Dimensional Fund Advisors LP lessened its holdings in shares of Equitable Holdings, Inc. (NYSE:EQH - Free Report) by 0.2% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 4,043,360 shares of the company's stock after selling 9,412 shares during the period. Dimensional Fund Advisors LP owned 1.33% of Equitable worth $210,590,000 as of its most recent filing with the Securities and Exchange Commission.

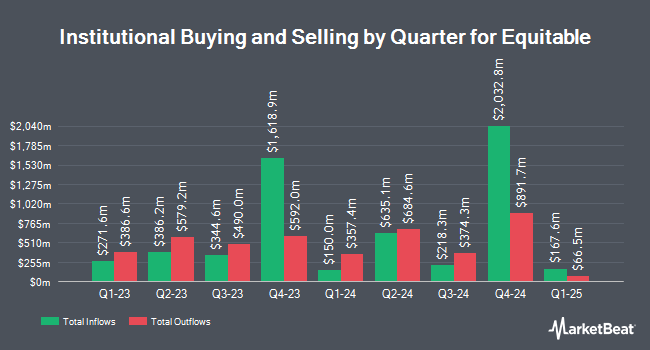

A number of other hedge funds also recently made changes to their positions in EQH. Boston Partners bought a new stake in shares of Equitable during the first quarter valued at approximately $108,264,000. Allspring Global Investments Holdings LLC increased its stake in shares of Equitable by 5,536.0% during the first quarter. Allspring Global Investments Holdings LLC now owns 2,109,113 shares of the company's stock valued at $110,286,000 after acquiring an additional 2,071,691 shares during the period. Nuveen LLC acquired a new position in shares of Equitable during the first quarter valued at approximately $99,319,000. Alyeska Investment Group L.P. increased its stake in shares of Equitable by 237.0% during the fourth quarter. Alyeska Investment Group L.P. now owns 1,758,637 shares of the company's stock valued at $82,955,000 after acquiring an additional 1,236,799 shares during the period. Finally, BNP Paribas Financial Markets acquired a new position in shares of Equitable during the fourth quarter valued at approximately $53,927,000. Institutional investors own 92.70% of the company's stock.

Equitable Price Performance

Equitable stock traded up $1.7410 during mid-day trading on Friday, hitting $53.6110. The company's stock had a trading volume of 2,787,151 shares, compared to its average volume of 3,087,900. The company has a quick ratio of 0.14, a current ratio of 0.14 and a debt-to-equity ratio of 4.94. The stock has a market capitalization of $16.06 billion, a P/E ratio of 43.24 and a beta of 1.14. Equitable Holdings, Inc. has a twelve month low of $37.99 and a twelve month high of $56.61. The stock's fifty day moving average price is $53.13 and its two-hundred day moving average price is $52.11.

Equitable Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, August 12th. Shareholders of record on Tuesday, August 5th were given a $0.27 dividend. The ex-dividend date was Tuesday, August 5th. This represents a $1.08 annualized dividend and a yield of 2.0%. Equitable's payout ratio is 87.10%.

Wall Street Analysts Forecast Growth

A number of research analysts recently commented on EQH shares. Morgan Stanley lowered their price objective on shares of Equitable from $68.00 to $67.00 and set an "overweight" rating on the stock in a research note on Monday, August 18th. Evercore ISI lowered their price objective on shares of Equitable from $69.00 to $64.00 and set an "outperform" rating on the stock in a research note on Thursday, May 1st. Wells Fargo & Company lowered their price objective on shares of Equitable from $66.00 to $63.00 and set an "overweight" rating on the stock in a research note on Friday, August 8th. UBS Group lowered their price objective on shares of Equitable from $77.00 to $75.00 and set a "buy" rating on the stock in a research note on Tuesday, May 27th. Finally, Keefe, Bruyette & Woods raised their price objective on shares of Equitable from $63.00 to $64.00 and gave the company an "outperform" rating in a research note on Wednesday, July 9th. Nine equities research analysts have rated the stock with a Buy rating and one has given a Hold rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $64.90.

Get Our Latest Stock Analysis on Equitable

Insider Buying and Selling at Equitable

In other Equitable news, COO Jeffrey J. Hurd sold 6,790 shares of Equitable stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $54.09, for a total value of $367,271.10. Following the transaction, the chief operating officer owned 88,678 shares in the company, valued at approximately $4,796,593.02. The trade was a 7.11% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, Director Bertram L. Scott sold 2,600 shares of Equitable stock in a transaction on Thursday, August 21st. The shares were sold at an average price of $51.86, for a total value of $134,836.00. Following the transaction, the director owned 26,001 shares in the company, valued at $1,348,411.86. This represents a 9.09% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 143,090 shares of company stock worth $7,549,152. 1.10% of the stock is owned by corporate insiders.

About Equitable

(

Free Report)

Equitable Holdings, Inc, together with its consolidated subsidiaries, operates as a diversified financial services company worldwide. The company operates through six segments: Individual Retirement, Group Retirement, Investment Management and Research, Protection Solutions, Wealth Management, and Legacy.

See Also

Before you consider Equitable, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equitable wasn't on the list.

While Equitable currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.