, seatbelts, steering wheels, and inflator technologies.

Read More

Before you consider Autoliv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autoliv wasn't on the list.

While Autoliv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.