Earnest Partners LLC cut its holdings in shares of CTS Corporation (NYSE:CTS - Free Report) by 1.9% during the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 1,639,583 shares of the electronics maker's stock after selling 30,945 shares during the quarter. Earnest Partners LLC owned approximately 5.49% of CTS worth $68,125,000 at the end of the most recent quarter.

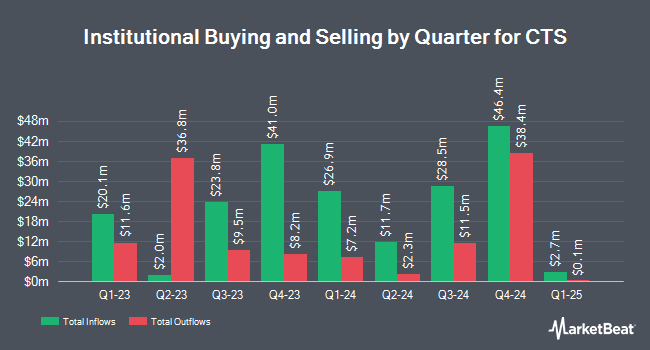

Several other institutional investors and hedge funds have also made changes to their positions in CTS. Pacer Advisors Inc. raised its position in CTS by 17.3% during the first quarter. Pacer Advisors Inc. now owns 2,863 shares of the electronics maker's stock valued at $119,000 after buying an additional 422 shares during the period. Aristides Capital LLC increased its stake in shares of CTS by 7.8% in the 1st quarter. Aristides Capital LLC now owns 6,255 shares of the electronics maker's stock valued at $260,000 after buying an additional 450 shares during the period. Russell Investments Group Ltd. grew its stake in shares of CTS by 2.6% during the first quarter. Russell Investments Group Ltd. now owns 21,199 shares of the electronics maker's stock worth $881,000 after purchasing an additional 544 shares during the period. Quarry LP grew its stake in CTS by 572.4% in the fourth quarter. Quarry LP now owns 659 shares of the electronics maker's stock valued at $35,000 after acquiring an additional 561 shares during the period. Finally, GAMMA Investing LLC grew its stake in CTS by 81.3% in the first quarter. GAMMA Investing LLC now owns 1,273 shares of the electronics maker's stock valued at $53,000 after acquiring an additional 571 shares during the period. 96.87% of the stock is owned by institutional investors and hedge funds.

CTS Stock Down 2.0%

Shares of NYSE CTS traded down $0.85 during trading on Tuesday, reaching $41.65. 27,738 shares of the stock were exchanged, compared to its average volume of 181,348. The business's 50-day moving average price is $41.70 and its 200 day moving average price is $41.39. CTS Corporation has a twelve month low of $34.02 and a twelve month high of $59.68. The company has a quick ratio of 2.04, a current ratio of 2.61 and a debt-to-equity ratio of 0.16. The company has a market capitalization of $1.23 billion, a price-to-earnings ratio of 19.66, a price-to-earnings-growth ratio of 1.19 and a beta of 0.83.

CTS (NYSE:CTS - Get Free Report) last announced its earnings results on Thursday, July 24th. The electronics maker reported $0.57 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.55 by $0.02. The firm had revenue of $135.30 million during the quarter, compared to analyst estimates of $132.65 million. CTS had a net margin of 12.32% and a return on equity of 12.31%. During the same quarter in the prior year, the firm posted $0.54 EPS. CTS has set its FY 2025 guidance at 2.200-2.350 EPS. As a group, equities analysts forecast that CTS Corporation will post 2.28 EPS for the current fiscal year.

CTS Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, October 24th. Shareholders of record on Friday, September 26th will be issued a dividend of $0.04 per share. This represents a $0.16 annualized dividend and a yield of 0.4%. The ex-dividend date of this dividend is Friday, September 26th. CTS's payout ratio is currently 7.55%.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen upgraded CTS from a "hold" rating to a "buy" rating in a report on Saturday, July 12th. One equities research analyst has rated the stock with a Hold rating, According to MarketBeat.com, the stock presently has an average rating of "Hold".

Get Our Latest Stock Report on CTS

CTS Company Profile

(

Free Report)

CTS Corporation manufactures and sells sensors, actuators, and connectivity components in North America, Europe, and Asia. The company provides encoders, rotary position sensors, slide potentiometers, industrial and commercial rotary potentiometers. It also provides non-contacting, and contacting pedals; and eBrake pedals.

Recommended Stories

Before you consider CTS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CTS wasn't on the list.

While CTS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.