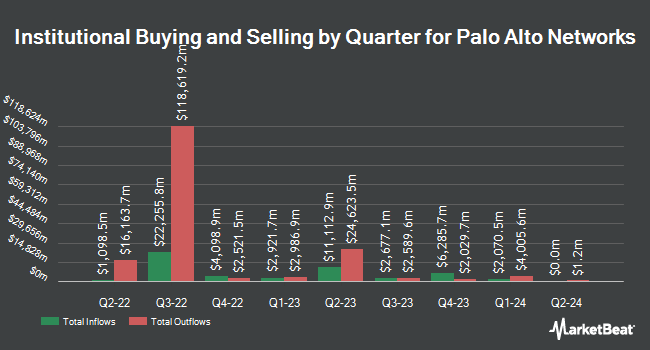

Eastern Bank reduced its stake in shares of Palo Alto Networks, Inc. (NASDAQ:PANW - Free Report) by 6.8% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 253,801 shares of the network technology company's stock after selling 18,394 shares during the period. Eastern Bank's holdings in Palo Alto Networks were worth $43,309,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also made changes to their positions in the stock. Csenge Advisory Group increased its stake in shares of Palo Alto Networks by 2.4% during the first quarter. Csenge Advisory Group now owns 2,271 shares of the network technology company's stock worth $381,000 after purchasing an additional 53 shares in the last quarter. Strategic Investment Solutions Inc. IL increased its stake in shares of Palo Alto Networks by 64.0% during the fourth quarter. Strategic Investment Solutions Inc. IL now owns 141 shares of the network technology company's stock worth $26,000 after purchasing an additional 55 shares in the last quarter. SYM FINANCIAL Corp increased its stake in shares of Palo Alto Networks by 1.4% during the first quarter. SYM FINANCIAL Corp now owns 4,047 shares of the network technology company's stock worth $691,000 after purchasing an additional 55 shares in the last quarter. Crew Capital Management Ltd. increased its stake in shares of Palo Alto Networks by 2.5% during the first quarter. Crew Capital Management Ltd. now owns 2,310 shares of the network technology company's stock worth $394,000 after purchasing an additional 57 shares in the last quarter. Finally, JDM Financial Group LLC increased its stake in shares of Palo Alto Networks by 22.4% during the fourth quarter. JDM Financial Group LLC now owns 322 shares of the network technology company's stock worth $59,000 after purchasing an additional 59 shares in the last quarter. 79.82% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In other news, EVP Dipak Golechha sold 5,000 shares of the stock in a transaction dated Monday, June 23rd. The shares were sold at an average price of $201.85, for a total value of $1,009,250.00. Following the completion of the transaction, the executive vice president owned 101,135 shares in the company, valued at $20,414,099.75. This trade represents a 4.71% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Aparna Bawa sold 526 shares of the stock in a transaction dated Friday, May 30th. The shares were sold at an average price of $190.00, for a total transaction of $99,940.00. Following the completion of the transaction, the director owned 8,632 shares of the company's stock, valued at $1,640,080. This represents a 5.74% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 569,248 shares of company stock worth $111,279,829. 2.50% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts recently weighed in on the stock. Roth Capital assumed coverage on shares of Palo Alto Networks in a research report on Thursday, May 15th. They set a "neutral" rating and a $210.00 price target on the stock. KeyCorp lowered shares of Palo Alto Networks from an "overweight" rating to a "sector weight" rating in a research report on Thursday. Northland Securities lowered their price target on shares of Palo Alto Networks from $210.00 to $177.00 and set a "market perform" rating on the stock in a research report on Wednesday, May 21st. Jefferies Financial Group set a $235.00 price target on shares of Palo Alto Networks in a research report on Tuesday. Finally, DA Davidson lowered their price target on shares of Palo Alto Networks from $225.00 to $215.00 and set a "buy" rating on the stock in a research report on Thursday. Two investment analysts have rated the stock with a sell rating, fourteen have issued a hold rating and twenty-six have given a buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $209.61.

Get Our Latest Stock Analysis on PANW

Palo Alto Networks Trading Down 0.4%

Shares of NASDAQ PANW traded down $0.72 during mid-day trading on Friday, reaching $172.88. The company had a trading volume of 16,231,498 shares, compared to its average volume of 5,904,851. The firm has a 50 day simple moving average of $196.32 and a two-hundred day simple moving average of $187.19. The stock has a market cap of $115.28 billion, a P/E ratio of 98.79, a PEG ratio of 5.11 and a beta of 0.97. Palo Alto Networks, Inc. has a 52-week low of $142.01 and a 52-week high of $210.39.

Palo Alto Networks (NASDAQ:PANW - Get Free Report) last issued its quarterly earnings results on Tuesday, May 20th. The network technology company reported $0.80 earnings per share for the quarter, topping analysts' consensus estimates of $0.77 by $0.03. Palo Alto Networks had a net margin of 13.95% and a return on equity of 19.48%. The firm had revenue of $2.29 billion during the quarter, compared to analysts' expectations of $2.28 billion. During the same quarter in the prior year, the business earned $0.66 EPS. Palo Alto Networks's quarterly revenue was up 15.3% compared to the same quarter last year. On average, equities analysts expect that Palo Alto Networks, Inc. will post 1.76 EPS for the current year.

About Palo Alto Networks

(

Free Report)

Palo Alto Networks, Inc provides cybersecurity solutions worldwide. The company offers firewall appliances and software; and Panorama, a security management solution for the global control of network security platform as a virtual or a physical appliance. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering, laptop and mobile device protection, DNS security, Internet of Things security, SaaS security API, and SaaS security inline, as well as threat intelligence, and data loss prevention.

See Also

Before you consider Palo Alto Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Palo Alto Networks wasn't on the list.

While Palo Alto Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.