EdgeRock Capital LLC acquired a new position in shares of Pure Cycle Corporation (NASDAQ:PCYO - Free Report) during the 2nd quarter, according to its most recent 13F filing with the SEC. The fund acquired 31,333 shares of the utilities provider's stock, valued at approximately $336,000. EdgeRock Capital LLC owned about 0.13% of Pure Cycle as of its most recent SEC filing.

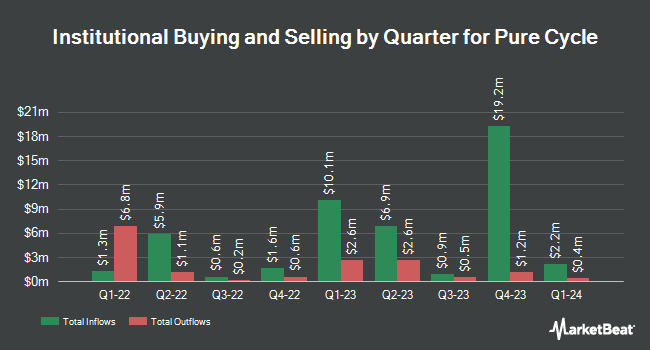

Several other hedge funds and other institutional investors also recently bought and sold shares of PCYO. BNP Paribas Financial Markets increased its holdings in Pure Cycle by 87.0% in the fourth quarter. BNP Paribas Financial Markets now owns 8,832 shares of the utilities provider's stock valued at $112,000 after buying an additional 4,110 shares during the last quarter. Bank of America Corp DE increased its holdings in Pure Cycle by 42.4% in the fourth quarter. Bank of America Corp DE now owns 25,511 shares of the utilities provider's stock valued at $323,000 after buying an additional 7,593 shares during the last quarter. Deutsche Bank AG bought a new stake in Pure Cycle in the fourth quarter valued at about $126,000. Millennium Management LLC bought a new stake in Pure Cycle in the fourth quarter valued at about $166,000. Finally, Diamond Hill Capital Management Inc. increased its holdings in Pure Cycle by 5.2% in the first quarter. Diamond Hill Capital Management Inc. now owns 67,219 shares of the utilities provider's stock valued at $704,000 after buying an additional 3,333 shares during the last quarter. 51.39% of the stock is currently owned by hedge funds and other institutional investors.

Pure Cycle Stock Performance

Shares of PCYO stock opened at $10.96 on Friday. The company has a quick ratio of 2.40, a current ratio of 3.52 and a debt-to-equity ratio of 0.05. The business has a 50 day moving average of $10.40 and a two-hundred day moving average of $10.42. Pure Cycle Corporation has a 52 week low of $9.65 and a 52 week high of $14.63. The company has a market cap of $263.81 million, a P/E ratio of 19.93 and a beta of 1.33.

Pure Cycle (NASDAQ:PCYO - Get Free Report) last issued its earnings results on Wednesday, July 9th. The utilities provider reported $0.09 EPS for the quarter. Pure Cycle had a return on equity of 10.19% and a net margin of 49.58%.The company had revenue of $5.14 million during the quarter.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen raised Pure Cycle from a "sell" rating to a "hold" rating in a report on Saturday, September 13th.

Check Out Our Latest Research Report on Pure Cycle

Pure Cycle Profile

(

Free Report)

Pure Cycle Corporation designs, constructs, operates, and maintains water and wastewater systems in the Denver metropolitan area and Colorado Front Range in the United States. It operates in two segments, Wholesale Water and Wastewater Services, and Land Development. The company engages in the wholesale water production, storage, treatment, and distribution systems; wastewater collection and treatment systems; development of 930-acre master-planned community; oil and gas leasing business; and construction and leasing of single-family homes.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pure Cycle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pure Cycle wasn't on the list.

While Pure Cycle currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.